How to Get ₹20,000 Urgently Without Salary – Quick Help from Vizzve Financial

Need ₹20,000 Right Now but Have No Salary Proof? You’re Not Alone.

Financial emergencies don’t wait – and neither should you. Whether it's a medical bill, utility payment, travel expense, or just an unexpected need, getting ₹20,000 urgently without a salary slip is now possible. Thanks to Vizzve Financial, you don’t need to be a salaried employee to get help fast.

🔍 Who Can Get ₹20,000 Without a Salary Slip?

You can still qualify if you're:

-

A freelancer

-

A small business owner

-

A gig worker

-

A homemaker with alternate income

-

Or someone with no formal income proof

At Vizzve Financial, we understand that income comes in many forms – and we’re here to support you.

✅ Why Choose Vizzve Financial for a ₹20,000 Loan?

Here’s why thousands trust Vizzve:

-

No Salary Slip Required: Ideal for self-employed or informal earners.

-

Fast Approval: Loans approved in just a few minutes.

-

Minimum Documents: Basic KYC – Aadhar, PAN, and bank statement.

-

Same-Day Disbursal: Money is transferred to your account within hours.

-

100% Online Process: Apply from anywhere, anytime.

-

Low EMI Options: Easy repayment on your terms.

🚀 How to Apply for a ₹20,000 Loan Without Salary Proof

Step-by-step:

-

Visit www.vizzve.com

-

Click on "Apply Now"

-

Fill in your basic details

-

Upload PAN, Aadhar, and bank statement

-

Get instant approval and receive funds directly in your account

🧠 Tips to Improve Approval Chances

-

Maintain an active bank account with regular transactions

-

Ensure your credit report is healthy

-

Be honest while filling out your application

-

Keep all ID proofs ready for upload

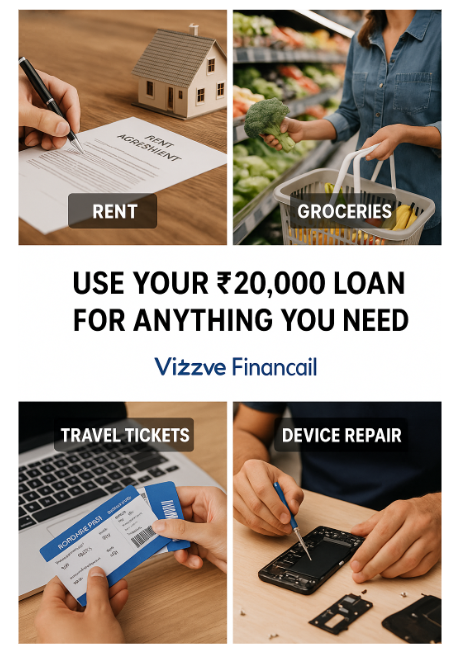

💬 Real-Life Use Cases

-

Pay urgent rent or bills

-

Buy essentials or groceries

-

Cover travel or emergency tickets

-

Mobile or laptop repair

-

Immediate family needs

📣 Final Thoughts

You don’t need a monthly salary to access fast credit. With Vizzve Financial, getting ₹20,000 urgently is simple, stress-free, and secure. Whether you’re between jobs, self-employed, or earning cash informally – you’re still eligible.

🔗 Apply now at www.vizzve.com and get ₹20,000 in your account within hours!

In today’s digital lending landscape, you can secure an urgent ₹20,000 loan without a salary slip by submitting alternative income documents (bank statements, ITR, etc.) and leveraging platforms that offer real-time approval and same-day disbursal. Interest rates for such loans typically range from 10.5% to 26% p.a., processing fees run around 1–2% of the loan amount, and maintaining a healthy credit score (650–750+) further boosts your approval odds

Frequently Asked Questions

1. Can I get a ₹20,000 loan without a salary slip?

Yes. Most lenders—including fintech platforms—accept alternative income proofs such as 6–12 months of bank statements, filed ITRs, or Form 16 in lieu of salary slips to assess repayment capacity .

2. What documents will I need?

You’ll typically need:

-

KYC proofs: Aadhar card, PAN card

-

Bank statements: Last 6–12 months showing regular credits

-

Tax documents: Most recent ITR or Form 16

Some lenders may also allow collateral (FDs, gold) or a guarantor to strengthen your application

3. How quickly will I receive the funds?

Digital lenders like Vizzve Financial offer real-time approval and same-day disbursal, with funds hitting your account within a few hours of application approval

4. What interest rate can I expect?

Personal loan interest rates for amounts up to ₹20,000 generally fall between 10.50% and 26% p.a., depending on your credit profile and the lender’s policies

5. Do I need a minimum credit score?

While requirements vary, a credit score of 650 or above is often the baseline. For the best rates, aim for 750+ by clearing existing dues and keeping credit utilization low

.

6. Can unemployed or homemaker applicants qualify?

Yes—if you can demonstrate alternate income (e.g., rental income, business revenue) through bank statements or tax filings. You can also improve your application by having a creditworthy co-applicant or pledging collateral

7. Are there processing fees?

Most lenders charge a processing fee of 1–2% of the loan amount (non-refundable), plus applicable taxes. For example, ICICI Bank’s fee is up to 2% of the principal

8. Can I prepay or foreclose my loan early?

Yes, but note that some lenders levy a prepayment charge (e.g., up to 4% of the outstanding principal if closed before 24 EMIs, decreasing thereafter)

.

9. How can I improve my approval chances?

-

Maintain a strong credit score (≥750)

-

Provide clear alternative income proof (bank statements, ITR)

-

Offer collateral (fixed deposits, gold)

-

Add a co-applicant with stable income or credit history

10. Which lenders offer loans without salary proof?

Beyond Vizzve Financial, several NBFCs and digital platforms (e.g., Airtel Flexi, Bajaj Finserv, PaySense) specialize in no-salary-slip loans, each with varying interest rates and eligibility criteria