💳 Get Instant Loan on Aadhaar Card Without Salary Slip — No Hassle, No Delay!

Need a quick loan but don’t have a salary slip? No worries! Whether you’re a freelancer, gig worker, small business owner, or self-employed, getting an instant loan on your Aadhaar card without a salary slip is now easier than ever.

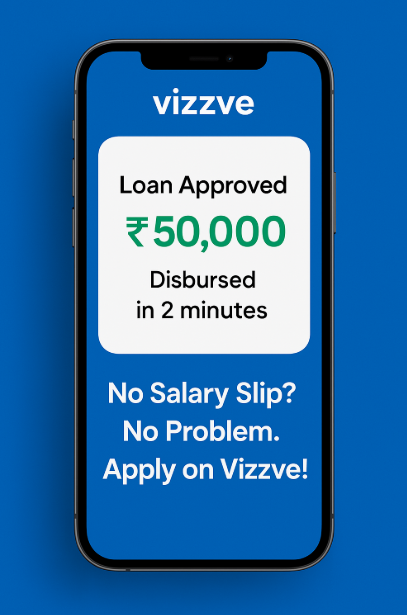

Thanks to digital lending platforms like Vizzve, you can access funds quickly with minimal paperwork, even if you're not in a traditional job role.

✅ Why Choose Aadhaar-Based Loans Without Salary Slip?

Aadhaar-based loans allow you to apply easily, verify your identity online, and get funds instantly—no salary slip required.

Key Benefits:

-

Easy Online Application: Use Aadhaar for instant KYC—no long queues or paperwork.

-

Quick Disbursal: Get funds directly into your bank account within hours.

-

No Salary Slip Needed: Ideal for freelancers, self-employed, and gig workers.

-

Minimal Documentation: Just your Aadhaar, PAN, and alternate income proof (like bank statements).

📌 Eligibility Criteria

To apply for an instant loan via Aadhaar card without a salary slip, you’ll typically need:

-

Age: 21 to 60 years

-

Citizenship: Must be an Indian resident

-

Aadhaar Card: Must be valid and linked to your mobile number

-

Employment Type: Freelancers, business owners, gig workers, or salaried on break

-

Alternate Income Proof: Bank statements (last 3–6 months), ITRs, freelance invoices, etc.

-

Credit Score: 650+ recommended

-

Bank Account: Must have an active Indian bank account

📄 Required Documents

You don’t need a salary slip, but make sure you have:

-

Aadhaar Card (for ID, address, and e-KYC)

-

PAN Card

-

Bank Statements (Last 3–6 Months)

-

Utility Bill (if separate address proof needed)

📝 How to Apply – Step-by-Step Guide

Here’s how you can apply for a loan without a salary slip through Aadhaar:

-

Check Eligibility: Make sure you meet the age, credit score, and income proof criteria.

-

Select a Trusted Lender: Choose a reliable NBFC, bank, or instant loan app like Vizzve.

-

Apply Online: Visit the website or download the app. Fill in personal details including Aadhaar number and employment type.

-

Upload Alternative Income Proof: Add bank statements, ITRs, or freelance receipts.

-

Approval & Disbursal: Once verified, your loan is approved and funds are sent directly to your account—often within minutes!

🔐 Apply Now via www.vizzve.com

Fast, secure, and salary-slip-free! Click the link to get started: Apply Now at Vizzve

❓ Frequently Asked Questions

Can I Get a Loan Without a Salary Slip?

Yes, many lenders accept alternate income proofs like bank statements or freelance invoices.

What Documents Can I Use Instead of Salary Slips?

You can submit bank statements, ITRs, gig/freelance payments, or business income records.

Is It Safe to Take a Loan Without Income Proof?

Yes, if you choose a trusted lender like Vizzve. But always read the loan terms carefully.

What’s the Maximum Loan I Can Get?

It varies by lender, but instant loans typically range from ₹10,000 to ₹2,00,000.

What Are the Interest Rates Like?

Interest rates depend on your credit score and the lender. Always compare before applying.

Need funds now without a salary slip?

💼 Whether you’re your own boss or working on your own terms, Vizzve has your back.

Apply today and get money when you need it most—no payslip, no problem!

Instant loan on Aadhaar card

-

Loan without salary slip

-

Aadhaar-based loan

-

Quick personal loan India

-

Vizzve instant loan

-

Aadhaar card loan for freelancers

-

No income proof loan India

-

Loan app without salary slip

-

Self-employed loan India

-

Fast personal loan Vizzve