🏡 How to Get Lowest Home Loan Interest Rates in 2025 – Vizzve Financial Guide

Published on: April 27, 2025

by: Hari

💬 Introduction: Your Guide to Affordable Home Loans in 2025

Buying a home in 2025? 🏡

You don’t just need a good loan — you need the lowest interest rate possible to save lakhs over the years.

Vizzve Financial is here to guide you with insider tips to secure the best home loan deal at the lowest rate available today.

📈 How to Get the Lowest Home Loan Rates in 2025

1. Maintain a High CIBIL Score (750+)

Banks reward good credit behavior.

✔️ Pay credit card bills and EMIs on time.

✔️ Clear existing debts before applying.

Vizzve Tip: Even if your CIBIL is moderate, apply through Vizzve Financial — we match you to lenders with flexible criteria!

2. Compare Multiple Loan Offers

Never settle for the first offer.

Use Vizzve Financial to compare offers from top banks and NBFCs at once.

👉 Compare Now

3. Choose a Shorter Tenure

Shorter tenure = Lower interest rates.

While EMI might be higher monthly, total interest paid is much lower.

4. Opt for a Higher Down Payment

A higher down payment reduces your loan amount, making you a low-risk borrower — leading to lower interest rates!

5. Apply During Special Offers & Festivals

Many banks roll out discounted rates during festive seasons like Diwali, Akshaya Tritiya, and New Year campaigns.

Stay updated with Vizzve Financial alerts!

6. Show Additional Income Proof

Salary slips, business income, rental income, side income — showcasing strong repayment capacity fetches better interest rates.

7. Apply Jointly (Spouse or Parent)

Adding a co-applicant with a good income or CIBIL boosts loan eligibility and often gets better rates.

🏆 Why Choose Vizzve Financial for the Best Home Loan Deals?

-

📋 Compare top banks instantly in one click

-

⚡ Get pre-approved offers without affecting CIBIL

-

📈 Exclusive cashback and lower rates through partners

-

🛡️ Secure application process with RBI-registered lenders

-

🤝 Free consultation with loan advisors

🗣️ Real Customer Success Stories

⭐⭐⭐⭐⭐

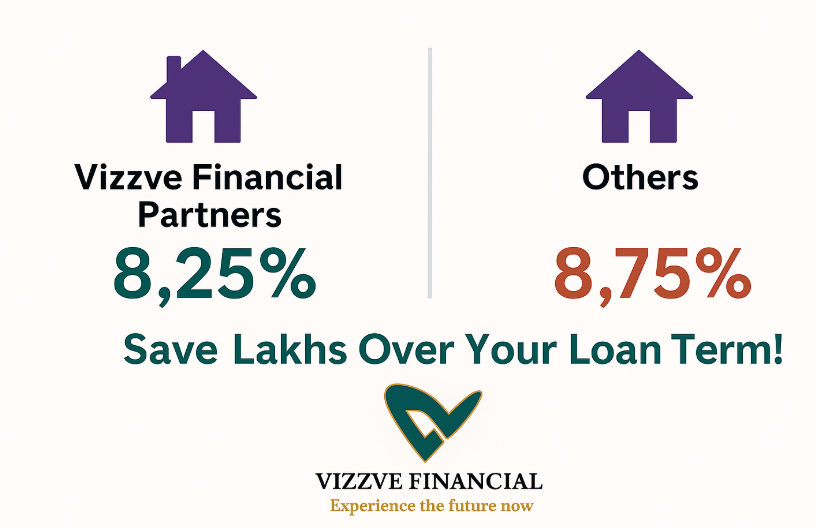

"Thanks to Vizzve, I locked a 8.25% rate when other banks were offering 8.75%. Saved ₹3 lakh over 20 years!"

— Manish S., Chennai

⭐⭐⭐⭐⭐

"Comparing through Vizzve helped me choose the right bank. Fast, safe and no agent hassle."

— Ritika G., Pune

❓ Frequently Asked Questions (FAQs)

Q1. What is a good home loan interest rate in 2025?

👉 Rates starting from 8.25% p.a. are considered excellent in 2025.

Q2. How can Vizzve Financial help me get a better rate?

👉 Vizzve lets you compare multiple lenders, spot special tie-up offers, and apply directly with minimal documents.

Q3. Does applying via Vizzve affect my credit score?

👉 No, pre-approved offers through Vizzve are soft inquiries and do not impact your CIBIL score.

Q4. Can freelancers or business owners also apply?

👉 Absolutely! Vizzve Financial helps salaried, self-employed, and business owners find the best deals.

Q5. How much processing time is needed?

👉 In most cases, you get approvals within 24–48 hours after document submission.