IMF Loan to Pakistan 2025: $1.1 Billion Tranche Approved – Key Conditions & Economic Impact

Vizzve Admin

💸 IMF Loan to Pakistan in 2025 – Full Details, Conditions & Impact

Published by: Vizzve Financial | Category: Global Economy | South Asia | IMF Updates

📅 Updated: May 10, 2025 | ⏱️ Reading Time: 4 minutes

📍 What Is the IMF Loan to Pakistan?

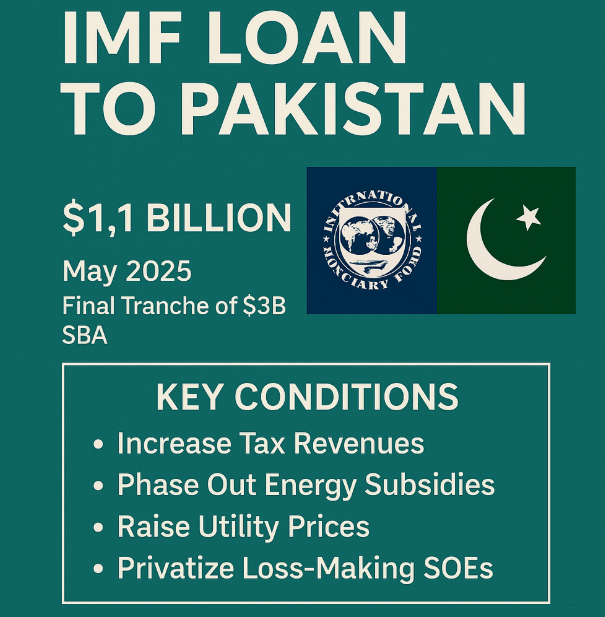

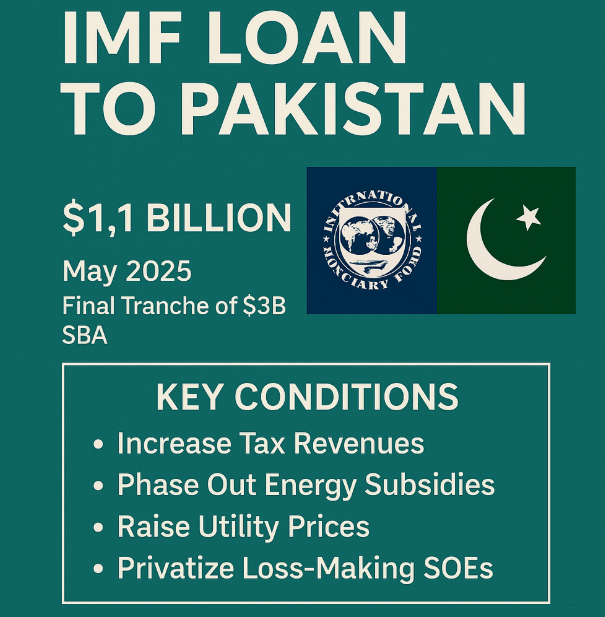

In May 2025, the International Monetary Fund (IMF) approved a $1.1 billion loan disbursement to Pakistan as part of its ongoing $3 billion Stand-By Arrangement (SBA). This disbursement comes after Pakistan completed a rigorous economic review and pledged new fiscal reforms.

🇵🇰 Why Does Pakistan Need IMF Loans?

Pakistan has been facing:

-

🏦 Critically low foreign reserves (under $4 billion in April 2025)

-

📉 Rising inflation (over 28% YOY)

-

⚡ Energy crisis & mounting debt

-

🏗️ Slow industrial output

-

💵 Dollar shortage and currency depreciation

The IMF loans provide temporary relief to avoid default and stabilize the economy.

🧾 Key Conditions Attached to the IMF Loan

The IMF always attaches reform demands. For 2025, Pakistan must:

-

📊 Increase Tax Revenues (especially through GST & fuel levies)

-

💡 Phase Out Energy Subsidies

-

🔼 Raise Utility Prices (Electricity, gas rates increased again in May)

-

🏛️ Privatize Loss-Making SOEs (like PIA and Pakistan Steel)

-

📈 Maintain Market-Based Exchange Rate

🏦 Breakdown of the $3 Billion IMF Program

| Component | Amount | Status |

|---|

| First Tranche | $1.2 Billion | Released (2023) |

| Second Tranche | $700 Million | Released (2024) |

| Final Tranche | $1.1 Billion | ✅ Approved (May 2025) |

| Total | $3 Billion | Fully Disbursed |

🌍 Global & Domestic Reactions

-

Pakistan PM Shehbaz Sharif: "This IMF loan gives breathing space to rebuild our economy."

-

Finance Minister: "Tough reforms ahead, but necessary for stability."

-

IMF Statement: "Pakistan must continue on a path of fiscal discipline and economic modernization."

-

Critics: “IMF conditions are burdening the common man with price hikes.”

📉 Economic Impact on Pakistan in 2025

| Indicator | Before Loan | After Loan (Forecast) |

|---|

| Forex Reserves | $3.9 Billion | $5.2 Billion |

| Inflation Rate | 28.3% | 22.0% (by Q3 2025) |

| Rupee Exchange Rate (USD) | 296 | 283 (stabilizing) |

| Power Tariff (Per unit) | ₹36.7 | ₹39.5 |

❓ FAQs – IMF Loan to Pakistan

Q1: Is this Pakistan’s first IMF loan?

No. Pakistan has taken 23+ IMF programs since 1958. The current $3B loan was approved in 2023 and ends in 2025.

Q2: Will prices rise due to the IMF loan?

Yes. Fuel, electricity, and daily commodities may become costlier due to subsidy cuts and tax increases.

Q3: Will this solve Pakistan’s economic crisis?

Temporarily. Long-term stability requires structural reforms, improved exports, and reduced dependence on borrowing.

Q4: How is India reacting?

India is watching closely. A stable Pakistan benefits the region, but India has raised concerns about IMF funds being misused in the past.

-

IMF Loan to Pakistan 2025 details

-

Pakistan IMF agreement 2025 conditions

-

Why Pakistan needs IMF loan

-

Latest IMF tranche to Pakistan

-

IMF Pakistan economic crisis

-

Pakistan economy May 2025

-

$1.1 billion IMF loan update

-

Fuel price hike after IMF deal

-

IMF news today Pakistan

-

IMF bailout vs debt trap

📌 Final Words

The IMF loan gives Pakistan a temporary lifeline, but the burden of reforms and rising living costs will test both the government and its citizens. While this may stabilize the short-term economic crisis, long-term solutions still depend on governance, export growth, and debt management.

📲 For more global financial insights and personal loan options, visit www.vizzve.com

#IMFLoan #Pakistan2025 #EconomicCrisis #Inflation #ForexCrisis #PakistanIMFDeal #GlobalEconomy #SouthAsiaNews #DebtCrisis #FuelPriceHike #VizzveInsights

Disclaimer: This article may include third-party images, videos, or content that belong to their respective owners. Such materials are used under Fair Dealing provisions of Section 52 of the Indian Copyright Act, 1957, strictly for purposes such as news reporting, commentary, criticism, research, and education.

Vizzve and India Dhan do not claim ownership of any third-party content, and no copyright infringement is intended. All proprietary rights remain with the original owners.

Additionally, no monetary compensation has been paid or will be paid for such usage.

If you are a copyright holder and believe your work has been used without appropriate credit or authorization, please contact us at grievance@vizzve.com. We will review your concern and take prompt corrective action in good faith... Read more