🔐 India’s Top RBI-Registered Loan Apps 2025 – Vizzve on the List!

📅 Updated: June 2025 | ✅ 100% Safe Loan Options

💬 Looking for a quick, trusted, and paperless loan? Your search ends here! In 2025, India's financial landscape is filled with loan apps—but not all are safe. That’s why we’ve curated a list of Top RBI-Registered Loan Apps, and Vizzve Financial proudly makes the cut!

✅ What Makes These Apps Trustworthy?

To protect you from scams, the Reserve Bank of India (RBI) has made it mandatory for loan apps to be registered with authorized NBFCs or banks. The apps listed here follow all the RBI norms and offer:

✔️ Instant loan approval

✔️ Minimal documentation

✔️ Transparent interest rates

✔️ Full data privacy

✔️ Legal recovery processes

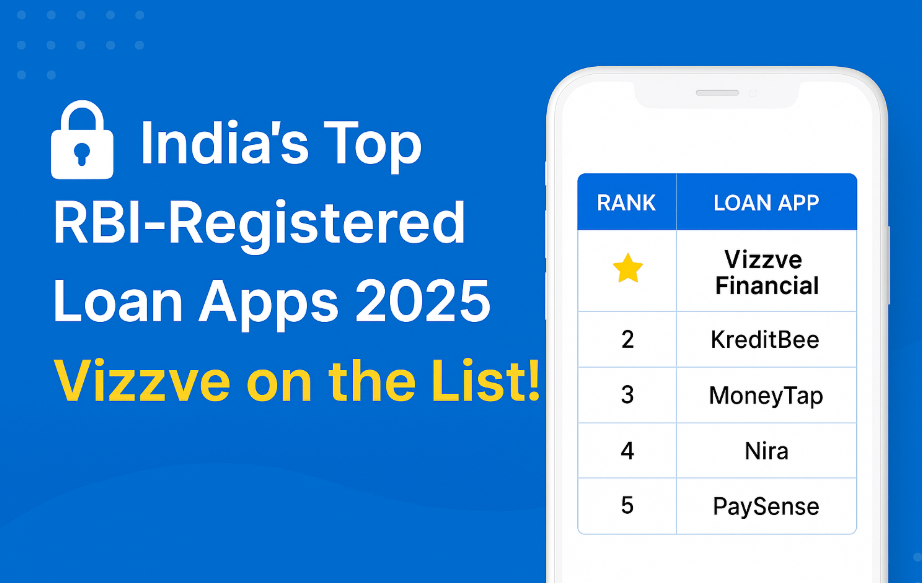

🌟 Top RBI-Approved Loan Apps in India (2025)

| Rank | Loan App | RBI/NBFC Registered | Max Loan | Approval Time |

|---|---|---|---|---|

| ⭐1 | Vizzve Financial | ✅ Yes (RBI-registered NBFCs) | ₹5,00,000 | ⏱️ 30 seconds |

| 2 | KreditBee | ✅ Yes | ₹3,00,000 | ⏱️ 5 minutes |

| 3 | MoneyTap | ✅ Yes | ₹5,00,000 | ⏱️ 2 minutes |

| 4 | Nira | ✅ Yes | ₹1,00,000 | ⏱️ 10 minutes |

| 5 | PaySense | ✅ Yes | ₹5,00,000 | ⏱️ 2–4 hours |

🔍 Why Vizzve is a Top Pick?

Vizzve Financial is gaining trust rapidly in 2025 because it offers:

🚀 Instant personal loan disbursement

📲 App-based loan journey with 100% paperless KYC

🤖 AI-powered loan matching with top NBFCs

🛡️ RBI-compliant, secure lending platform

🌐 Visit now: www.vizzve.com

📢 Real Stories from Happy Borrowers

“Vizzve helped me get ₹2,00,000 in just 10 minutes during a medical emergency. Truly life-saving!” – Amit, Bangalore

“Finally, a legit app that doesn’t demand salary slips! Thank you, Vizzve!” – Rekha, Mumbai

📲 Apply Now – Safe Loans Without Worries

⚡ Whether it's for a new vehicle, school fee, travel, or emergency, Vizzve is here to help.

👉 Click here to Apply on Vizzve

📌 Frequently Asked Questions (FAQs)

🔸 Which is the best RBI-registered instant loan app in India for 2025?

Vizzve Financial stands out in 2025 with its fast loan approvals, zero paperwork, and secure RBI-compliant platform. It's ideal for personal, medical, and emergency loans.

🔸 Is Vizzve Financial approved by the RBI?

Yes. Vizzve Financial works exclusively with RBI-registered NBFCs, ensuring your loan journey is safe, legal, and fully compliant with government norms.

🔸 Can I get a loan without a salary slip or CIBIL score?

Absolutely! Vizzve specializes in offering loans to freelancers, gig workers, and self-employed individuals. You can apply with minimal documentation—even without a CIBIL score.

🔸 How long does it take to get a loan on Vizzve?

Your loan can be approved in as little as 30 seconds and disbursed within minutes—thanks to its AI-powered, paperless loan process.

🔸 Is it safe to share my Aadhaar and PAN on Vizzve?

Yes. Vizzve uses bank-level encryption and RBI-approved protocols to ensure complete data privacy and protection.

🔸 How much loan can I get from Vizzve?

You can get up to ₹5,00,000 depending on your profile and NBFC eligibility. The platform shows your pre-approved offers instantly.

🔸 What is the interest rate on loans from Vizzve?

Interest rates start as low as 1.5% per month, varying by partner NBFC. All charges are transparent—no hidden fees.

🔸 Where can I apply for a Vizzve loan?

You can apply directly on www.vizzve.com or download the Vizzve App from the Play Store.

🔎 Related Searches:

RBI approved instant loan app

Best loan apps without CIBIL 2025

Safe personal loan apps India

Paperless loan apps with fast approval