In a world grappling with economic slowdowns, inflation shocks, and geopolitical tensions, India has emerged as a beacon of stability.

Despite global headwinds, the country’s macroeconomic fundamentals remain resilient, and investor confidence continues to rise.

From controlled inflation and strong domestic demand to robust forex reserves, multiple factors have contributed to India’s unexpectedly balanced economic performance in 2025.

1. Controlled Inflation and Prudent Monetary Policy

The Reserve Bank of India (RBI) has managed to keep inflation largely within its target range of 4–6%. This is a major achievement, considering volatile global energy prices and food supply disruptions.

By adopting a cautious monetary stance — gradually adjusting repo rates and ensuring liquidity balance — the RBI has kept borrowing costs manageable without stifling growth.

This policy precision has built confidence among both domestic and foreign investors.

2. Strong Domestic Demand Driving Growth

Unlike export-heavy economies hit by weak global trade, India’s growth is domestically driven.

Private consumption — which accounts for nearly 60% of GDP — has remained robust, powered by rising incomes, urbanization, and a digital-first economy.

Rural consumption is also seeing a gradual rebound thanks to better monsoon patterns, agricultural reforms, and government-backed credit schemes.

3. Public Investment in Infrastructure

Massive government spending on infrastructure projects — from roads and railways to renewable energy — has been a cornerstone of India’s steady economic trajectory.

The National Infrastructure Pipeline (NIP) and the PM Gati Shakti plan have created jobs, boosted private investment, and accelerated logistics efficiency.

Such projects have multiplier effects, strengthening the foundation for long-term sustainable growth.

4. Tech-Led Transformation and Start-up Resilience

India’s tech ecosystem continues to thrive, with startups driving innovation in fintech, AI, and green technology.

Even amid global funding slowdowns, Indian entrepreneurs are focusing on profitability and scalability, signaling a maturing digital economy.

Government initiatives like Digital India and Startup India have also improved access to digital infrastructure, especially in tier-2 and tier-3 cities.

5. Fiscal Discipline and Global Confidence

India’s fiscal deficit is on track to narrow as the government balances spending with revenue generation.

Consistent tax collections (especially GST) and rising exports in sectors like electronics and pharmaceuticals have bolstered the fiscal position.

Rating agencies and global financial institutions, including the IMF and World Bank, have praised India’s policy stability and governance reforms.

6. Strong Currency and Resilient Forex Reserves

India’s foreign exchange reserves remain comfortably above $600 billion, providing a cushion against external shocks.

The rupee, though slightly volatile, has performed better than most emerging market currencies — reflecting confidence in India’s economic fundamentals.

7. Future Outlook: Sustainable and Inclusive Growth

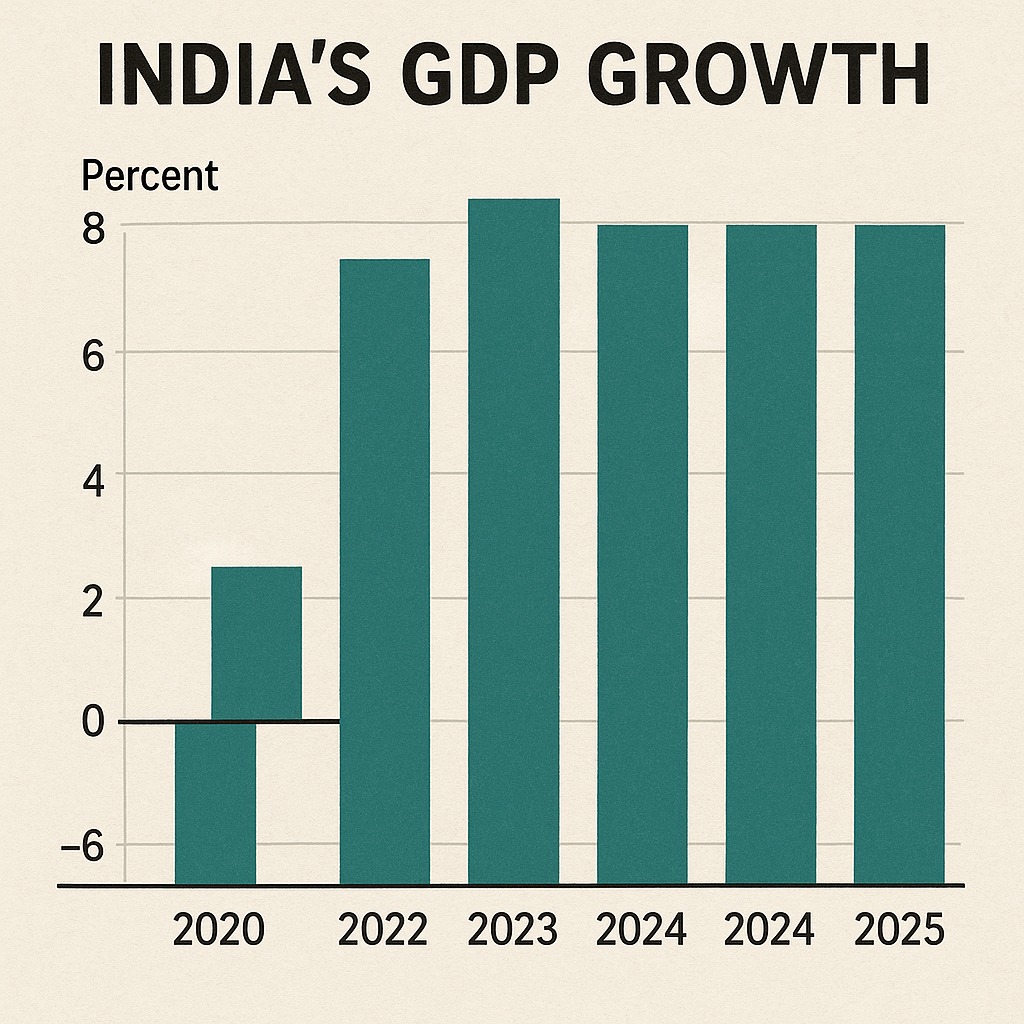

Looking ahead, India’s growth is expected to remain around 6.5–7% in FY 2025–26, supported by strong fundamentals, policy reforms, and digital adoption.

The government’s focus on green transition, job creation, and inclusive development will likely ensure that India’s growth is not just fast, but also sustainable and equitable.

Conclusion

While much of the world grapples with economic instability, India’s measured approach to policy, investment, and innovation has made it a standout performer.

This unusual stability is not accidental — it is the result of sound governance, strategic reform, and a resilient domestic market that continues to defy global odds.

FAQs:

Q1. Why is India’s economy considered unusually stable in 2025?

India’s economy is showing stability due to strong domestic demand, prudent monetary policies by the RBI, steady public investment in infrastructure, and a resilient service sector. Unlike many global economies, India’s growth is driven by internal consumption rather than exports.

Q2. What is India’s projected GDP growth for FY 2025–26?

According to various economic reports, India’s GDP growth is projected to be between 6.5% and 7% for FY 2025–26 — making it one of the fastest-growing major economies in the world.

Q3. How has the Reserve Bank of India (RBI) maintained stability?

The RBI has maintained balance by carefully adjusting interest rates, controlling liquidity, and keeping inflation within the target range of 4–6%. This has prevented economic overheating while ensuring credit flow to productive sectors.

Q4. What role does domestic demand play in India’s economic resilience?

Domestic consumption — especially in retail, housing, and digital services — forms nearly 60% of India’s GDP. This strong internal demand cushions the economy from global shocks and keeps industries and employment stable.

Q5. How have government policies supported economic stability?

Government initiatives like PM Gati Shakti, National Infrastructure Pipeline, and Digital India have boosted investment, improved logistics, and modernized governance. Fiscal discipline and reforms in taxation have further strengthened macroeconomic stability.

Published on : 7th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed