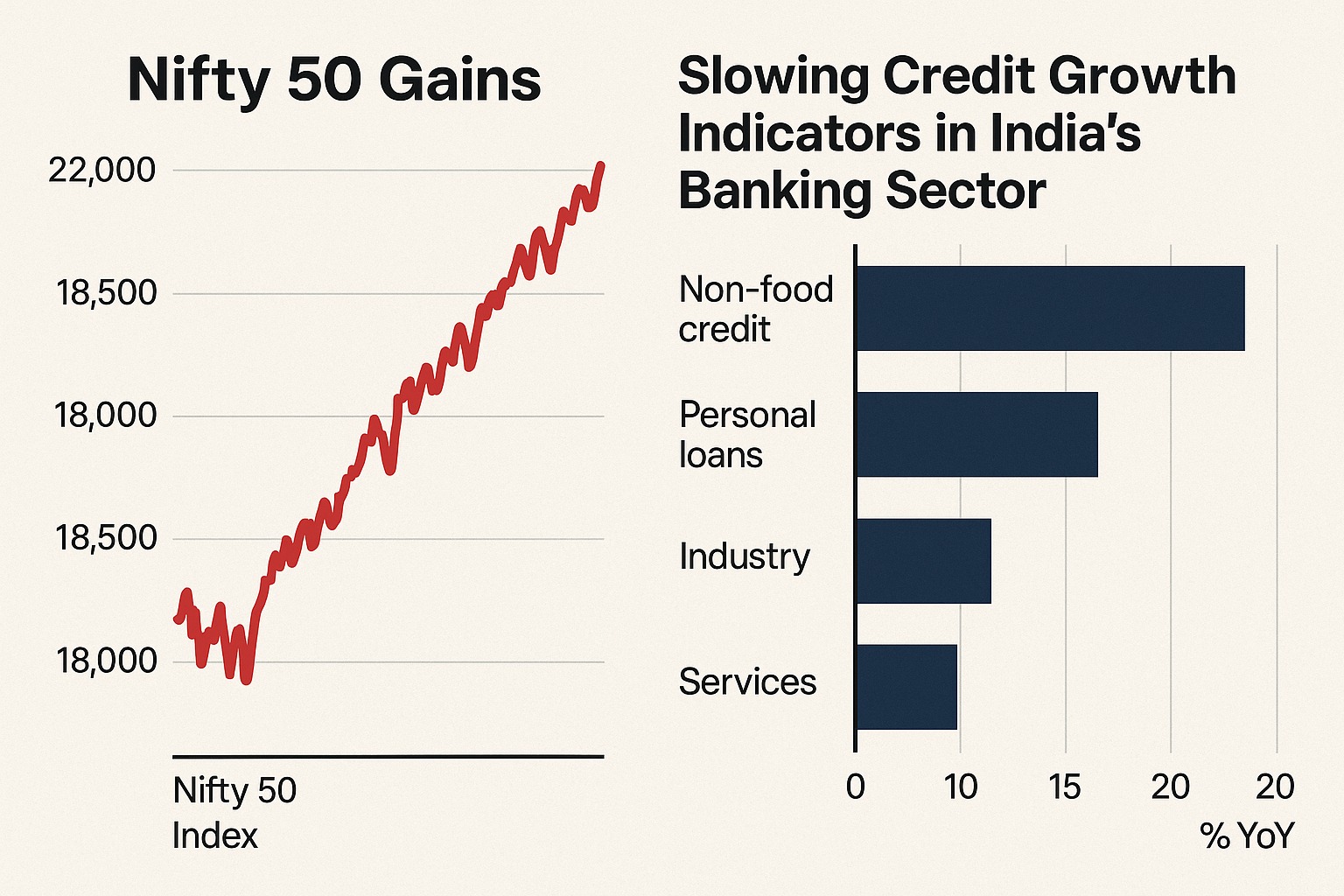

India’s stock markets have maintained an upward climb, with the Nifty 50 index recently crossing new highs, reflecting investor optimism. Yet, behind this bullish sentiment, a different economic story unfolds — credit growth in the banking sector is showing visible signs of deceleration.

This divergence between market performance and lending activity offers crucial insights into the state of India’s economy. It highlights how financial markets can appear vibrant even as parts of the real economy move at a slower pace.

Why Are Equities Rising When Credit Growth Is Slowing?

Despite slowing loan growth, equities are rallying — and several factors explain this apparent contradiction:

1. Market Optimism on Economic Fundamentals

Investor sentiment remains high due to robust GDP projections, strong corporate earnings, and expectations that India will continue to outperform global peers in growth.

2. Policy Confidence and Liquidity Support

With inflation stabilizing and the central bank likely to maintain or ease its monetary stance, investors expect continued policy support. The hope of future rate cuts fuels market optimism.

3. Large-Cap Dominance and Global Exposure

The Nifty 50 is heavily weighted toward large, well-capitalized companies that rely less on bank credit and more on global markets, internal accruals, and strong demand. These companies continue to drive overall index strength.

4. Equity Markets as Forward Indicators

Markets often anticipate future improvement. Rising equity indices may be pricing in a recovery in credit demand later in the fiscal year as interest rates moderate and industrial confidence returns.

What It Means for Borrowers

For individual and corporate borrowers, the slowdown in credit growth translates into both challenges and opportunities.

Tighter Lending Conditions: Banks are becoming more cautious, focusing on credit quality over volume. Borrowers with weaker financial profiles may face higher interest rates or stricter scrutiny.

Selective Lending Trends: Credit growth remains stronger in retail segments such as housing, but weaker in large industrial lending and unsecured loans.

Borrowing Costs May Stay Elevated: Even with easing inflation, the benefits of lower policy rates may not immediately reach borrowers if banks prioritize margins and asset quality.

Stronger Borrowers Gain Leverage: Businesses and individuals with solid credit records may use this phase to negotiate better loan terms, as banks prefer safe assets in uncertain cycles.

What It Means for Investors

The gap between buoyant stock markets and slowing credit growth offers both opportunities and cautionary signals for investors.

1. Equities May Be Running Ahead of Fundamentals

While markets are forward-looking, slowing credit growth could eventually reflect in weaker corporate spending and slower earnings momentum.

2. Stock Selection Matters

Investors should favor companies with low debt, strong cash flows, and diversified revenue streams, as these firms are less vulnerable to credit tightening.

3. Bond Market Dynamics

Slower loan growth could soften corporate bond yields and influence liquidity in debt markets. Fixed-income investors should watch for shifts in yield spreads and RBI policy cues.

4. Balanced Diversification

A portfolio balanced across equities, fixed income, and short-term instruments remains the most prudent approach in a phase where liquidity cycles are uncertain.

5. Long-Term Opportunity

If the credit cycle revives in the coming quarters, it could align with the next phase of economic expansion — offering fresh upside for equity investors positioned early.

Key Risks to Watch

Delayed Credit Transmission: Policy rate changes may take longer to affect borrowing costs if banks remain cautious.

Weak Corporate Investment: Slow loan growth could signal limited corporate appetite for expansion or capex.

Bank Profitability Pressure: Lower credit growth may affect interest income, impacting financial sector earnings.

Market Overvaluation: If equity valuations continue to rise without corresponding credit expansion, a correction could follow.

Global Uncertainty: External shocks — from commodity prices to geopolitical tensions — could dampen both market momentum and lending sentiment.

Conclusion

India’s economic story is showing two sides: a thriving equity market and a slowing credit engine.

While investors celebrate market highs, borrowers and banks are navigating a cautious lending environment. This divergence is not necessarily alarming — it reflects the transition phase of an economy adjusting to new rates, new risks, and new global realities.

For borrowers, prudence and preparedness will matter more than optimism. For investors, the key will be discipline — staying invested, diversified, and focused on fundamentals rather than short-term rallies.

Over time, as credit demand recovers and lending confidence rebuilds, the gap between the financial markets and the real economy may begin to narrow. Until then, both optimism and caution must coexist.

FAQs

Q1. Why is credit growth slowing in India?

A: Several factors — including tighter bank lending norms, higher borrowing costs, and selective sectoral lending — are contributing to the slowdown.

Q2. Why are markets still rising despite slower credit growth?

A: Markets are forward-looking and often price in expectations of future recovery, policy support, and global investor confidence.

Q3. How does this affect retail borrowers?

A: Borrowing could become more selective, with tighter eligibility and stable-to-high interest rates, especially for unsecured loans.

Q4. What should investors watch for?

A: Focus on fundamentals, avoid overvalued stocks, and monitor credit and liquidity indicators for signs of overheating or slowdown.

Q5. Can credit growth rebound soon?

A: If interest rates ease and business sentiment improves, a rebound is possible by the next fiscal year as liquidity and demand align.

Published on : 12th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed