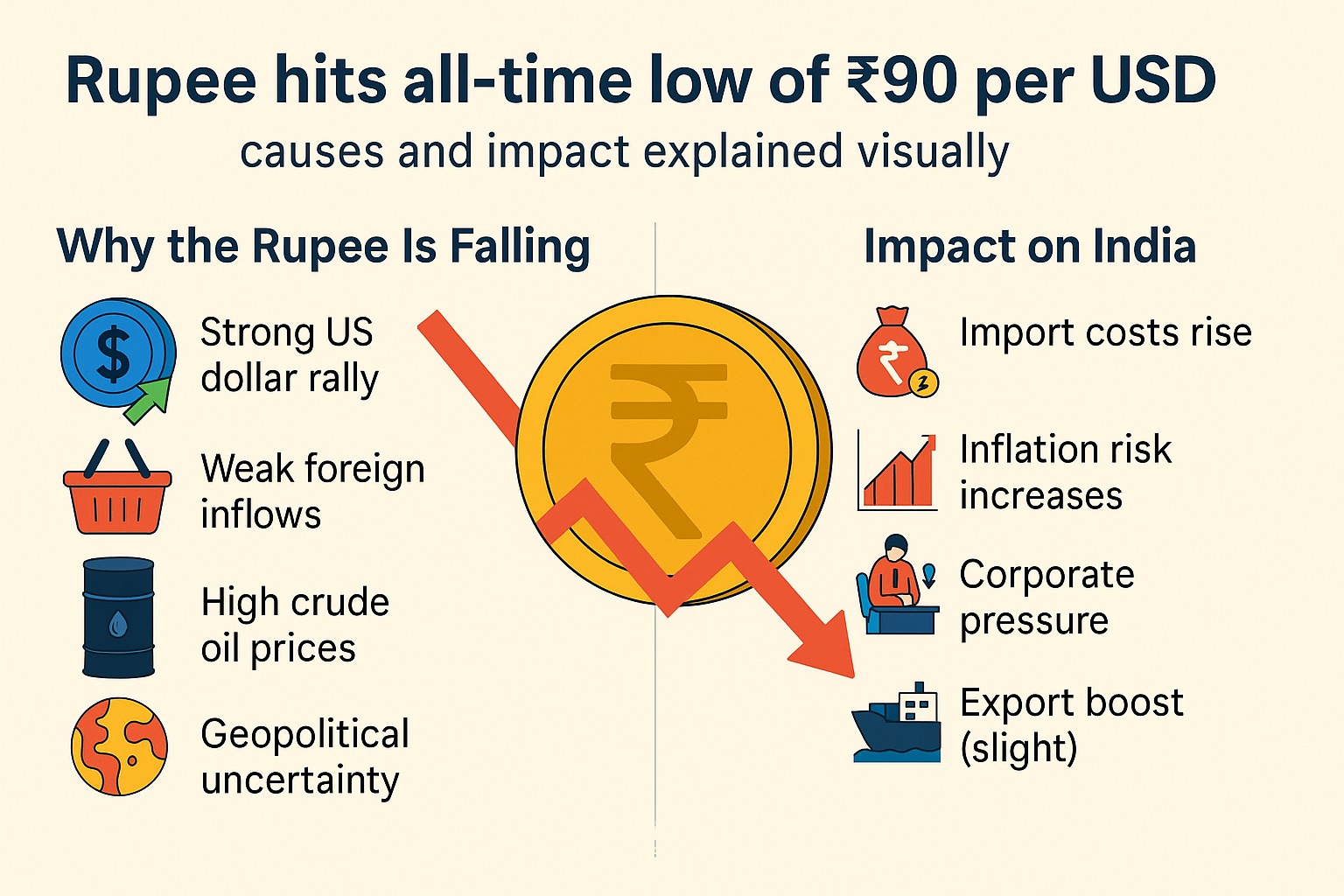

The Indian Rupee has slipped past ₹90 per USD, hitting a record low due to strong US dollar demand, weak foreign inflows, high crude oil prices, and global risk aversion. This increases import costs, inflation risks, and market volatility, while RBI may intervene to stabilize the currency.

INTRODUCTION

For the first time in history, the Indian Rupee (INR) has fallen below ₹90 per US dollar, marking one of the most significant currency events of the decade.

This dramatic move reflects a combination of global economic stress and domestic vulnerabilities.

A falling rupee affects:

Import bills

Inflation

Borrowing costs

Investor sentiment

Stock markets

Everyday household budgets

This detailed blog explains why this happened, what it means, and what to expect next.

Why the Indian Rupee Fell Below ₹90/USD

1. Strong US Dollar & Rate Expectations

The US Dollar Index (DXY) is rising on strong US economic data.

The Federal Reserve delayed rate cuts → foreign money flows to USD.

Emerging market currencies weaken, including INR.

2. Weak Foreign Portfolio Inflows (FPI)

Foreign investors have been pulling out capital due to:

High global yields

India’s premium valuations

Concerns over corporate earnings

When FPIs sell Indian assets → they buy USD → INR weakens.

3. High Crude Oil Prices

India imports 85% of its oil.

Higher oil → more dollar demand → rupee pressure increases.

4. Geopolitical Tensions

Middle East tensions

Russia–Ukraine conflict

Global supply chain disruptions

All drive investors toward safe-haven USD.

5. Rising India Import Bill

Electronics, gold, crude, machinery — all require USD payments.

High import demand = greater USD demand → rupee drops.

Impact of Rupee Falling Below ₹90/USD

1. Rising Inflation (Imported Inflation)

Costlier imports = higher prices of:

Fuel

Electronics

Consumer goods

Raw materials

Inflation risk rises sharply.

2. Stock Market Volatility

IT & exporters may benefit

Banks, oil-dependent sectors face pressure

FPIs may continue selling

3. Corporate Pressure

Companies with foreign loans face higher repayment costs.

4. Travel & Education Abroad Become Costlier

Foreign tuition fees

Hotel bookings

Airfare

Overseas expenses

All rise instantly.

5. Government Fiscal Burden Increases

Higher oil and import costs strain:

Fiscal deficit

Subsidy burden

Balance of payments

Pros & Cons of Rupee Decline

| Pros | Cons |

|---|---|

| Boosts exports | Inflation rises |

| Helps IT & outsourcing sectors | Imports become expensive |

| Attracts long-term FDI eventually | Borrowing costs increase |

| Improves remittances value | Weakens purchasing power |

What RBI May Do Now

The RBI typically responds by:

✓ Intervening in forex markets

Selling dollars from reserves to stabilize INR.

✓ Managing liquidity

To control imported inflation.

✓ Verbal intervention

Statements to calm markets.

✓ Holding or adjusting rates cautiously

To maintain stability without hurting growth.

What This Means for Investors

Short-Term

Expect volatility in banking, oil & gas, aviation sectors.

IT and export-heavy stocks may see inflows.

Medium to Long Term

Stable fundamentals may attract long-term foreign money.

Currency markets will stabilize once US rate cuts start.

Key Takeaways

Rupee at ₹90 per USD marks a historic event

Driven by global dollar rally, FPI outflows & high oil prices

Inflation risks and import costs will rise

RBI intervention is expected

Markets may stay volatile but long-term fundamentals remain strong

Expert Commentary

As a currency and macro analyst following INR trends for years, breaching ₹90 was not a surprise. Global macro conditions—especially US rate cycles—have always played a major role. India’s fundamentals remain strong, but short-term volatility will persist until global monetary conditions ease. The key now is RBI’s intervention strategy and crude price movement.

FAQs

1. Why did the rupee fall below ₹90/USD?

Due to strong dollar, high crude, FPI selling, and global uncertainty.

2. Will the rupee fall further?

Depends on US Fed policy, crude prices, and RBI intervention.

3. Does a weak rupee increase inflation?

Yes — imported inflation rises.

4. Is a weak rupee good for exporters?

Yes, exporters earn more.

5. Will RBI intervene?

Very likely.

6. What sectors benefit from a weak rupee?

IT, pharma, textiles.

7. What sectors are hurt?

Banks, aviation, oil & gas.

8. Does rupee fall affect foreign education?

Yes — it becomes more expensive.

9. Should investors worry?

Short-term volatility is expected.

10. Will interest rates rise?

Only if inflation rises sharply.

11. Does rupee fall affect gold prices?

Yes — imported gold becomes costlier.

12. Is this a long-term trend?

Not necessarily — recovery depends on global factors.

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and an easy approval process. Apply at www.vizzve.com

Published on : 4th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed