💸 Instant ₹10,000 Loan Without Salary Slip – Get Approved Fast at Vizzve

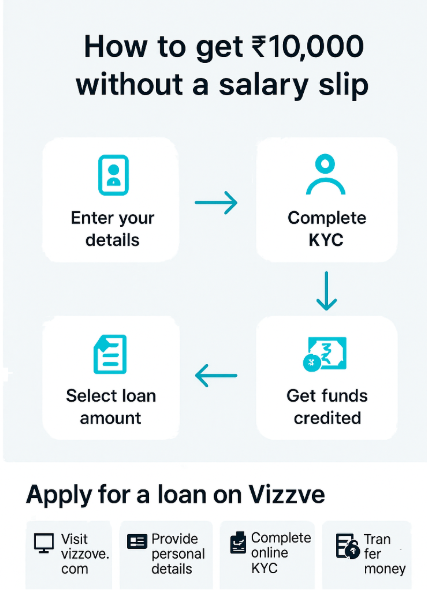

Life doesn’t always come with a payslip—and that’s okay. Whether you're a freelancer, self-employed, or in between jobs, Vizzve Financial offers a smarter way to get a quick ₹10,000 personal loan without a salary slip. If you need money urgently, www.vizzve.com is here to help with a smooth, fully digital loan process.

🔍 Real-Life Example

Akash, 32, from Jaipur, left his job to care for his parents and took up freelance work. When an urgent home repair popped up, he needed ₹10,000. Without a payslip, he turned to Vizzve Financial. With just his bank statement and Aadhaar, his loan was approved in minutes, and funds were disbursed the same day.

💡 What Is a ₹10,000 Loan Without Salary Slip?

It’s a short-term personal loan designed for those who don’t have traditional proof of income. Platforms like Vizzve Financial accept:

Loans are processed online and funds are disbursed quickly—ideal for emergencies.

👥 Who Can Apply?

You’re eligible even without a payslip if you’re:

-

✅ Freelancers or gig workers

-

✅ Self-employed business owners

-

✅ Commission-based professionals (agents, consultants)

-

✅ Landlords or investors earning rent/dividends

-

✅ In a job gap but with good credit or alternate proof of income

📊 Interest Rates & Loan Details

No salary slip? No problem. Just keep these ready:

You don’t need a fixed job to qualify for a personal loan. Whether you’re freelancing, between jobs, or self-employed—Vizzve Financial makes it easier than ever to get the money you need, when you need it. Apply now and handle life’s surprises with confidence.

🤔 Frequently Asked Questions (FAQ)

Q1. Can I get a ₹10,000 loan without a salary slip?

Yes, Vizzve Financial allows you to apply using alternative documents like bank statements, ITRs, or proof of freelance income.

Q2. How quickly will I receive the loan amount?

If your documents are in order, your ₹10,000 loan can be approved and disbursed within a few hours.

Q3. Is income proof mandatory for the ₹10,000 loan?

No, income proof is not mandatory, but providing bank statements or ITRs improves your chances of approval.

Q4. Can freelancers or gig workers apply for a loan at Vizzve?

Absolutely. Vizzve is designed for freelancers, self-employed professionals, and gig workers with non-traditional income.

Q5. What documents do I need to apply?

You’ll need your PAN card, Aadhaar card, a selfie for KYC, and optionally your bank statements or ITRs.

Q6. Is a credit score required to get a ₹10,000 loan?

A credit score helps, but it’s not mandatory. Vizzve evaluates your overall financial profile including banking habits.

Q7. Can I get a loan if I’m unemployed?

Yes, if you have savings, rental income, investments, or alternate income, you can still qualify.

Q8. Is collateral required for this personal loan?

No. The ₹10,000 loan is unsecured, so you don’t need to pledge anything.

Q9. Will this affect my CIBIL score?

Yes. Timely repayments can improve your credit score, while missed payments may lower it.

Q10. What is the repayment tenure for ₹10,000?

You can choose from 6, 9, or 12-month flexible repayment options.

Q11. Can students or homemakers apply for this loan?

Only if they have some form of income or co-applicant. Otherwise, they may not be eligible.

Q12. Is there a mobile app for Vizzve Financial?

Yes! You can apply via the Vizzve mobile app or the website – both are fast and user-friendly.

Q13. What if my loan is rejected?

You can reapply after improving your financial documents, such as updating your bank statement or applying with a co-applicant.

Q14. Can I prepay or foreclose my ₹10,000 loan?

Yes, you can prepay anytime. Check with Vizzve for foreclosure charges or zero-prepayment offers.

Q15. How safe is the online process with Vizzve?

100% secure. Vizzve uses bank-grade encryption and RBI-compliant protocols for digital KYC and loan disbursal.