Instant vs. Traditional Loans: Which One Truly Benefits You?

In today’s fast-paced financial landscape, choosing between instant loans and traditional loans can significantly impact your borrowing experience. While both serve the core purpose of providing financial assistance, they differ in terms of application process, disbursal speed, documentation, and flexibility.

Let’s explore the differences and help you decide which option works best for your current financial goals.

What Are Instant Loans?

Instant loans are short-term, quick-approval financial products offered by banks, NBFCs, and digital lenders. These are primarily processed online and require minimal documentation.

Key Features:

Quick approval and disbursement (often within 24 hours)

Minimal paperwork

Primarily offered through apps or online portals

Smaller loan amounts (₹10,000 to ₹5 lakhs)

Higher interest rates due to convenience

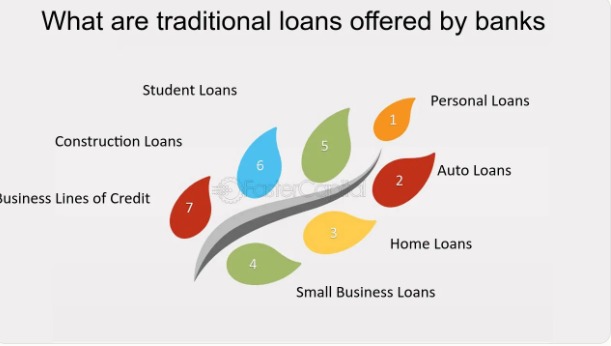

What Are Traditional Loans?

Traditional loans refer to financial products like personal loans, home loans, car loans, or business loans offered by banks and NBFCs via branch visits or formal channels.

Key Features:

Longer processing time (up to 7–10 working days)

Thorough documentation and credit checks

Larger loan amounts available

Lower interest rates compared to instant loans

Physical branch visits often required

Instant Loans vs Traditional Loans: A Detailed Comparison

| Feature | Instant Loans | Traditional Loans |

|---|---|---|

| Approval Time | Within minutes to 24 hours | 3 to 10 working days |

| Documentation | Minimal | Extensive |

| Loan Amount | ₹10,000 – ₹5,00,000 | ₹50,000 – ₹50,00,000+ |

| Interest Rates | Higher (12% – 30%) | Lower (8% – 15%) |

| Processing Method | 100% online | Offline/Online mix |

| Credit Check | Soft or basic check | Thorough CIBIL score check |

| Best For | Emergency needs | Planned, large expenses |

Which Loan Should You Choose?

The best choice depends on your current financial needs, urgency, and repayment ability:

Choose Instant Loans if:

You need funds urgently (medical emergency, travel, or short-term expense)

You prefer a digital, paperless experience

You are okay with higher interest rates for faster access

Choose Traditional Loans if:

You are planning a large expense like home renovation, wedding, or business expansion

You want a longer tenure and better interest rate

You can wait for the disbursement process

Why Vizzve Finance Recommends a Balanced Approach

At Vizzve Finance, we understand that financial situations vary. We help you evaluate both options with personalized loan advisory based on:

Your credit profile

Urgency of funds

Loan amount requirements

Income and repayment capacity

We’ve seen a surge in demand for instant loans for emergencies, but traditional loans remain the best for long-term goals. This blog has recently trended on Google due to increased search for quick loans and comparison guides, especially in metro cities like Mumbai, Delhi, and Bangalore.

Conclusion

Choosing between instant and traditional loans is not a one-size-fits-all decision. Evaluate your urgency, loan amount, repayment plan, and interest affordability before applying. Let Vizzve Finance guide you in selecting the best loan product tailored to your financial goals.

Frequently Asked Questions (FAQs)

1. Are instant loans safe?

Yes, instant loans are safe when borrowed from trusted lenders or regulated NBFCs. Always read the terms and verify the lender’s RBI registration.

2. Can I get an instant loan without a credit score?

Some instant loan providers offer credit to first-time borrowers with low or no credit score, though interest rates may be higher.

3. What is the main disadvantage of traditional loans?

The main drawback is the long processing time and extensive paperwork involved, which may not be suitable for urgent financial needs.

4. Is it possible to prepay or foreclose an instant loan?

Yes, but check for any prepayment penalties or lock-in periods before doing so.

5. Does Vizzve Finance offer both types of loans?

Vizzve Finance partners with multiple lenders and helps you choose the most suitable instant or traditional loan based on your financial profile.

Published on: July 28, 2025

Published by: Selvi

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed