When employees need urgent financial support—whether for a medical emergency, gadget purchase, or education—employee loans offer a reliable solution. But there’s often confusion between interest-free loans and low-interest employee loans. So, which one should you go for in 2025?

Here’s a detailed comparison to help you make a smart financial decision—with insights from Vizzve Finance, your trusted lending partner.

What is an Interest-Free Employee Loan?

An interest-free loan is typically offered by employers as a short-term financial benefit. The employee repays only the principal amount, with no additional interest.

Pros:

Zero interest = zero additional cost

Great for small, short-term needs

Usually processed internally, often faster

Cons:

Limited to employer policy

May be taxable as a perquisite under Indian Income Tax Act if it exceeds ₹20,000

Not always available or reliable

No credit score benefit

What is a Low-Interest Employee Loan?

A low-interest employee loan—like those offered via NBFCs such as Vizzve Finance—comes with significantly reduced interest rates (starting from 1.3% per month), and quick, flexible repayment options.

Pros:

Higher loan limits (up to ₹5 lakhs with Vizzve)

No tax on loan amount or interest

Improves credit score when repaid on time

Can be used for multiple purposes: medical, home, gadgets, education, etc.

100% digital application, no employer approval needed

Cons:

Some interest payable, though much lower than market rates

EMI obligations must be met regularly

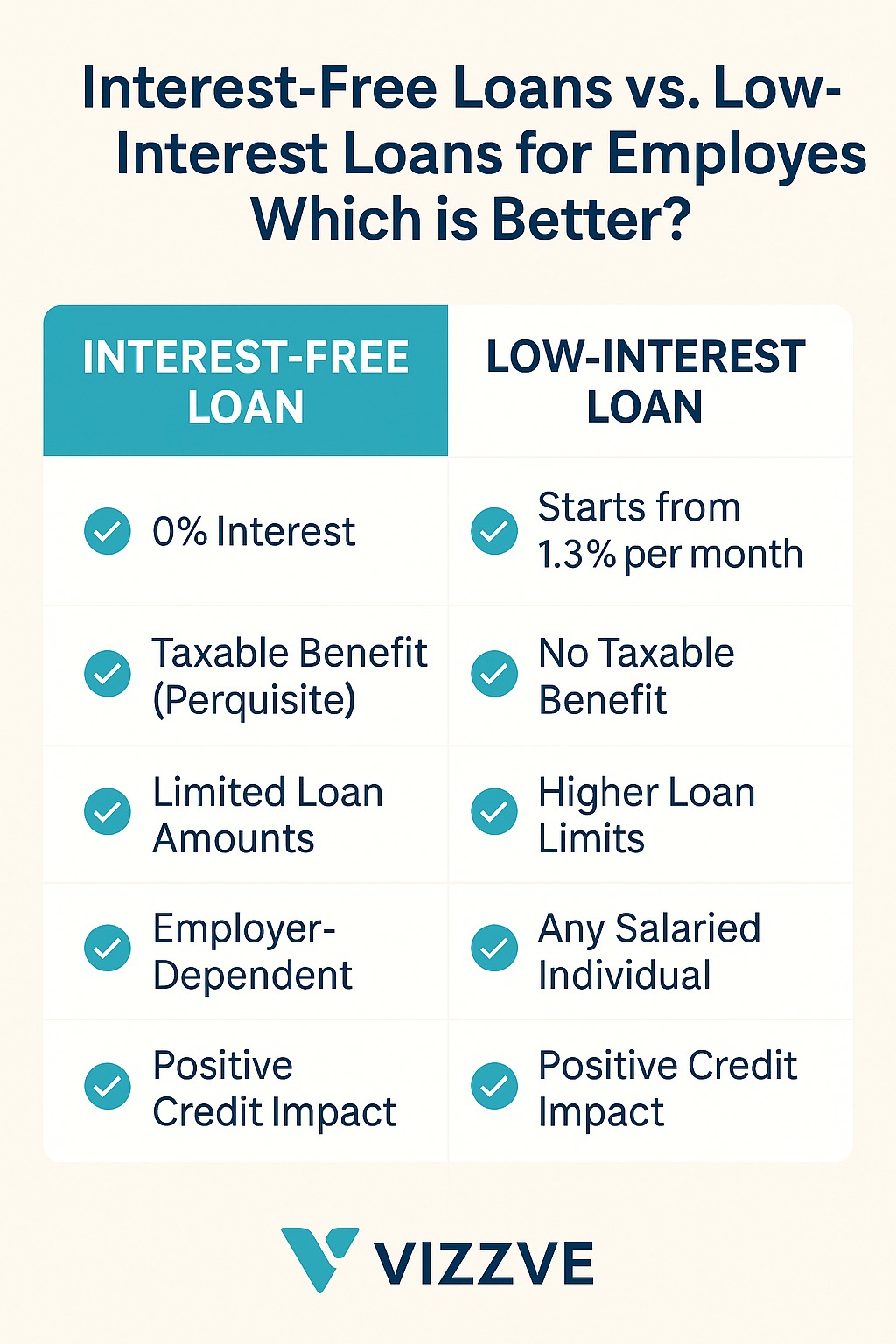

Comparison Table

| Feature | Interest-Free Loan | Low-Interest Loan (Vizzve) |

|---|---|---|

| Interest | 0% | Starts from 1.3% per month |

| Taxable Benefit (Perquisite) | Yes (if > ₹20,000) | No |

| Approval Speed | Depends on HR/Admin | Instant (within 10 minutes) |

| Loan Limit | Usually Low | ₹5,000 – ₹5,00,000 |

| Credit Score Impact | None | Positive with timely EMIs |

| Eligibility | Employer-dependent | Any salaried individual |

| Application Mode | Offline/Internal | 100% Online via Vizzve App |

So, Which Is Better?

✅ Use an interest-free loan when:

The loan amount is small (under ₹20,000)

You need quick help directly from your employer

You don’t mind limited repayment options

✅ Choose a low-interest loan (like Vizzve) when:

You need larger loan amounts

Want to avoid tax complications

Prefer digital convenience, instant approval, and credit score building

Example Use Case:

Rahul, an IT employee, needed ₹1,20,000 for his child's education. His employer offered only ₹20,000 interest-free. He chose Vizzve Finance for the full amount at a low interest, repaid in 12 easy EMIs—and improved his credit score too.

FAQs –

1. Is the interest-free loan better than a low-interest loan?

Only for small, tax-exempt amounts. For bigger needs, low-interest loans offer better flexibility and credit advantages.

2. Will I get a tax deduction for repaying either type?

No tax deduction on repayment, but low-interest loans are not taxed as perquisite, unlike interest-free loans.

3. Can I take both types of loans?

Yes. You can avail a small interest-free loan from your employer and a larger personal loan from Vizzve simultaneously.

4. Do low-interest loans impact my CIBIL score?

Yes, positively—if EMIs are paid on time.

5. What is the fastest way to get a low-interest employee loan?

Apply via the Vizzve Finance app and get disbursal in under 24 hours.

Published on : 25th July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed