Learn How Loans Work Before You Borrow

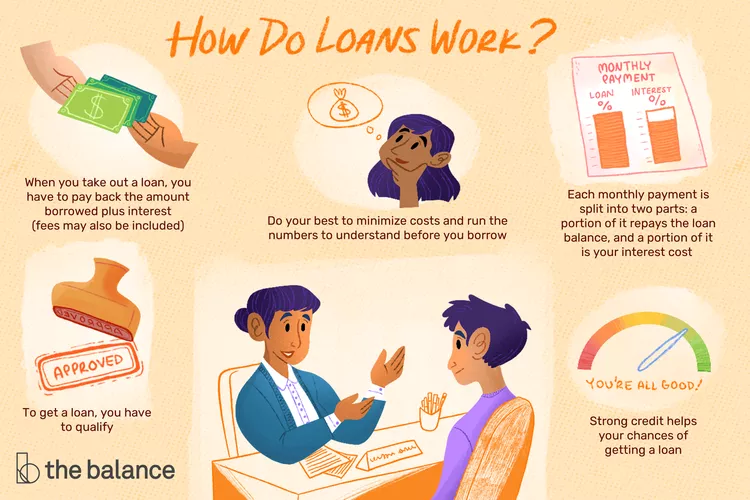

A loan is a sum of money borrowed from a lender, such as a bank or financial institution, which you agree to repay over time with interest. Understanding how loans work is essential before borrowing to ensure you make informed decisions and manage debt responsibly.

What Is a Loan?

A loan involves receiving money or assets now with the promise to repay the principal (the original amount borrowed) plus interest (a fee charged by the lender) over a set period. Loans can be:

Secured Loans: Backed by collateral like property or a vehicle, which the lender can claim if you default. Examples include home loans and car loans.

Unsecured Loans: Not tied to any asset, typically with higher interest rates. Examples include personal loans and credit cards.

How Does the Loan Process Work?

Application: You submit your details and reason for borrowing to the lender.

Assessment: The lender evaluates your credit score, income, existing debts, and repayment capacity.

Approval/Rejection: Based on your eligibility and risk, the lender approves or denies the loan.

Loan Agreement: If approved, you sign a contract detailing loan amount, interest rate, repayment schedule, and terms.

Disbursement: The lender transfers the funds to you.

Repayment: You repay the loan in monthly installments (EMIs) that include principal plus interest until fully paid.

Types of Loans

| Loan Type | Secured/Unsecured | Common Purpose |

|---|---|---|

| Home Loan | Secured | Buying or building a home |

| Personal Loan | Unsecured | Emergency, travel, weddings |

| Vehicle Loan | Secured | Purchasing cars or bikes |

| Education Loan | Secured/Unsecured | College/university fees |

| Gold Loan | Secured | Short-term financial needs |

| Business Loan | Secured/Unsecured | Starting or expanding business |

| Credit Card | Unsecured | Daily expenses, revolving credit |

Key Terms to Know

Interest Rate: The percentage charged on the loan amount for borrowing.

EMI (Equated Monthly Installment): Fixed monthly payment combining principal and interest.

Tenure: The loan repayment period.

Processing Fees: Charges by the lender to process your loan application.

Prepayment: Paying off the loan early, sometimes with penalties.

Tips Before You Borrow

Assess how much you need and can afford to repay comfortably.

Check your credit score and improve it to get better rates.

Compare different lenders for the best interest rates and terms.

Read and understand the loan agreement thoroughly.

Avoid borrowing more than necessary to reduce financial strain.

Frequently Asked Questions (FAQ)

Q1: What happens if I miss a loan payment?

Missing payments can lead to penalties, increased interest, and damage your credit score.

Q2: Is a secured loan safer than an unsecured loan?

Secured loans usually have lower interest rates since collateral reduces lender risk.

Q3: Can I repay my loan early?

Yes, but some lenders may charge a prepayment penalty. Check your loan terms.

Q4: How is my loan eligibility determined?

Lenders consider income, credit score, employment stability, and existing debts.

Q5: What’s the difference between a loan and a line of credit?

A loan provides a lump sum upfront; a line of credit gives flexible access up to a limit.

Published on: July 28, 2025

Published by: PAVAN

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed