When you need urgent funds, breaking your fixed deposit (FD) or redeeming your mutual funds (MFs) may seem like the easiest choice. However, many banks and financial institutions allow you to borrow against these investments instead. This helps you access cash while keeping your money invested and earning returns.

But is it safe? And does it make better financial sense than traditional loans like personal loans or credit cards? Let’s break it down with clarity.

What Does 'Loan Against FD or MF' Mean?

It is a secured loan where your FD or mutual fund units are used as collateral instead of income proof alone.

For FD loans, lenders typically offer 80–95% of deposit value.

For MF loans, lending value may vary based on fund category, NAV, and market volatility.

Advantages of Taking Loans Against Investments

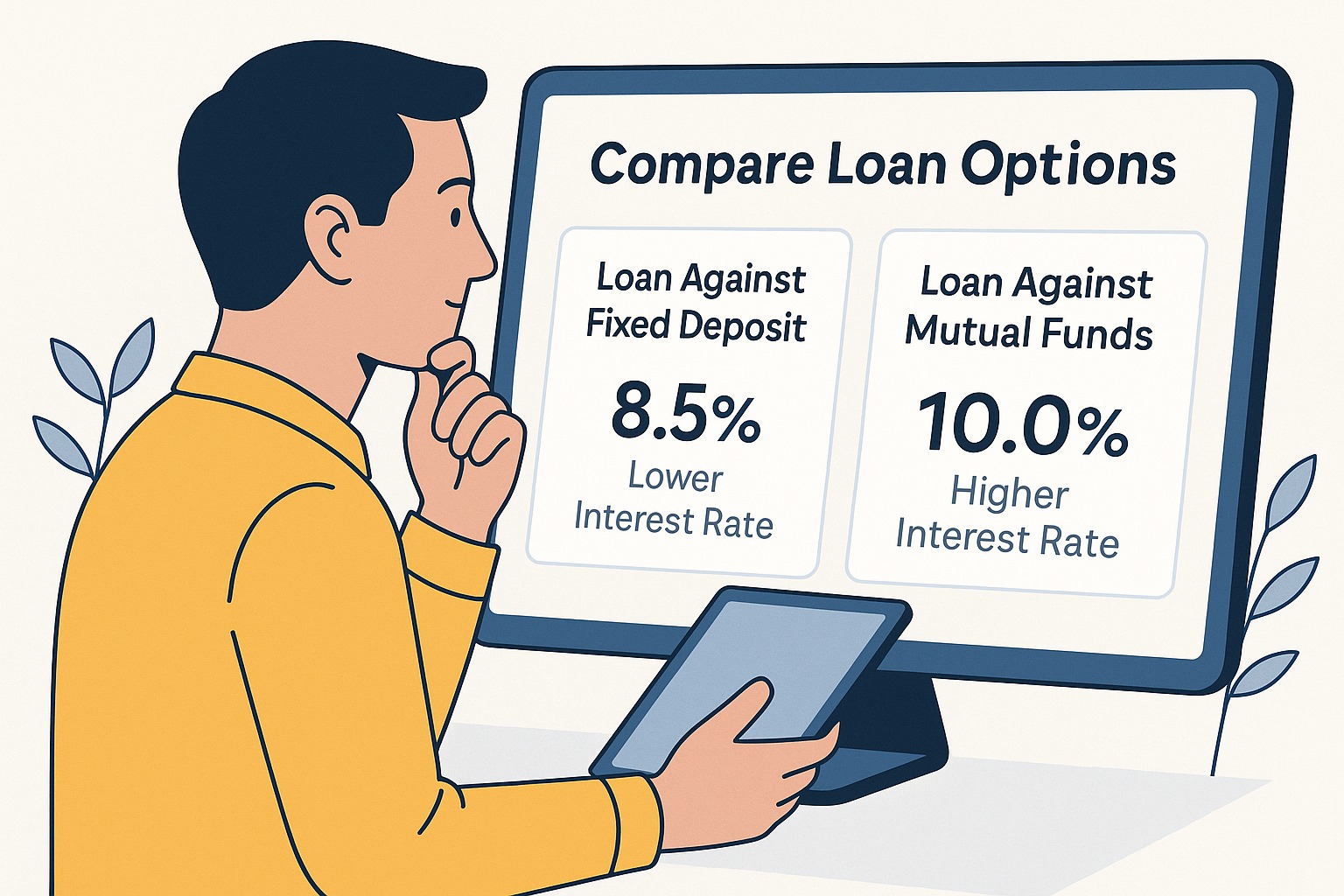

1️⃣ Lower Interest Rates than Unsecured Loans

Since the loan is secured, interest rates are usually much lower compared to personal loans, credit cards, BNPL or cash-advance products.

2️⃣ You Don’t Break Your Investment

Your FD continues to earn interest, and your mutual fund units stay invested, preserving long-term compounding benefits.

3️⃣ Faster Approval and Minimal Documentation

Since your investment acts as security, the loan approval process is generally quick, hassle-free, and paper-light.

4️⃣ Flexible Repayment & Prepayment

Most lenders allow flexible repayment, sometimes even interest-only payback until final settlement.

5️⃣ No Impact on Credit Score Unless Default Occurs

Since funds are secured, loan approval and usage do not negatively affect credit score unless you default.

Risks & Things to Watch Out For

1️⃣ Investment Can Be Liquidated if You Default

If you fail to make payments, the lender can sell or redeem your collateral to recover dues.

2️⃣ Mutual Funds Carry Market Risk

If your MF value falls significantly, you may face:

Margin calls

Reduced eligibility value

Additional collateral requirements

3️⃣ Can Create Psychological Overspending

Easy availability of low-cost credit may lead to unplanned borrowing, weakening long-term savings discipline.

4️⃣ Interest Cost May Still Hurt Financial Goals

Even though rates are lower, long repayment periods may reduce the net return you earn from the investment.

When Is It a Smart Choice?

✔ Short-term, temporary liquidity need

✔ Expected cash inflow soon (bonus, maturity, insurance, commission, receivables)

✔ Investment earning good returns & worth continuing

✔ Emergency situations where breaking FD/MF harms long-term planning

✔ To avoid high-interest debt like credit cards or instant loans

When to Avoid It

✖ Borrowing for lifestyle purchases

✖ No clear repayment plan

✖ MF market is already falling or volatile

✖ You are heavily leveraged (multiple EMIs)

✖ Using it to cover recurring monthly expenses

FD vs MF — Which Is Safer for Borrowing?

| Feature | Loan Against FD | Loan Against MF |

|---|---|---|

| Risk Level | Very Low | Moderate (Market Dependent) |

| Interest Rate | Lower | Slightly Higher |

| Loan Value | High (80–95%) | Varies by fund type |

| Suitability | Conservative investors | Market-linked investors |

| Volatility Concerns | None | High in equity funds |

❓ FAQs

Q1: Does taking a loan against FD cancel interest earnings?

No, your FD continues to earn interest until maturity.

Q2: Are equity mutual funds risky for collateral loans?

Yes, because market volatility may affect loan value and conditions.

Q3: Is it cheaper than a personal loan?

In most cases, yes, because it is secured credit.

Q4: What happens if repayment stops?

The lender may liquidate or redeem your investment.

Q5: Should I break FD or borrow against it?

Compare interest saved vs interest earned — if FD return is far lower than loan interest, repayment may be wiser.

Published on : 17th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed