Many people take loans — home loans, personal loans, business loans, car loans, education loans. But not everyone understands the tax implications behind them.

One of the biggest questions borrowers ask is:

👉 “Can I claim tax benefits on the interest I pay?”

The answer: It depends on the type of loan and how you use it.

Here’s a simple and clear guide.

✅ Loans Where Interest IS Tax-Deductible

1. Home Loan (Most Popular Tax Benefit)

A. Section 24(b) — Interest Deduction (Up to ₹2 lakh/year)

For self-occupied property: max deduction ₹2,00,000

For let-out property: no upper limit, but maximum loss set-off = ₹2 lakh

Applicable only on interest component, not principal

B. Section 80C — Principal Repayment (Up to ₹1.5 lakh/year)

Includes home loan principal, stamp duty & registration charges.

C. Section 80EE / 80EEA — Additional Interest (First-time buyers)

Extra deduction available under certain conditions.

2. Education Loan (100% Interest Deduction)

Under Section 80E, entire interest paid on an education loan is tax-deductible for 8 years.

Covers:

Higher education in India or abroad

Courses in any field

Loans taken by self, spouse, or children

No limit on deduction amount.

3. Business Loan / MSME Loan

Interest paid on:

Business loans

Working capital loans

Machinery loans

Cash credit

…is fully tax-deductible as a business expense.

Deduction allowed under:

Section 37(1) → Business expenditure

Section 36(1)(iii) → Interest on borrowed capital

4. Loan Taken for Investing in Property or Shares

If you take a loan to invest:

In rental property → Interest deduction allowed

In shares or mutual funds → Interest allowed as expense under “Income from Other Sources” (with limits)

5. Loan Against Property (LAP) — Condition-Based

If used for business → Interest is tax-deductible

If used for investments → Generally deductible

If used for personal expenses → NO deduction

❌ Loans Where Interest Is NOT Tax-Deductible

1. Personal Loan (Usually No Tax Benefit)

Interest on personal loans is not tax-deductible — except in special cases:

If used for business → deduction allowed

If used for buying/renovating property → interest can be claimed

If used for investments → partially deductible

But for normal use (wedding, travel, shopping, gadgets) → NO tax benefit.

2. Car Loan / Bike Loan

For personal use → No deduction

For business use → Interest is deductible as business expense

3. Credit Card Loans / EMI Conversions

Interest on credit card outstanding is not tax-deductible, unless used for business purchases.

4. Consumer Durable Loans

Loans for:

Electronics

Furniture

Appliances

…do not offer any tax benefits.

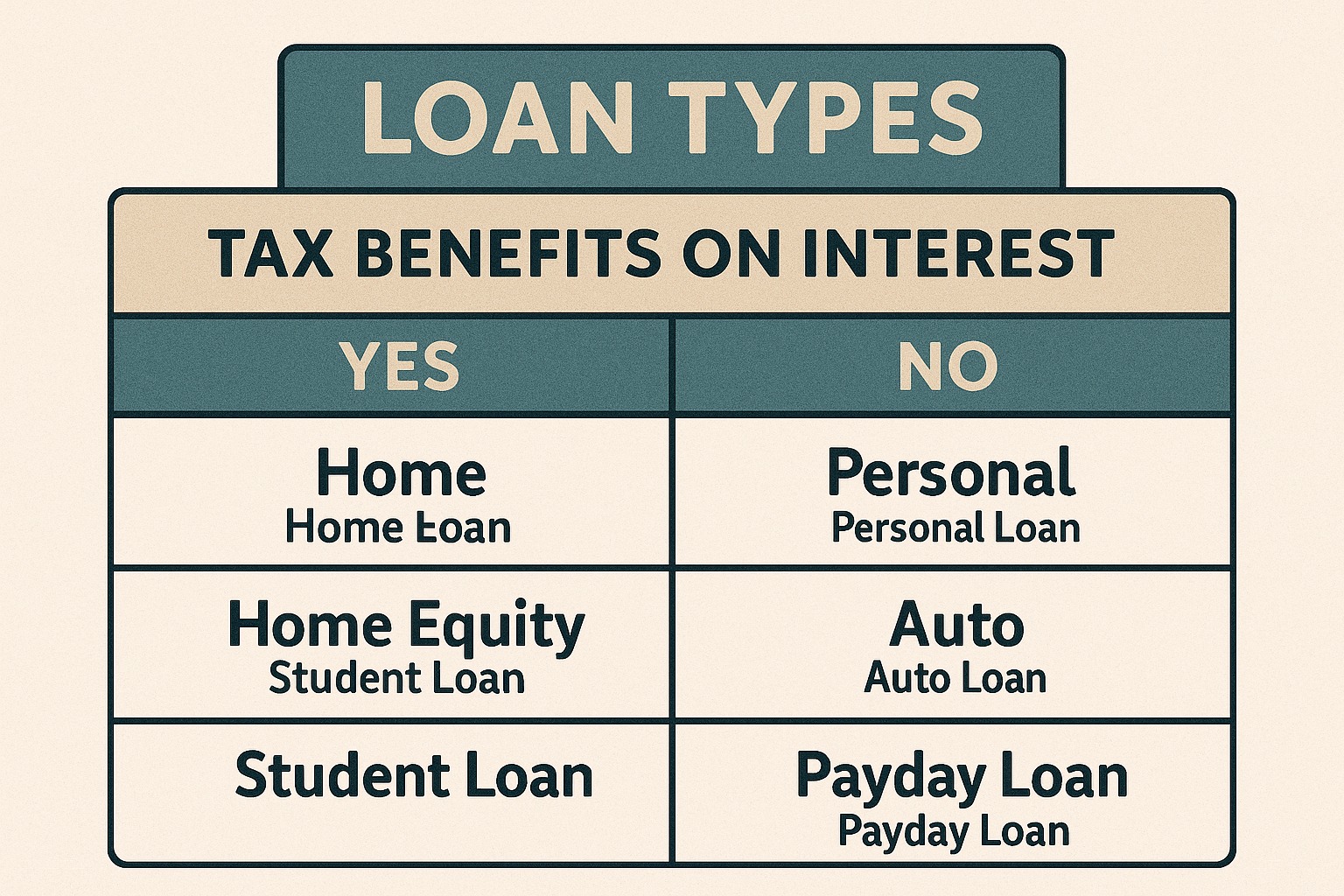

Summary Table: When Loan Interest Is Deductible

| Loan Type | Interest Tax-Deductible? | Section |

|---|---|---|

| Home Loan | ✅ Yes | 24(b), 80C, 80EE, 80EEA |

| Education Loan | ✅ Yes | 80E |

| Business Loan | ✅ Yes | 37(1), 36(1)(iii) |

| Loan Against Property | ✔ Sometimes | Depends on usage |

| Personal Loan | ❌ No (except for specific uses) | Depends |

| Car Loan | ❌ No (personal use) / ✔ Yes (business) | Business expense |

| Credit Card Loan | ❌ No (personal) / ✔ Yes (business) | Business expense |

FAQs

1. Is personal loan interest tax-deductible?

Only if used for business, property purchase, or investments. Not for personal spending.

2. Are car loan EMIs tax-deductible?

Yes, for business vehicles. No for personal vehicles.

3. Can I claim tax benefits on two home loans?

Yes — subject to overall Section 24(b) and 80C limits.

4. Is education loan principal tax-deductible?

No. Only interest is deductible.

5. Are credit card EMIs tax-deductible?

No, unless used solely for business.

Published on : 19th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed