You checked your CIBIL score — it’s good.

Maybe 720, 750, or even 800+.

You applied for a personal loan confidently…

But to your surprise:

❌ Loan Rejected

This is more common than people realize.

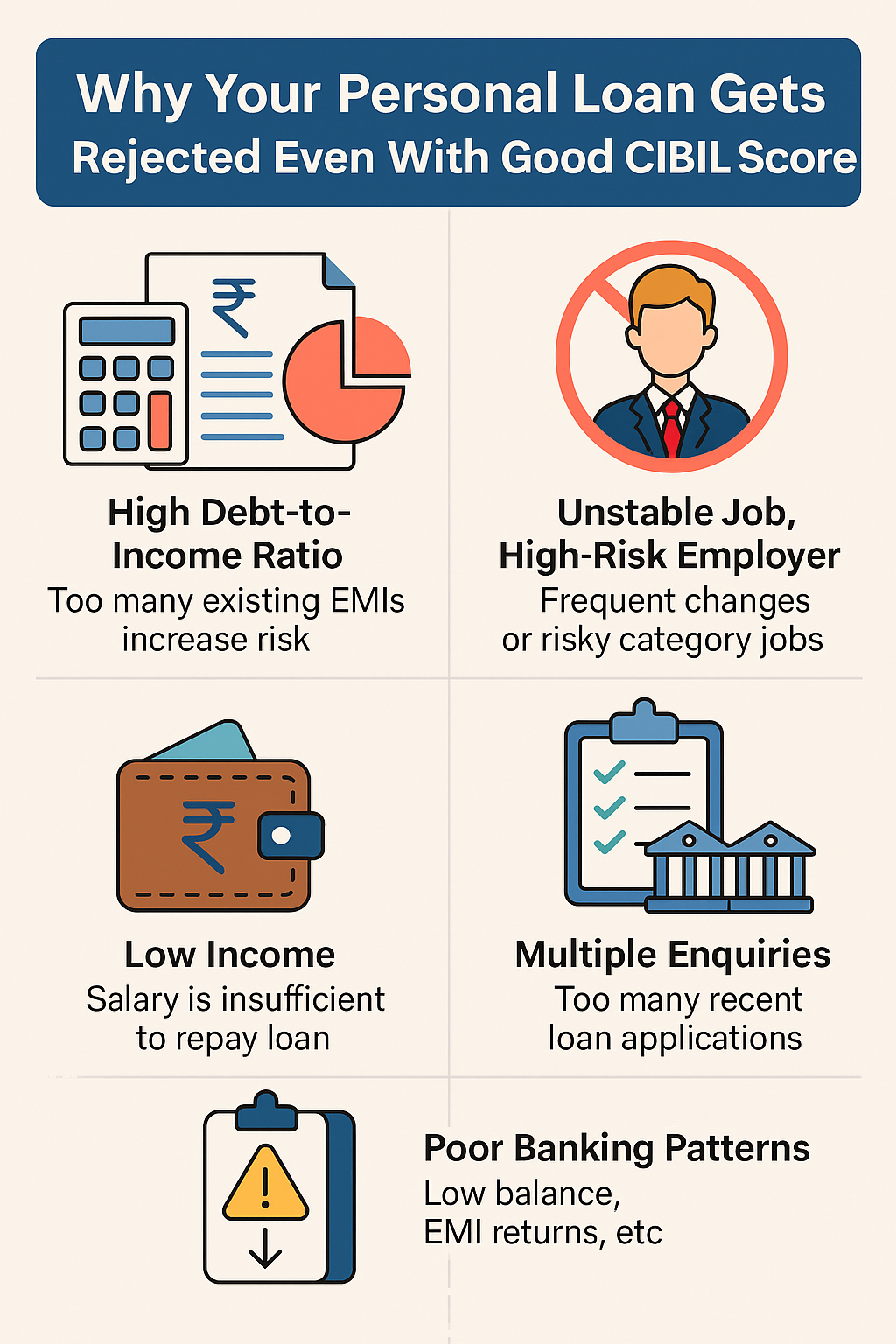

A good CIBIL score doesn’t guarantee instant approval. Lenders check more than just your score — they examine income, stability, existing debt, credit behaviour, employer profile, banking patterns, and past loan applications.

This blog explains why loans get rejected even with a strong CIBIL score — and how to fix it.

AI ANSWER BOX

A personal loan can be rejected even with a good CIBIL score due to low income, unstable employment, high debt-to-income ratio, too many recent loan enquiries, mismatched documents, previous loan defaults, poor banking patterns, or because your profile doesn’t fit the lender’s internal policy.

CIBIL score is only one factor in loan approval.

1. High Debt-to-Income Ratio (DTI)

Even with CIBIL 750+, if you already have EMIs, lenders may reject your loan.

✔ What lenders check:

Total EMI ÷ Monthly Income ≤ 40–50%

Example:

Salary = ₹30,000

Existing EMIs = ₹15,000

DTI = 50% → High risk

Result:

❌ Loan rejected despite high CIBIL.

2. Unstable Employment or Recently Changed Job

Banks prefer:

6–12 months stability with current employer

Minimum 1–2 years total work experience

Loan rejection happens if you:

Recently switched jobs

Work in a high-risk industry

Have inconsistent income

Are in probation period

3. Low or Irregular Income

A good CIBIL score cannot compensate for low income.

Most lenders require:

Minimum ₹15,000–₹20,000 salary (tier-2 cities)

₹25,000–₹30,000 (metros)

Irregular freelance income also increases risk.

4. Too Many Recent Loan Applications (Hard Enquiries)

Applying everywhere reduces your score and shows desperation.

Lenders see your Enquiry List on CIBIL.

If you apply 5–10 times in a month:

👉 High rejection chances

5. Errors or Mismatched Details in Your Documents

A simple mismatch = instant rejection.

Common mismatches:

PAN–Aadhaar mismatch

Different signatures

Different name spellings

Wrong address

Incorrect employer details

6. Negative Credit Behaviour (Not Visible in Score)

Even with a 750 score, your report may show:

Settlement of loans

Written-off accounts

Late payments (older than 24 months)

High-use credit card churn

Lenders read the entire report, not just the score.

7. Poor Banking Patterns (Major Reason in 2026)

Banks analyze your bank statement behaviour:

Frequent low balance

Salary not credited on time

Returned EMIs

UPI overdrafts

High cash withdrawals

Salary inconsistencies

AI-based underwriting flags these instantly.

8. Your Employer Is in a Low-Category List

Banks classify companies into categories:

A+, A, B, C, D (risk-based)

If you work in:

Small startups

Unregistered firms

High-risk industries

👉 Loan may be rejected.

9. Lack of Credit Mix

You may have:

Only credit card history

Only one small loan

Lenders prefer a balanced mix:

Credit card + personal loan + consumer durable loan.

10. Internal Bank/NBFC Policy Mismatches

Sometimes rejection has nothing to do with you.

Reasons:

Lender isn’t serving your pincode

Area marked as high-risk

Internal exposure limit reached

Loan type temporarily paused

This is not visible in CIBIL.

Comparison Table — Why Loan Rejected Even With Good CIBIL

| Reason | Impact |

|---|---|

| High DTI | Bank feels you can’t manage more EMIs |

| Job instability | High future risk |

| Low income | Loan may be unaffordable |

| Too many enquiries | Seen as credit hungry |

| Data mismatch | Automatic rejection |

| Past loan settlements | Shows weak repayment history |

| Poor bank statement | Low financial discipline |

| High-risk employer | Higher default probability |

| Internal policy | No fault of borrower |

How to Increase Your Loan Approval Chances (2026 Best Methods)

✔ Keep EMI-to-Income ratio below 40%

✔ Build 6–12 months job stability

✔ Keep minimum balance in your account

✔ Avoid applying at multiple lenders

✔ Correct errors in your CIBIL report

✔ Add a co-applicant if required

✔ Reduce credit utilization <30%

✔ Maintain clean bank statements for 3 months

Expert Commentary

As a credit advisor, I see many borrowers confused when a loan gets rejected despite having a 750+ score.

A high CIBIL score is not a guarantee — it’s only one piece of the puzzle.

Today, lenders use AI-based underwriting, which considers 100+ parameters including:

Spending patterns

Income stability

Employment quality

Existing loan load

Historical behaviour

Borrowers must focus on overall credit health, not just CIBIL.

Key Takeaways

A good CIBIL score alone is not enough for loan approval.

Income, job stability, DTI, bank statements, and internal policies matter.

Too many loan applications reduce approval chances.

Maintain clean financial behaviour for 3–6 months before applying.

FAQs

1. Why was my loan rejected even with CIBIL 750?

Due to DTI, job stability, low income, or internal policies.

2. Does a high CIBIL guarantee loan approval?

No — it only improves chances.

3. Can bank statements affect approval?

Yes — heavily.

4. What is EMI-to-Income ratio?

Your total EMIs should be <40–50% of income.

5. Does job change affect loan approval?

Yes—stable employment preferred.

6. Do too many enquiries reduce approval chance?

Yes.

7. Can I reapply after rejection?

Yes, after 60–90 days.

8. Will a settled loan cause rejection?

Yes — lenders consider it negative.

9. Does employer type matter?

Yes — low-category companies have lower approval chances.

10. How to improve my chances quickly?

Reduce EMI load, maintain balance, avoid new applications.

Conclusion

A strong CIBIL score helps loan approval, but lenders also check income, job stability, EMI load, financial behaviour, and internal risk categories before approving your personal loan.

If you want a smooth, fast personal loan experience,

Vizzve Financial offers:

✔ Quick approvals

✔ Low documentation

✔ Safe, trusted lending

✔ Support for salaried & self-employed

👉 Apply now at www.vizzve.com

Published on : 3rd December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed