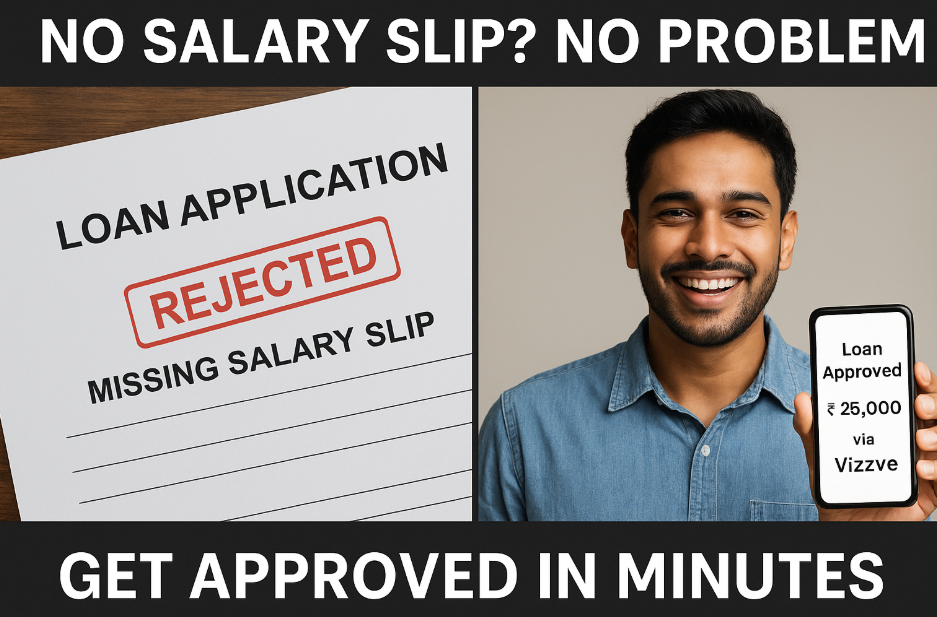

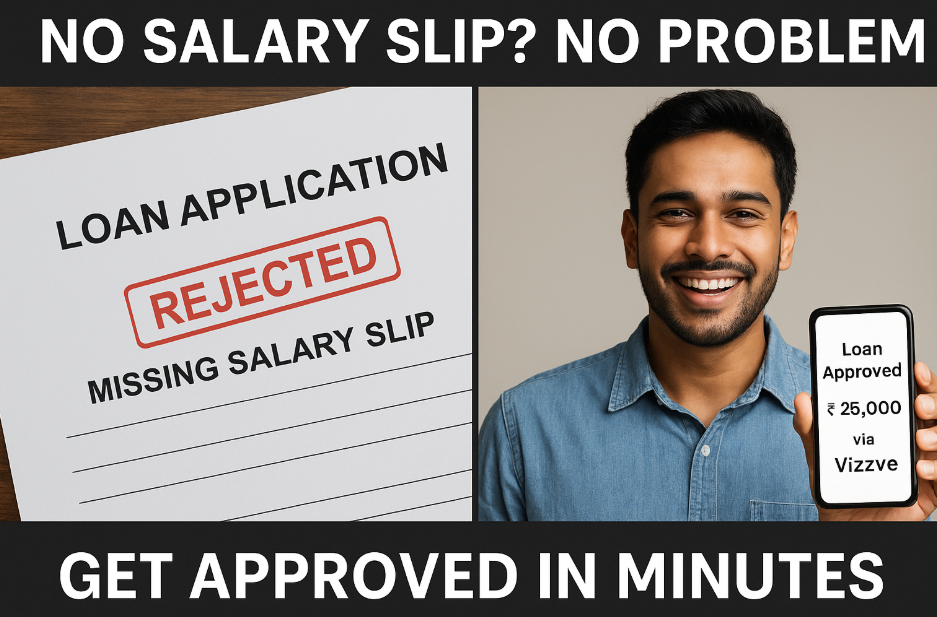

Loan Without Salary Slip – How to Get Instant Approval in 2025

Vizzve Admin

💼 Loan Without Salary Slip – How to Get Instant Approval in 2025

Published by: Vizzve Financial | May 2025

🧾 Can You Really Get a Loan Without a Salary Slip?

✅ Yes, you can! Especially from fintechs and NBFC partners like those integrated on Vizzve.com.

Traditional banks may deny loans due to lack of documents like:

But Vizzve simplifies it by offering instant approval on just Aadhaar + PAN.

🏦 Vizzve Loan Eligibility Without Salary Slip

| ✅ Criteria | 📌 Requirement |

|---|

| Minimum Age | 21 years |

| Maximum Age | 58 years |

| Documents Needed | Aadhaar + PAN only |

| Income Proof | ❌ Not mandatory |

| Employment Type | Self-employed, gig worker, homemaker, student |

| Loan Amount Range | ₹5,000 – ₹2,00,000 |

| CIBIL Score Required? | ❌ Not for micro-loans up to ₹25,000 |

| Approval Time | 10–30 minutes |

🔧 Use Cases – Who Can Benefit?

👩🍳 Homemakers – Need funds for a family function? No income proof? Vizzve gives instant approval.

🛵 Gig Workers – Swiggy, Zomato, Uber, and Rapido drivers can get personal loans using just KYC.

👨🎓 Students – Need ₹10,000–₹25,000 for courses or emergencies? No payslip needed.

🧑🔧 Freelancers – Graphic designers, writers, and tuition teachers with irregular income are all eligible.

🏠 Micro-business owners – Running a boutique, catering, or home bakery? Get working capital easily.

💳 Loan Features with Vizzve

-

✅ Same-day disbursal

-

📲 100% online process

-

📉 Low interest starting from 1.5% per month

-

🧘 Zero paperwork stress

-

🔐 Safe & RBI-compliant NBFC partnerships

-

🧾 EMI options available for flexible repayment

🧠 FAQs – Loan Without Income Proof (India 2025)

Q1. Can I get a loan without any job proof?

✔️ Yes, Vizzve offers loans even to those without formal jobs—students, homemakers, and freelancers included.

Q2. What is the maximum loan I can get without a salary slip?

💰 Up to ₹2,00,000 depending on partner NBFC approval and repayment history.

Q3. Will my CIBIL score affect approval?

📉 Not for micro-loans below ₹25,000. For larger loans, a soft check may happen.

Q4. Can I get a loan urgently—within 1 hour?

✅ Yes. Most Vizzve users receive the loan within 30 minutes of approval.

Q5. Do I need to submit bank statements or IT returns?

📝 Not for basic loans. Aadhaar + PAN is often enough.

✅ Final Words

In 2025, your loan eligibility shouldn’t depend on a salary slip. Whether you're a delivery partner, homepreneur, or between jobs—Vizzve Financial gives you financial freedom with zero stress.

📲 Apply Online in Minutes – www.vizzve.com

📞 Call: 8449 8449 58 | No CIBIL Needed | Trusted by Lakhs

Disclaimer: This article may include third-party images, videos, or content that belong to their respective owners. Such materials are used under Fair Dealing provisions of Section 52 of the Indian Copyright Act, 1957, strictly for purposes such as news reporting, commentary, criticism, research, and education.

Vizzve and India Dhan do not claim ownership of any third-party content, and no copyright infringement is intended. All proprietary rights remain with the original owners.

Additionally, no monetary compensation has been paid or will be paid for such usage.

If you are a copyright holder and believe your work has been used without appropriate credit or authorization, please contact us at grievance@vizzve.com. We will review your concern and take prompt corrective action in good faith... Read more