The terms “loan write-off” and “loan waive-off” are often misunderstood in banking and finance. Many believe they mean the same thing — but they are very different and have completely different outcomes for borrowers and banks.

Understanding the difference is essential, especially in today’s environment where rising NPAs, restructuring, and recovery actions are common.

This blog explains what these terms mean, how they work, and how they impact borrowers.

What Is a Loan Write-Off?

A loan write-off means the bank removes the loan from its active books for accounting purposes, but the borrower still owes the money.

✔ Bank writes it off internally

✔ Borrower is still legally liable

✔ Bank continues recovery efforts

✔ Credit score remains negatively affected

✔ Loan appears as “written-off” or “settled” in CIBIL/CRIF report

A write-off simply means the bank doesn’t expect full recovery soon and adjusts its balance sheet.

It does NOT mean the borrower gets freedom from repayment.

Example:

A borrower stops paying EMIs for 180 days → loan becomes NPA → bank “writes it off” while still trying to recover.

What Is a Loan Waive-Off?

A loan waive-off means the bank/government completely forgives the borrower’s loan.

The borrower is no longer liable to pay the remaining amount.

✔ Borrower gets full relief

✔ Loan is cancelled permanently

✔ Mostly occurs due to government policy decisions

✔ Common in agriculture loan waivers

✔ Credit bureau status changes to “waived-off”

This is NOT done for regular personal loans or home loans.

Waive-offs are rare and usually apply to farmers or disaster-hit borrowers under government schemes.

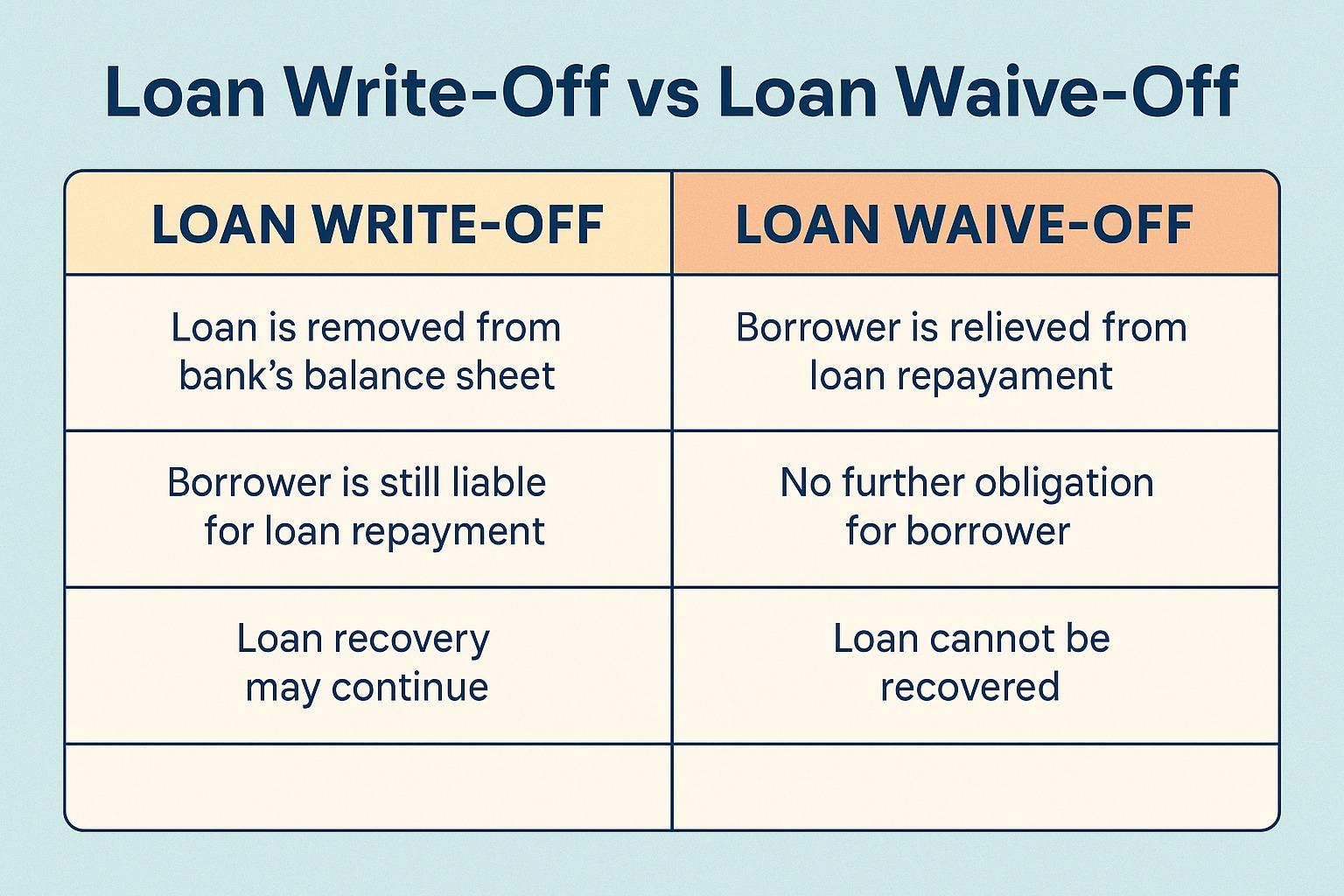

Loan Write-Off vs Waive-Off — Key Differences

| Feature | Loan Write-Off | Loan Waive-Off |

|---|---|---|

| Borrower must repay? | ✔ Yes | ❌ No |

| Who decides? | Bank | Government/Bank (rarely) |

| Purpose | Clean balance sheet | Borrower relief |

| Recovery continues? | ✔ Yes | ❌ No |

| Impact on credit score | ❗ Very Negative | ❗ Very Negative (worse) |

| Legal liability | Continues | Removed |

| Common for | NPAs, defaults | Agricultural/relief loans |

| Frequency | Common | Rare |

Common Myths vs Reality

❌ Myth: Write-off means my loan is forgiven

✔ Reality: You still owe the bank. They can still pursue recovery.

❌ Myth: Waive-off improves my credit score

✔ Reality: A waive-off permanently damages your credit history.

❌ Myth: Banks lose money due to write-offs

✔ Reality: Banks provision for NPAs; write-offs are accounting adjustments.

How Does Loan Write-Off Impact Your Credit Score?

A written-off loan appears as:

“Written-off”, “Settled”, or “Post Write-off Settled” in CIBIL/CRIF.

Impact:

Credit score may drop 100–150 points

Loan approval becomes extremely difficult

High-interest rates offered in future

Banks classify borrower as high-risk

It stays on the report for 7 years.

What Happens During a Waive-Off?

If the government waives off your loan:

The entire balance is cancelled

You don’t have to pay anything

Bank closes the account

It appears as “Waived-off” in your credit report

Future loan approvals become harder

Banks may avoid lending to waived-off borrowers due to repayment risk.

Why Do Banks Write-Off Loans?

Banks write off unpaid loans mainly to:

Clean their balance sheets

Reduce NPA percentage

Show healthier financial ratios

Claim tax benefits

Continue recovery through legal channels like:

SARFAESI

Recovery agents

Lok Adalats

Debt tribunals

Write-off does NOT stop recovery.

If Your Loan Is Written-Off, What Should You Do?

✔ Contact your bank

Discuss settlement or repayment options.

✔ Pay back in instalments

Some banks offer flexible repayment after write-off.

✔ Clear dues and request “Closed” status

This improves your credit score significantly.

✔ Avoid ignoring bank notices

This may lead to legal action.

Conclusion: Loan Write-Off ≠ Loan Waive-Off

To summarize:

✔ Write-Off = Accounting move, borrower still owes money

✔ Waive-Off = Borrower is fully freed from loan

However, both severely impact your credit score and should be avoided if possible.

For borrowers, the best solution is to:

Repay dues

Avoid default

Communicate early with the bank

Consider restructuring if needed

Staying financially disciplined helps maintain a healthy credit profile.

❓ FAQs

1. Does loan write-off mean I don’t have to repay?

No. You still have to repay the bank.

2. Does waive-off cancel the entire loan?

Yes. You get full relief from repayment.

3. Will write-off affect my CIBIL score?

Yes. It negatively impacts your rating.

4. Can a personal loan be waived off?

Not usually. Waive-offs mostly apply to agriculture or government-supported loans.

5. Can I take a loan after a write-off?

Yes, but only after clearing dues and improving your credit score.

Published on : 22nd November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed