Long-tenure loans — like 20–30 year home loans or 5–7 year personal/auto loans — look attractive because they offer smaller EMIs, making repayments seem easy and stress-free.

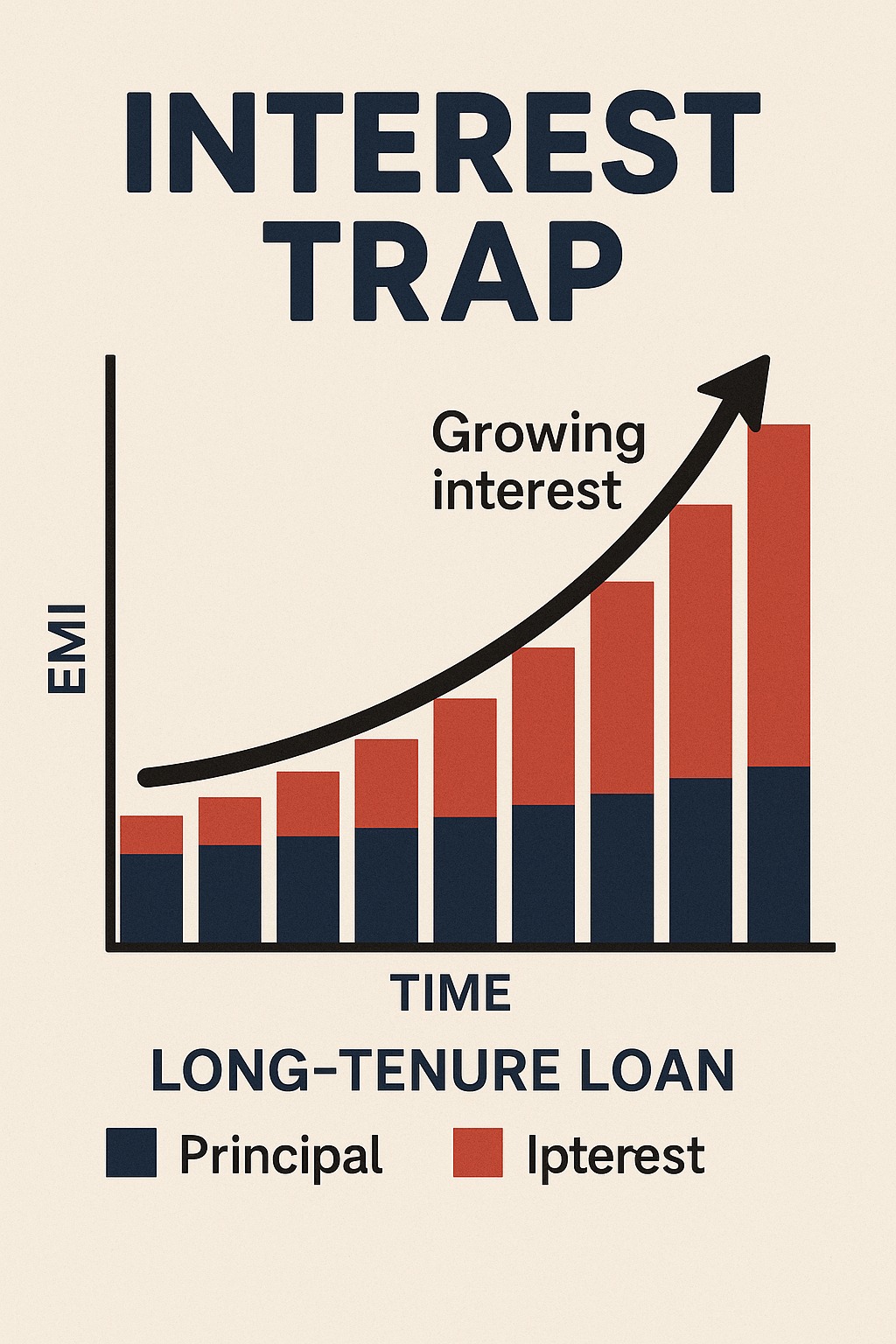

But behind those low monthly payments hides a dangerous financial reality: the longer the loan, the more interest you end up paying — often 2 to 3 times the actual loan amount.

This phenomenon is known as an Interest Trap.

Here’s why long-tenure loans create these traps and how you can avoid them.

1. You Pay Interest for a Much Longer Time

This is the biggest reason long-tenure loans become traps.

Example:

Loan: ₹30 lakh

Tenure: 30 years

Interest: 9%

Total interest paid: ₹57 lakh+

You're paying almost double the loan amount in interest.

A shorter tenure (say 15 years) may increase EMI but reduces interest drastically.

2. Early Years = Mostly Interest, Not Principal

In long-tenure loans:

First 5–8 years → 90% of EMI goes to interest

Principal hardly reduces

You build almost no equity in the early years

This keeps you locked into the loan for longer.

Even if you try to sell the property early, the outstanding balance remains high.

3. Interest Rate Hikes Hurt More in Long Tenures

If your loan is on a floating rate, rising interest rates can:

Increase EMI

OR extend your tenure even further

OR both

A small increase of 1–2% in interest rate can push a 20-year loan to 28–30 years, creating a deeper trap.

4. You Feel “Comfortable” Paying Low EMI — That’s the Trap

Low EMI creates illusion of affordability.

Borrowers think:

“It’s manageable.”

“Why stress with higher EMI?”

“Let’s take the longest tenure available.”

But this comfort costs lakhs in extra interest over time.

Banks want you to choose longer tenures because it increases their profit.

5. Your Wealth Grows Slower Because EMI Runs Forever

Long EMIs reduce your:

Ability to invest

Liquidity

Emergency funds

Flexibility for new goals

You get stuck paying EMIs instead of building wealth.

6. Inflation Reduces Real Income, Making EMI Burden Feel Heavier

Over decades:

Expenses rise

Lifestyle needs change

Family responsibilities grow

But EMI remains fixed — eating into a larger share of your finances.

7. Emotional Complacency: “I’ll repay anytime later”

When the tenure is long, borrowers delay:

Prepayments

Extra principal reduction

Refinancing

This delay deepens the trap and increases total interest.

8. Hidden Costs Add Up Over Long Tenures

Long loan durations mean:

Higher chances of rate resets

More processing charges for revisions

More interest during moratorium periods

More insurance renewals

All these silently inflate total cost.

How to Avoid the Long-Tenure Interest Trap

✔ Choose the shortest tenure you can comfortably afford

Even reducing tenure by 5 years saves lakhs.

✔ Make part-prepayments yearly (even small amounts help)

A single ₹50,000 part-payment can cut months off your loan.

✔ Increase EMI by 5–10% annually

This matches your salary growth and reduces interest drastically.

✔ Don’t choose max tenure just for low EMI

Calculate long-term cost before deciding.

✔ Refinance or transfer loan if interest rate is high

Helps cut tenure and total interest.

FAQs

1. Why do banks promote long-tenure loans?

Because they earn more interest over time.

2. Are long-tenure loans always bad?

No — they help with affordability, but you should prepay whenever possible.

3. How can I reduce total interest?

Choose shorter tenure, prepay often, and increase EMI yearly.

4. Do floating rates increase my interest trap risk?

Yes — rising rates extend tenure and increase interest.

5. Is a 30-year home loan advisable?

Only if you aggressively prepay and shorten the effective tenure.

Published on : 19th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed