You might think gambling is reserved for casinos and lottery tickets. But in truth, many of us gamble with our money every single day — without even realizing it.

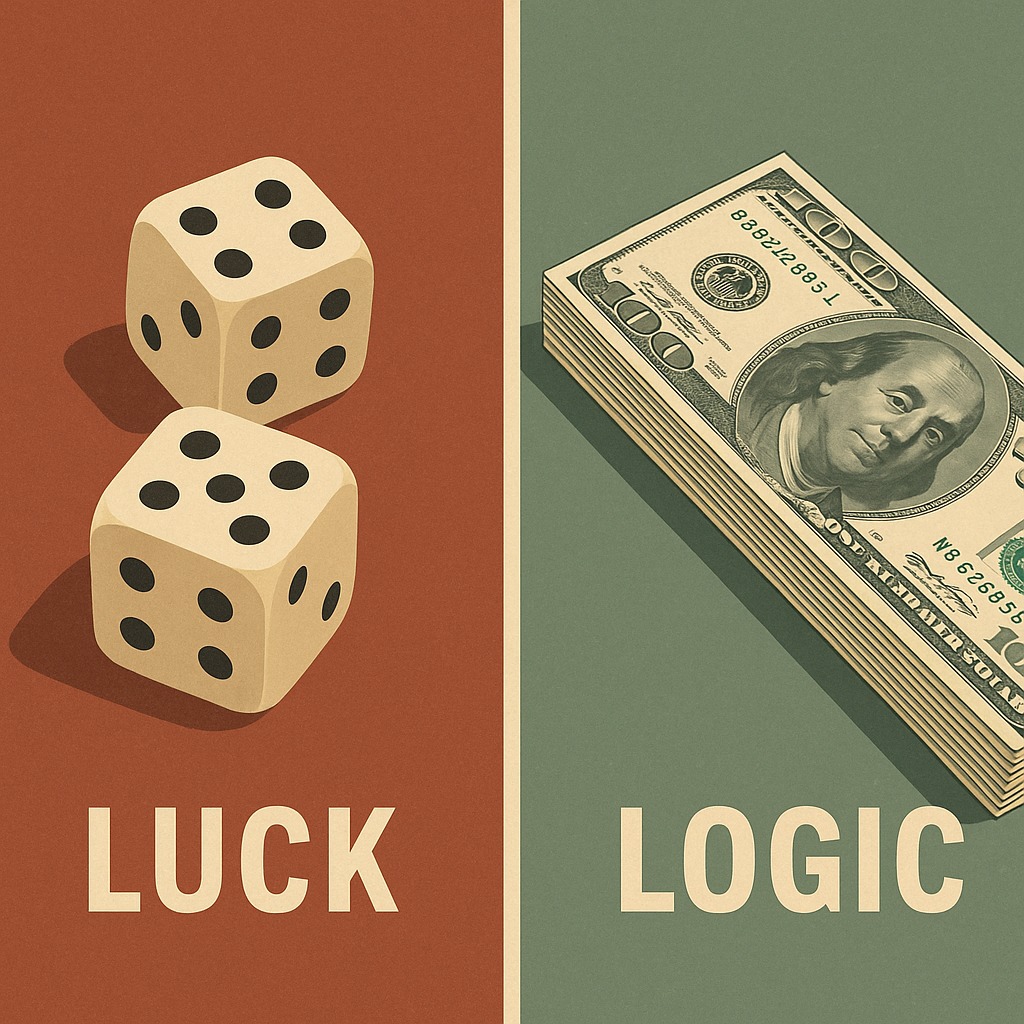

From emotional investing to blind spending, it’s easy to confuse luck with logic in personal finance. Let’s explore the subtle ways your money decisions may be less calculated than you think — and how to change that.

Everyday Gambling: It’s Closer Than You Think

Here are common situations where financial logic takes a back seat:

Investing Based on “Hot Tips”

Did you put money into a stock just because a friend said it’s trending? That’s speculation, not strategy.

Impulse Online Shopping

That dopamine hit from flash sales or “limited offers” is emotional gambling disguised as convenience.

Ignoring Budgeting

Spending without a plan is like playing roulette — you're hoping the wheel lands in your favor.

Taking Loans Without Purpose

Borrowing for wants instead of needs often backfires, especially when you hope “somehow I’ll repay it.”

Relying on Future Windfalls

Banking on a future bonus or inheritance to fix today’s debt? That’s high-stakes wishful thinking.

Logic-Driven Financial Habits

To move from gambling to grounding, adopt these logic-based approaches:

Use Data, Not Hype: Study investment options before acting.

Set Spending Limits: Budget isn’t a restriction — it’s your game plan.

Build Emergency Funds: Reduce the need to make desperate decisions.

Understand Risk vs Reward: If it sounds too good to be true, it usually is.

Track Patterns: Use apps or journals to study your own financial behaviors.

Key Differences: Luck vs Logic

| Factor | Gambling (Luck-Based) | Financial Planning (Logic-Based) |

|---|---|---|

| Decision Style | Emotionally impulsive | Thoughtful and researched |

| Outcome Control | Highly unpredictable | Based on informed assumptions |

| Risk Awareness | Often ignored | Acknowledged and managed |

| Long-term Impact | Often negative | Usually positive and stable |

Final Thought: Be the Player, Not the Pawn

Financial freedom isn’t about avoiding all risks — it’s about making calculated ones. Luck will always play a minor role, but logic should be your lead driver. Don’t roll the dice with your dreams. Strategize, act, and build your future with clarity.

FAQs

Q1: How can I tell if I’m gambling with money?

If you're making financial decisions emotionally, without a plan, or based on chance (not data), you're likely gambling.

Q2: Are small investments without research a gamble?

Yes. Even small amounts add up, and unresearched decisions can create bigger losses over time.

Q3: Can budgeting eliminate gambling behaviors?

It significantly reduces impulsive and emotion-driven choices, putting logic back in control.

Published on : 2nd August

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed