In the same period last year, the company sold a total of 501,207 units, comprising

Maruti Suzuki Q3 Results FY25 Live Updates: Highlights for 9 months (April-December), FY 2024-25

- The Company recorded its highest-ever nine monthly Sales Volume, Net Sales and Net Profit.

- The Company sold a total of 1,629,631 units during the period, a growth of 5% over 9MFY2023-24.

- Sales in the domestic market stood at 1,382,135 units and exports at 247,496 units.

- The Company registered Net Sales of INR 1,062,664 million in 9MFY2024-25 as compared to INR 982,403 million in 9MFY2023-24.

- The Company made a Net Profit of INR 102,441 million in 9MFY2024-25 as against INR 93,316 million in 9MFY2023-24.

Maruti Suzuki Q3 Results FY25 Live Updates: Q3 highlights

- The Company sold a total of 566,213 vehicles during the quarter. Sales in the domestic market were 466,993 units.

- The Company exported 99,220 units, the highest-ever in any quarter.

- The same period in the previous year saw total sales of 501,207 units comprising 429,422 units in domestic and 71,785 units in export markets.

- During the quarter, the Company registered highest-ever Net Sales of INR 368,020 million against INR 318,600 million in the same period the previous year.

- The Net Profit for the quarter was INR 35,250 million, an increase of 12.6% over INR 31,300 million in Q3FY2023-24.

Maruti Suzuki Q3 Results FY25 Live Updates: Changes in Directors

- Board approved the reappointment of Mr. Hisashi Takeuchi as Managing Director and Chief Executive Officer for three years

- recommended the re-appointment of Mr. Maheswar Sahu as an Independent Director for a further period of five years

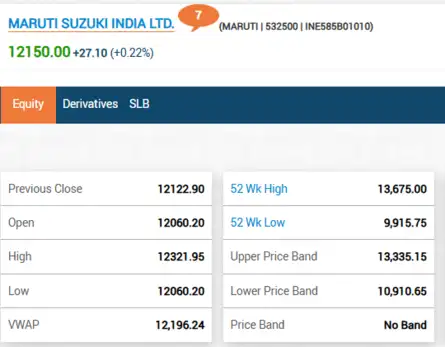

Maruti Suzuki Q3 Results FY25 Live Updates: Maruti Suzuki share price rises marginally

Maruti Suzuki Q3 Results: PAT rises 13% YoY to Rs 3,525 crore, revenue advances 16%

However, the profit fell short of market expectations, which had estimated Rs 3,624 crore

Maruti Suzuki Q3 Results FY25 Live Updates: Board approves amalgamation of Suzuki Motor Gujarat Pvt Ltd into and with Maruti Suzuki India Ltd

October, 2024, had granted its in-principle approval for amalgamation of Suzuki Motor Gujarat Private Limited, a wholly owned subsidiary, (“SMG”) into and with the Company," the company said in its press release.

Maruti Suzuki Q3 Results FY25 Live Updates: Motilal Oswal on Maruti Suzuki | Rating: Buy | TP: INR13,955 (+24%)

- MSIL has been able to buck the weak demand trend in PVs in 3Q, with 13% YoY growth in volumes. While domestic sales (ex of sale to Toyota) rose 6% YoY, exports grew 38% YoY. In fact, MSIL was able to clock record 250k unit sales in Dec’24 itself, up 8% YoY

- While discounts are likely to be high QoQ due to seasonality, the surge in discounts is expected to be lower than normal.

- While input costs are likely to be stable QoQ, the benefits from operating leverage would be offset by higher discounts. We expect MSIL margins to decline by 50bp QoQ.