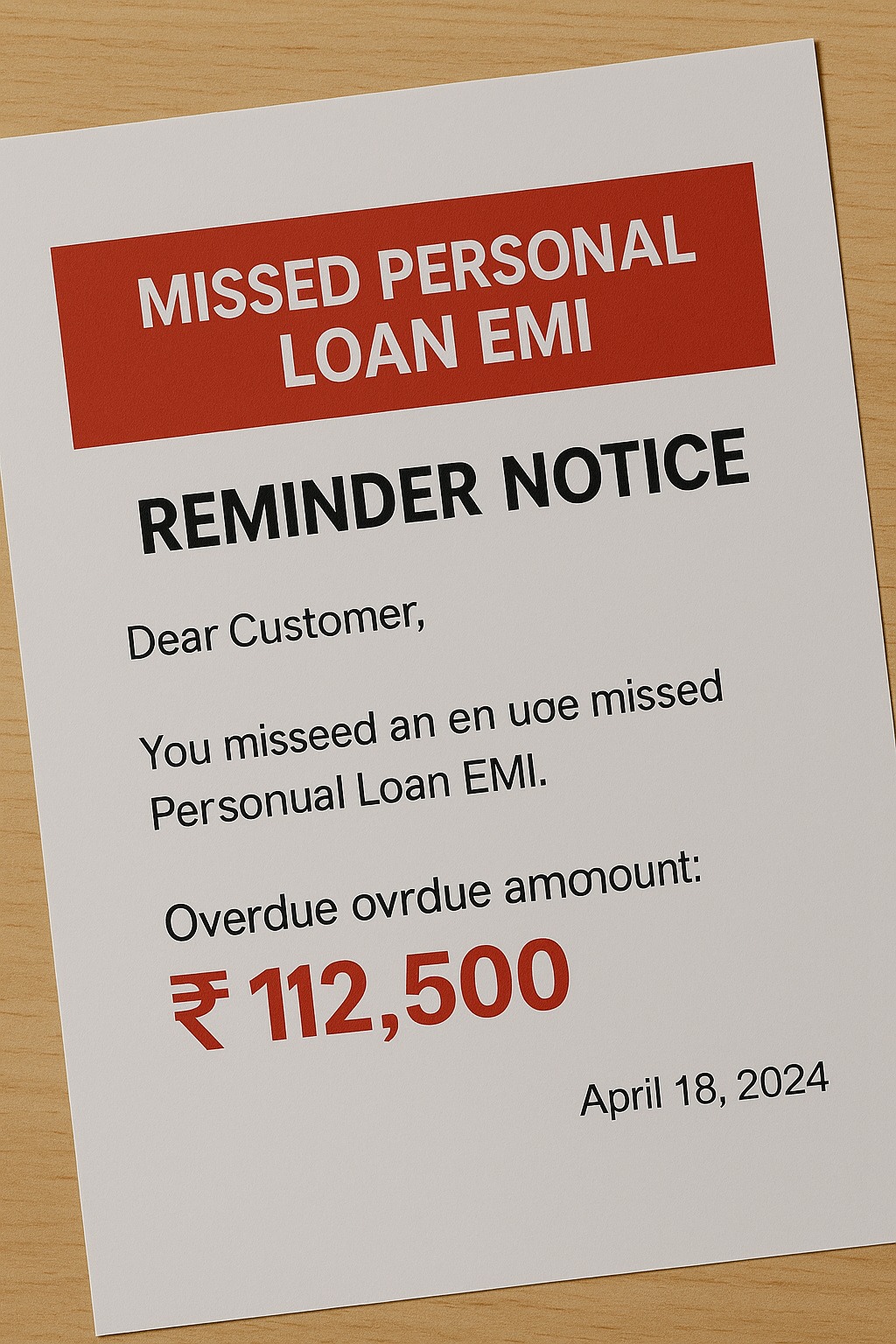

Everyone can face financial hiccups — an unexpected expense, delayed salary, or medical emergency. But if you’ve missed a personal loan EMI, it’s important to understand the real consequences it can have on your credit score and financial health.

While one missed payment might not seem serious, consistent delays can hurt your creditworthiness, increase your debt, and make future loans more expensive.

Let’s break it down 👇

1. Immediate Impact on Credit Score

Your credit score (CIBIL, Experian, or Equifax) reflects your repayment behavior.

A single missed EMI — if delayed by more than 30 days — is reported to credit bureaus and can reduce your score by 50–100 points depending on your profile.

The longer the delay, the greater the damage.

0–30 days: Minor impact, may not be reported immediately.

31–60 days: Reported as a late payment, visible on your credit report.

61–90 days: Labeled as delinquent — serious risk category.

90+ days: Classified as default/NPA, severely damaging your score.

Even a single missed EMI can linger on your credit report for up to 24 months.

2. Late Payment Charges and Penalties

Apart from the credit score drop, lenders impose:

Late payment fees (typically ₹500–₹1,000 per missed EMI)

Penalty interest (extra 2–3% per month on overdue amount)

GST on penalties

If missed payments continue, the loan may be tagged as “non-performing”, leading to collection calls or even legal notice in extreme cases.

3. Reduced Future Loan Eligibility

A missed EMI signals irregular repayment behavior to lenders.

Future loan applications may face:

Higher interest rates

Lower loan amounts

Rejection for pre-approved offers

This happens because lenders view delayed payers as higher-risk borrowers.

4. Effect on Loan Tenure and Interest

If you miss one or more EMIs, your repayment schedule is automatically extended.

You end up paying more interest overall, increasing your total loan cost.

If several EMIs are missed consecutively, lenders may restructure your loan — which can also show negatively on your credit report.

5. Legal or Collection Action (in case of defaults)

If you fail to pay for over 90 days, the loan is categorized as a Non-Performing Asset (NPA).

The lender may:

Initiate recovery through legal channels

Report the default to credit bureaus

Engage a collection agency to recover dues

While NBFCs and banks usually provide reminders before such action, communication is key — never ignore lender messages.

What to Do If You’ve Missed a Personal Loan EMI

✅ 1. Make the Payment as Soon as Possible

The sooner you clear the overdue amount, the lesser the impact on your credit score.

Most lenders won’t report delays under 30 days if payments are made quickly.

✅ 2. Contact Your Lender Immediately

Inform your lender of the reason for delay — many offer grace periods, EMI rescheduling, or payment deferrals in genuine cases.

✅ 3. Avoid Skipping Multiple EMIs

Each missed EMI compounds the problem.

If cash flow is an issue, request temporary restructuring or EMI pause options (some NBFCs offer this).

✅ 4. Set Auto-Pay or Reminders

To prevent future misses, set up auto-debit or UPI reminders before your due date.

✅ 5. Rebuild Your Credit Score

Once payments are up to date, focus on consistent on-time repayments for the next 6–12 months.

Your score will gradually recover if no new defaults occur.

Pro Tip:

If your EMI burden is too high, consider a debt consolidation loan from a trusted NBFC like Vizzve Financial to simplify payments and reduce stress.

Conclusion

Missing a personal loan EMI isn’t the end of the world — but ignoring it can be.

Act quickly, communicate with your lender, and prevent repeat delays to protect your credit profile.

A strong repayment history is the foundation of your financial reputation, unlocking better interest rates, faster approvals, and a stress-free borrowing experience.

FAQs:

Q1. Will missing one EMI affect my credit score?

Yes, even one missed EMI can reduce your score by 50–100 points if delayed beyond 30 days. Prompt repayment helps minimize the impact.

Q2. How long does a missed EMI stay on my credit report?

Missed payments typically remain visible on your credit report for up to 24 months, even after you repay the dues.

Q3. What if I miss multiple EMIs in a row?

If you miss 3 or more consecutive EMIs, your account may be labeled as a default (NPA), leading to legal or collection action.

Q4. Can I fix my credit score after missing an EMI?

Yes. Pay off the overdue EMIs quickly, continue making on-time payments, and avoid new credit applications for a few months. Your score will recover gradually.

Q5. What are the penalties for missing a personal loan EMI?

Banks and NBFCs charge late fees and additional interest (2–3% monthly) on the overdue amount, plus applicable GST.

Published on : 8th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed