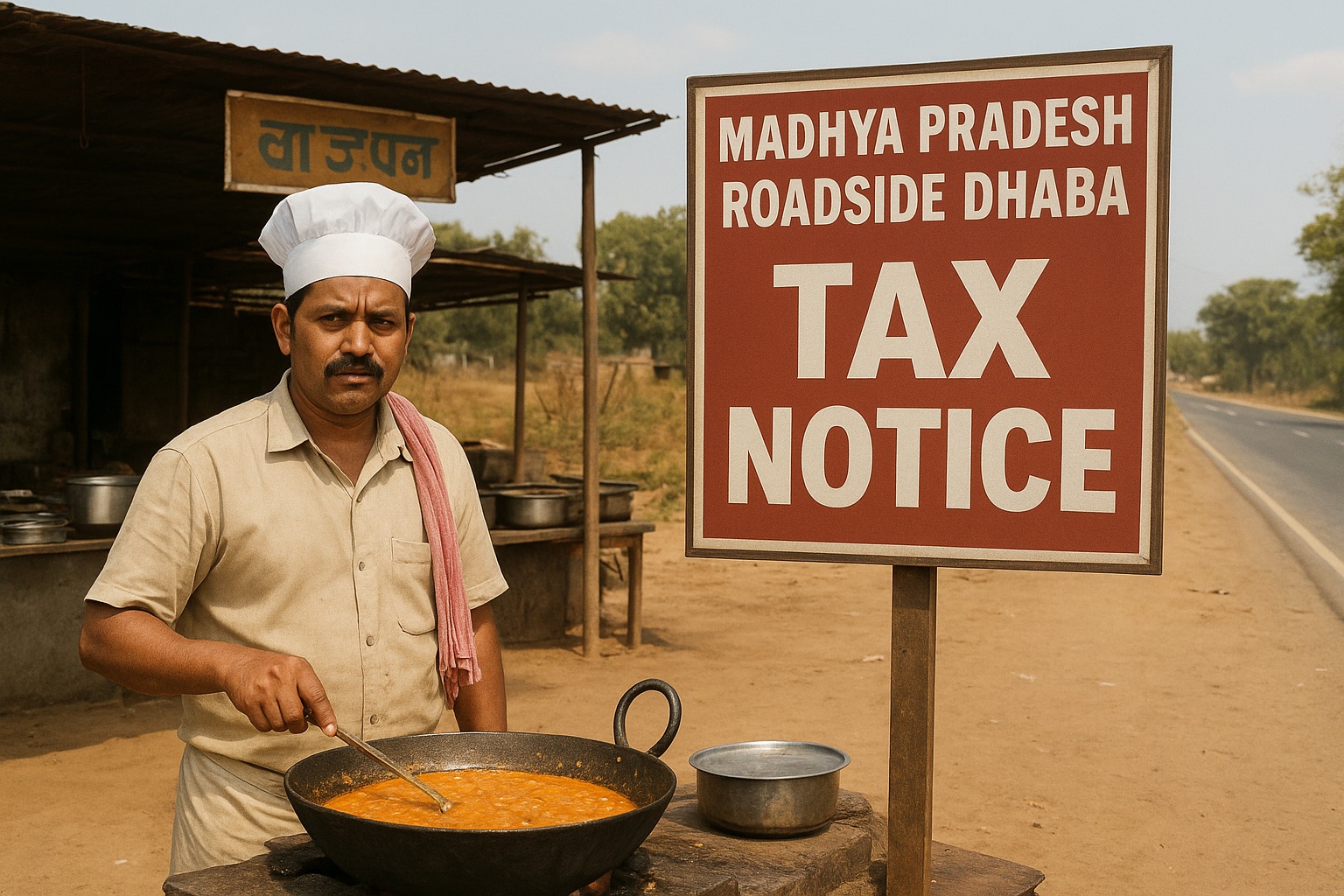

In a bizarre turn of events, a dhaba cook from Madhya Pradesh has received an income tax notice worth ₹46 crore. Shocked and unable to understand how such a huge liability was linked to him, the cook has now approached the police, suspecting identity theft or fraud.

The Case So Far

The cook, who earns a modest daily wage working at a roadside dhaba, was stunned when the Income Tax Department flagged him for undisclosed income worth ₹46 crore.

Believing he has become a victim of identity misuse, he filed a complaint with the local police.

Authorities are now investigating how his details were used to generate such a massive financial liability.

Possible Reasons Behind the Notice

Identity Theft: Fraudsters may have misused his PAN or Aadhaar details.

Fake Companies: Shell companies sometimes list unsuspecting individuals as directors or account holders.

Tax Scams: His credentials might have been used to launder money or evade taxes.

Larger Problem of Identity Fraud in India

This case is not isolated. Increasingly, common citizens are finding their documents misused for financial crimes.

PAN card misuse in shell companies.

Bank frauds involving forged KYC details.

Fake GST registrations using stolen identity documents.

What Should People Do in Such Cases?

File a Police Complaint: As the cook did, immediately report to authorities.

Inform the Income Tax Department: Request a rectification and mark yourself as a victim of fraud.

Monitor Financial Records: Regularly check your PAN, Aadhaar, and credit reports for suspicious activity.

Use Secure KYC Practices: Avoid sharing photocopies of IDs without masking sensitive details.

Conclusion

The case of the Madhya Pradesh dhaba cook receiving a ₹46 crore tax notice highlights the urgent need for stronger identity protection and awareness in India. While the authorities investigate, it serves as a reminder for everyone to stay vigilant about how their personal documents are used.

FAQ

Q1: Who received the Rs 46 crore tax notice?

A cook working at a dhaba in Madhya Pradesh.

Q2: Why did he get such a large notice?

It is suspected that his identity was misused in fraudulent financial activities.

Q3: What action did he take?

He approached the police and filed a complaint to clear his name.

Q4: Can ordinary citizens also face such fraud?

Yes, identity theft through PAN or Aadhaar misuse is increasingly common.

Q5: How can one protect themselves?

By securing ID documents, monitoring financial records, and reporting suspicious activities promptly.

Published on : 10th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share