With interest in personal loans and business loans rising across India, borrowers often compare banks vs NBFCs (Non-Banking Financial Companies).

While banks remain the most trusted lending institutions, NBFCs have become extremely popular due to their fast approvals, flexible eligibility and customer-friendly processes.

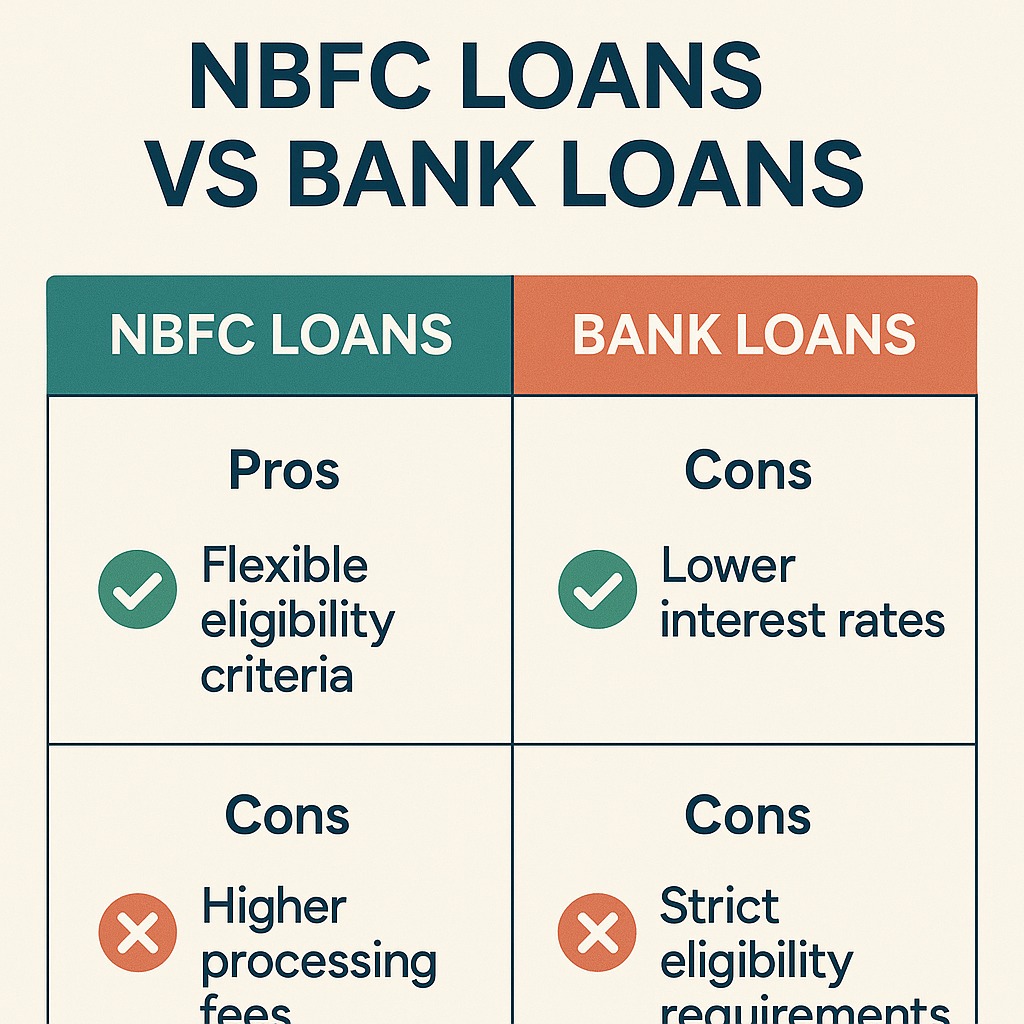

However, before choosing an NBFC loan, it’s important to understand both the advantages and drawbacks so you can make a financially safe decision.

What Are NBFCs?

NBFCs are financial institutions that offer loans, credit, insurance and investment services without having a banking license.

They follow RBI regulations but have more flexible lending norms compared to traditional banks.

Popular NBFC loans include:

Personal loans

Business loans

Gold loans

Vehicle loans

Consumer durable loans

Pros of Taking a Loan From NBFCs

1. Faster Approval & Disbursal

NBFCs use digital verification and simplified documentation, allowing quick approvals—sometimes within 30 minutes to 24 hours.

Ideal for urgent financial needs.

2. Flexible Eligibility Criteria

NBFCs often approve loans even if:

Your credit score is moderately low

You have frequent job changes

Your income documents are limited

This makes them accessible to a wider range of borrowers.

3. Higher Loan Approval Rates

NBFCs follow risk-based pricing, meaning they accept more customers by adjusting interest rates based on credit profile.

4. Minimal Documentation

Most NBFCs require:

Basic KYC

Income proof

Bank statements

No heavy paperwork or long procedures.

5. Tailored Loan Products

NBFCs offer:

Pre-approved loans

Instant top-up loans

Flexible tenure options

Zero-collateral products

Their products are often more customer-friendly than banks.

Cons of Taking a Loan From NBFCs

1. Higher Interest Rates

NBFC loans can be costlier, especially for borrowers with low credit scores.

Personal loan rates from NBFCs may be 2–6% higher than banks.

2. Higher Charges & Fees

NBFCs may charge:

High processing fees

Convenience fees

Penalty charges

Foreclosure fees

Always check the full chargesheet before applying.

3. Stricter Penalties on Late EMIs

NBFCs often impose higher penalties for:

Missed EMIs

Cheque bounce

Late payment fees

This can hurt your repayment track record and credit score.

4. Risk-Based Pricing May Increase EMI

If your credit score is low, NBFCs approve the loan but charge much higher interest.

This increases your EMI burden.

5. Not Always the Best for Large Loans

For large long-term loans like:

Home loans

SME loans

banks often offer better interest rates, longer tenure and more stability.

NBFC vs Bank Loans: Which Should You Choose?

Choose NBFC if you want:

✔ Faster approval

✔ Easy eligibility

✔ Small or medium loan

✔ Minimal documentation

✔ Flexibility with job/income profile

Choose Banks if you want:

✔ Lower interest rates

✔ Higher loan amounts

✔ Long-term loans

✔ Strict financial discipline

✔ Lower penalties and safer terms

Both options are good — your choice depends on your financial situation.

FAQs

Q1. Are NBFCs safe?

Yes. They are regulated by the RBI but operate with more flexibility than banks.

Q2. Do NBFCs check credit score?

Yes, but their approval criteria are more flexible than banks.

Q3. Which has lower interest on personal loans?

Banks generally offer lower interest for borrowers with strong credit scores.

Q4. Can I transfer loan from NBFC to bank?

Yes, through a balance transfer for lower interest.

Q5. Do NBFC loans improve credit score?

Yes, as long as EMIs are paid on time.

Published on : 15th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed