Freelancer? Self-employed? Student? Homemaker?

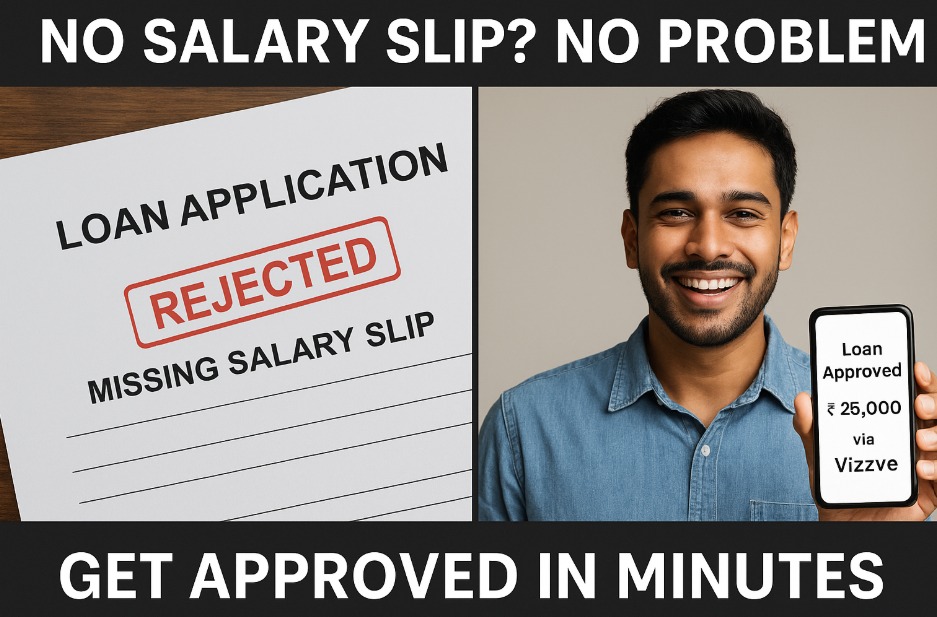

If you don’t have traditional income proof like salary slips or ITRs, getting a loan might feel impossible. But here’s the truth: you can still get a loan — you just need the right alternatives, documentation, and lender.

At Vizzve Finance, we help gig workers, entrepreneurs, and homemakers access trusted, RBI-compliant loans — even without a salary slip.

Who Usually Faces This Problem?

Freelancers or gig workers (Zomato, Swiggy, Ola drivers, etc.)

Self-employed professionals (designers, writers, tutors)

Housewives or homemakers

Students or recent graduates

Informal sector workers (contract staff, daily wage earners)

6 Smart Ways to Get a Loan Without Income Proof

1. Loan Against Fixed Deposit (FD)

Borrow up to 90% of your FD value with very low interest and zero income proof.

2. Loan Against Property or Gold

Use property documents or gold ornaments as collateral to secure a loan.

3. Apply with a Co-Applicant or Guarantor

Add a salaried friend/family member to your application to improve approval chances.

4. Use Bank Statement or Alternate Income Proof

Even without salary slips, showing regular credits in your bank account (like UPI payments or business income) can help.

5. Loan for Gig Workers (Special Vizzve Program)

Vizzve offers specially designed personal loans for delivery agents, drivers, freelancers, and contract workers based on transaction history—not just salary slips.

6. Gold Loan – Fastest Option

No income proof needed. You get money within hours by pledging gold jewellery.

Why Choose Vizzve Finance?

✔️ We approve loans for:

Gig workers with UPI/bank statement income

Self-employed individuals with informal earnings

Co-applicant or asset-based borrowers

✔️ 100% online process

✔️ Transparent interest & EMI terms

✔️ RBI-regulated NBFC partnerships

✔️ Ethical recovery & zero hidden charges

“Vizzve believes financial access shouldn’t depend only on a payslip.”

Tips to Improve Loan Approval Without Income Proof

Maintain consistent bank credits for the last 3–6 months

Avoid loan defaults or bounced cheques

Apply for smaller amounts first (₹25K–₹1L) to build trust

Use assets or co-applicant support if possible

Be honest about your income source — side hustle, tuition, rent, etc.

FAQs –

Q1. Can I get a personal loan if I don’t have a job?

Yes, through gold loan, FD-backed loan, or co-applicant-based loans.

Q2. I’m a freelancer with UPI income. Can I apply?

Yes. Vizzve accepts alternate proof like consistent UPI or bank credits.

Q3. Is CIBIL score still important?

Yes. Even without salary slips, a good credit score improves your chances.

Q4. Can homemakers get loans?

Yes, especially with a co-borrower, or by pledging assets like gold or FD.

Q5. Does Vizzve offer loans for gig workers?

Absolutely. We support India’s growing gig economy with flexible, low-doc loans.

Published on : 22nd July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed