Many believe that owning a credit card is the only way to build credit. But in India, there are several alternative and safer routes.

Whether you're just starting your financial journey or prefer to stay card-free, Vizzve shows you how to build a solid credit history without a credit card—even in 2025.

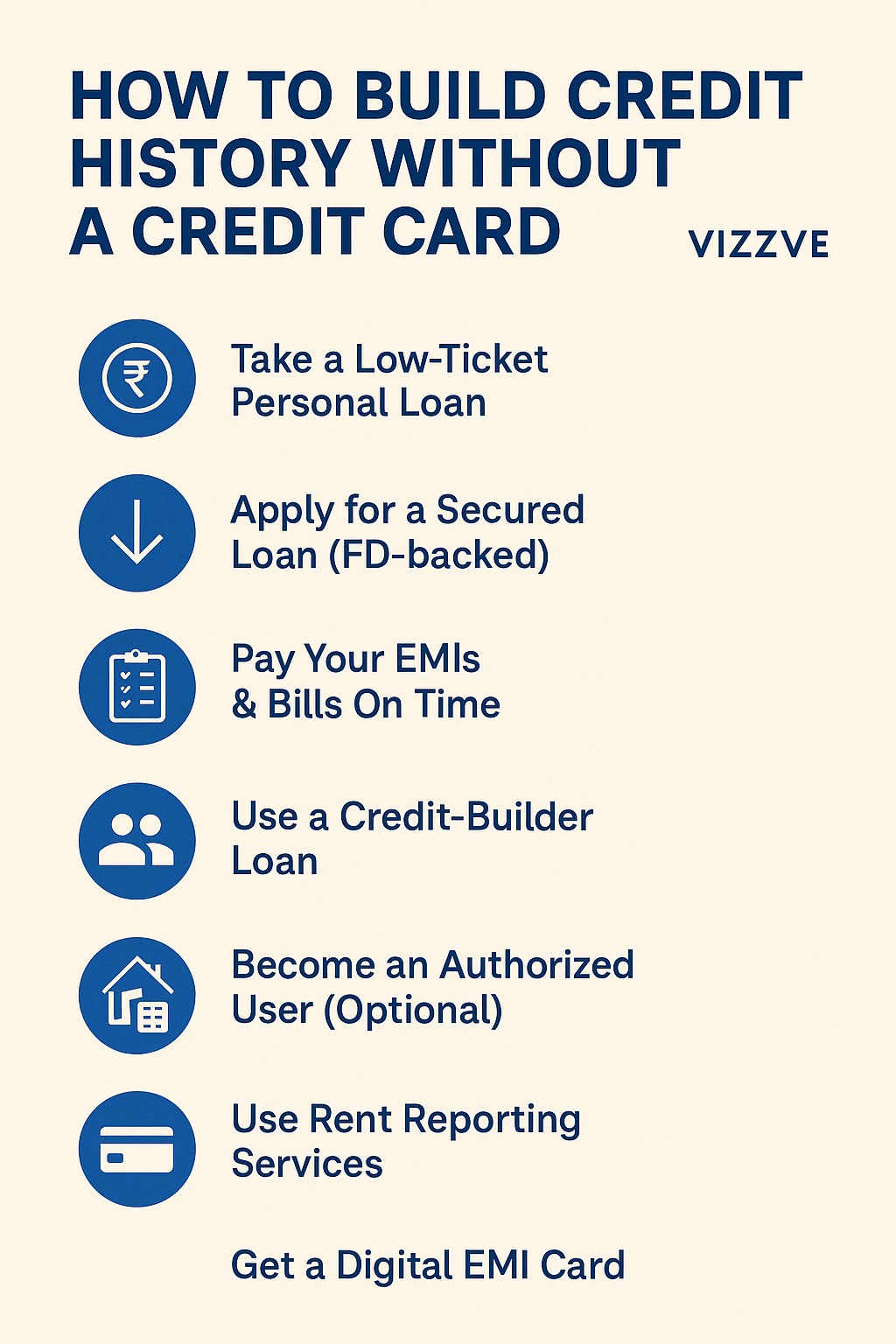

7 Powerful Ways to Build Credit Without a Credit Card

✅ 1. Take a Low-Ticket Personal Loan

Platforms like Vizzve Finance offer small personal loans (₹5K–₹50K)

Repay on time to boost your credit profile

Ideal for salaried professionals or gig workers

✅ 2. Apply for a Secured Loan (FD-backed)

Use a Fixed Deposit to get a small loan

Considered low-risk by lenders

Perfect to build credit with minimal interest

✅ 3. Pay Your EMIs & Bills On Time

EMIs for phones, appliances, or BNPL loans reflect in credit score

Use platforms that report to CIBIL, Experian, CRIF Highmark

Even electricity or rent tracked via some fintechs

✅ 4. Use a Credit-Builder Loan

Offered by select lenders via Vizzve

You borrow a small amount and repay it over time

Best for first-time earners

✅ 5. Become an Authorized User (Optional)

Ask a family member with good credit to add you as a secondary user

You don’t spend, but get the benefit of their credit history

✅ 6. Use Rent Reporting Services

Platforms now let you report monthly rent to credit bureaus

Helps salaried tenants build credit silently

✅ 7. Get a Digital EMI Card

Not a credit card, but gives purchase power + builds score

Platforms like Vizzve offer secure digital EMI cards (based on CIBIL)

Summary Table – Credit Building Alternatives

| Method | CIBIL Score Impact | Risk | Best For |

|---|---|---|---|

| Personal Loan (Vizzve) | High | Medium | First-time borrowers |

| FD-backed Loan | Medium | Low | Students, Housewives |

| EMI / BNPL | High | Medium | Salaried, Freelancers |

| Rent Reporting | Low–Medium | Low | Tenants, Young Professionals |

| Credit-builder Loan | Medium | Low | New to credit |

FAQs – Credit Without Credit Card

Q1. Can I get a good CIBIL score without a credit card?

Yes! Timely repayment of any form of credit builds score.

Q2. Will utility bills impact my credit score?

Only if you use a fintech that reports them to credit bureaus.

Q3. Is a secured loan safe?

Yes, it's backed by your FD, and the default risk is very low.

Q4. Does Vizzve offer small loans to new-to-credit users?

Yes. Vizzve specializes in helping first-time borrowers build healthy credit.

Vizzve Finance Tip:

💡 "Credit cards aren't the only gateway to credit history. Start small, repay on time, and your credit profile will grow."

Published on : 22nd July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed