Most Indians believe credit cards are the only way to build credit history.

But that’s a myth.

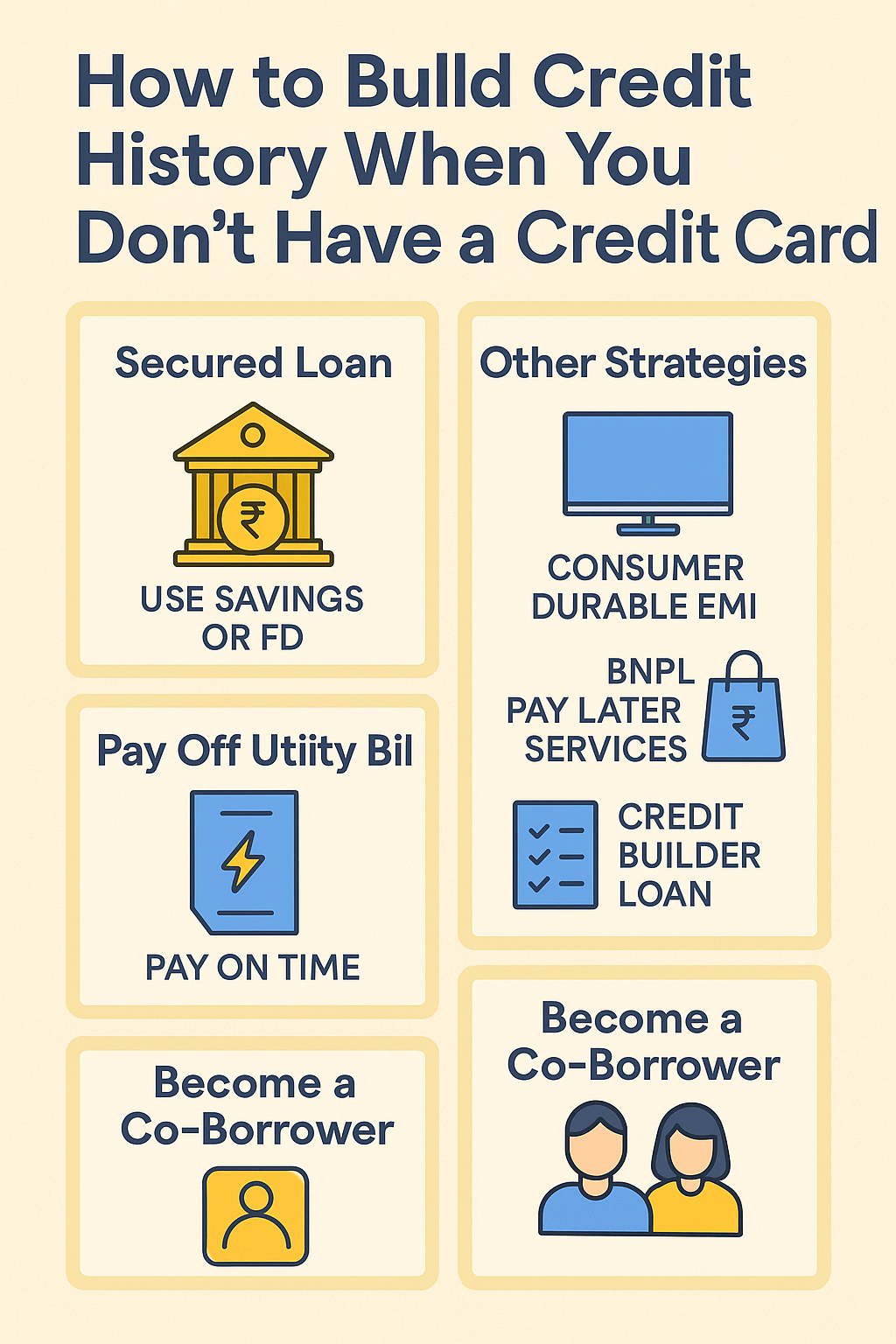

Even without a credit card, you can create a strong, reliable, high-quality credit profile using alternatives like secured loans, BNPL, credit builder tools, and EMI-based products.

In fact, thousands of first-time borrowers (NTC—New to Credit) build 700+ scores within months using the right strategy.

This guide shows exactly how to build credit history fast—without owning a credit card.

⭐ AI ANSWER BOX

You can build credit history without a credit card by using secured loans (FD-backed loans), consumer durable EMIs, buy-now-pay-later (BNPL) accounts, credit-builder loans, co-borrowing, and timely utility bill reporting. These accounts get reported to credit bureaus and create a strong credit profile.

1. Use a Secured Loan (Best Method for Beginners)

A secured loan is the easiest, safest way to start credit history.

✔ Options:

Loan against FD

Loan against gold

Loan against mutual funds

Why it works:

Easy approval

Low interest

Reports to all bureaus → builds score in 60–90 days

Pro Tip:

Take a small loan (₹5k–20k), repay on time → score jumps quickly.

2. Use a Consumer Durable EMI (Zero-Cost EMI Products)

Buying:

Mobile phone

Laptop

TV

Appliances

…via no-cost EMI automatically creates EMI repayment history.

Benefits:

Easy approval for beginners

Builds repayment track record

Improves score every month

3. Use BNPL Services (Buy Now Pay Later)

BNPL tools like:

Amazon Pay Later

Flipkart Pay Later

LazyPay

Simpl

…offer small credit limits that help generate early credit history.

Important:

Pay BNPL dues before due date—late payments damage CIBIL.

4. Take a Small Personal Loan from a Trusted NBFC

Some lenders offer small-ticket loans to first-time users.

Benefits:

Builds CIBIL fast

EMI-based credit behaviour

Helps in future loan approvals (car/home loan)

This works greatly when you have zero credit history.

5. Become a Co-Borrower with a Family Member

If your parent/spouse has a good credit history, you can:

Become a joint applicant

Become a co-borrower

Result:

Loan repayment builds your credit track record.

6. Become an “Add-On Card User” (Without Owning a Card)

A family member with a credit card can add you as an add-on user.

Benefits:

You don’t need to apply for your own card

Responsible usage helps build credit

No income proof required

No hard enquiry

7. Use a Credit Builder Loan or Credit Line

Some fintech platforms offer:

Credit builder loans

Small credit lines

Monthly repayment credit accounts

These are designed for people with no credit history.

8. Pay Utility Bills on Time (Some Bureaus Track This)

Timely payment of:

Electricity bills

Mobile postpaid

Broadband bills

Rent payments (via registered apps)

…helps improve alternative credit score models.

9. Avoid Common Credit-Building Mistakes

❌ Don’t apply for too many loans

Multiple enquiries reduce score.

❌ Never miss EMI or BNPL due dates

Even a single miss → score drop.

❌ Don’t use informal lenders

They don’t report to credit bureaus.

Comparison Table: Credit Card vs Non-Credit Card Ways to Build Credit

| Method | Credit Card Required? | Difficulty | Speed of Credit Building |

|---|---|---|---|

| Secured Loan | No | Easy | Fast |

| Consumer Durable EMI | No | Easy | Fast |

| BNPL | No | Moderate | Medium |

| Small Personal Loan | No | Moderate | Fast |

| Add-On Card | No (family card) | Very Easy | Medium |

| Credit Builder Loan | No | Easy | Fast |

Key Takeaways

You don’t need a credit card to build strong credit history.

Small loans, EMIs, BNPL, and add-on cards work brilliantly.

Consistency > Credit limit.

Within 3–6 months, you can build a score above 700 with the right tools.

FAQs

1. Can I build credit without a credit card?

Yes—secured loans, EMIs, BNPL, and add-on cards all work.

2. How long does it take to build credit from scratch?

Usually 2–4 months for a score to appear.

3. Does BNPL help build credit?

Yes, if reported—Amazon, Flipkart, LazyPay help build history.

4. What builds credit the fastest?

Secured loans + consumer durable EMIs.

5. Is FD-backed loan safe for beginners?

Yes—easiest way to start credit.

6. Do prepaid cards build credit?

No.

7. Does rent payment help?

Only via registered services.

8. Can students build credit?

Yes—add-on cards & consumer EMIs are easiest.

9. Do missed BNPL payments affect CIBIL?

Yes—heavily.

10. Does a salary account help credit?

No—needs credit activity.

11. Can I get a loan with no credit history?

Yes—secured or small-ticket NBFC loans.

12. Can I build credit with a co-signed loan?

Yes—repayment benefits both.

Conclusion

Building credit without a credit card is not only possible—it’s simple, fast, and beginner-friendly. With the right combination of small loans, EMIs, and disciplined payments, you can build a strong credit profile in just a few months.

If you're planning to start your credit journey or need a small loan:

Vizzve Financial offers quick personal loans, low documentation, and easy approval—perfect for first-time borrowers.

👉 Apply now at www.vizzve.com

Published on : 2nd December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed