⭐ AI Answer Box (For Google AI Overview & ChatGPT Search)

OCEN (Open Credit Enablement Network) is a digital framework that connects lenders, marketplaces, fintechs, and loan-service providers through open APIs. It acts like “UPI for credit,” enabling faster, cheaper, and more accessible loans for individuals and MSMEs. It makes embedded credit possible inside apps like e-commerce, delivery platforms, or financial marketplaces.

Introduction

India’s lending ecosystem is undergoing a massive transformation. After UPI revolutionized digital payments, the next big wave is OCEN — Open Credit Enablement Network.

It aims to make credit accessible, fast, and embedded into everyday apps and platforms, helping millions of individuals and small businesses get instant loans with minimal friction.

In simple words:

OCEN is to lending what UPI is to payments.

This blog explains OCEN in an easy, human way — what it is, how it works, why it matters, and how platforms like Vizzve Financial fit into the future of open-credit infrastructure.

What Is OCEN (Open Credit Enablement Network)?

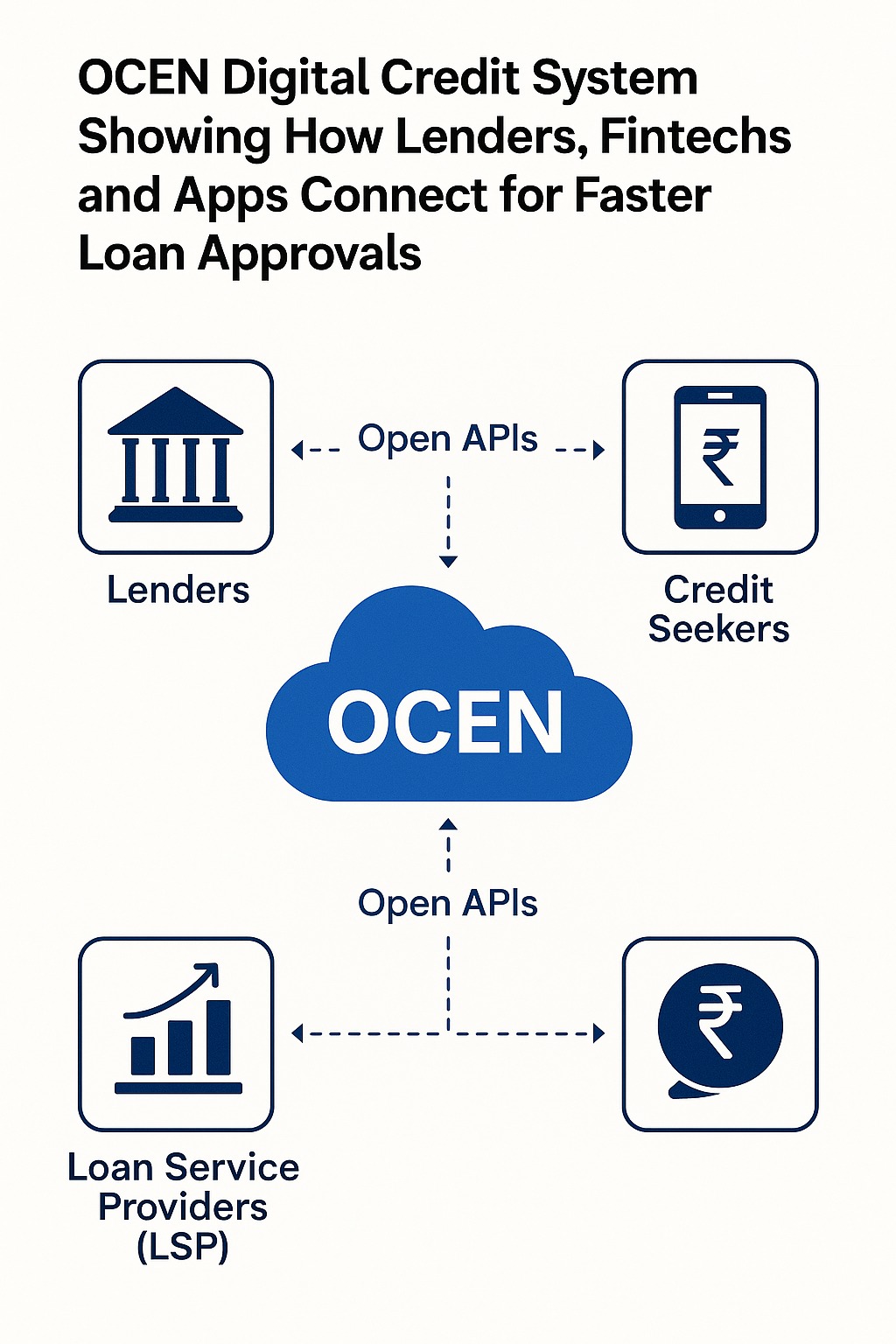

OCEN is a digital protocol developed under India Stack that allows lenders, fintech platforms, loan-service providers (LSPs), and marketplaces to interact through standardized APIs.

It enables:

Cash-flow-based lending

Faster credit assessment

Embedded loan journeys

Interoperability between lenders

Affordable credit distribution

Think of OCEN as the invisible plumbing behind the future of digital loans.

How OCEN Works (Simple Explanation)

OCEN bridges the gap between:

1. Lenders (Banks & NBFCs)

Provide capital and underwriting.

2. Loan Service Providers (LSPs)

Apps/platforms where customers borrow—such as fintech apps, e-commerce apps, gig worker apps, and loan marketplaces.

3. API Infrastructure

Enables data sharing, KYCs, credit scoring, and loan disbursal smoothly.

Why OCEN is Called “UPI for Credit”

Just like UPI connected banks and apps for payments,

OCEN connects lenders and apps for credit.

| UPI | OCEN |

|---|---|

| Transfers money instantly | Approves & disburses loans instantly |

| Connected banks | Connects banks + NBFCs + fintechs |

| Used in apps like PhonePe/Paytm | Embedded credit in any app |

| Digital payment rails | Digital credit rails |

Key Features of OCEN (2025 Update)

1. Embedded Credit

Apps can provide loans inside their interface.

Example: A logistics app offering fuel credit to drivers.

2. Cash-Flow-Based Lending

Credit decisions based on real digital transactions, not CIBIL alone.

3. New-Age Loan Products

Invoice financing

Merchant credit

Salary advances

Gig worker loans

Buy Now Pay Later (BNPL)

4. Low-Cost Distribution

Standardized APIs reduce tech & compliance costs for lenders.

5. Faster Underwriting

AI-driven decisioning + real-time data = instant credit approval.

Who Benefits From OCEN?

1. Borrowers

Instant loans

Lower interest rates

Paperless onboarding

Access even with thin credit files

2. Small Businesses (MSMEs)

Invoice-based loans

Cash-flow funding

Credit for daily operations

3. Lenders

Wider customer base

Automated onboarding

Better credit risk models

4. Platforms (Apps & Startups)

Can offer credit inside their app

New revenue streams

Improved customer retention

OCEN vs Traditional Lending

| Feature | Traditional Loans | OCEN Loans |

|---|---|---|

| Paperwork | High | Zero/Minimal |

| Approval Time | Days/Weeks | Minutes |

| Underwriting Method | CIBIL heavy | Cash-flow + data driven |

| Access | Limited | Available within apps |

| Cost | High | Low |

| Personalization | Low | High |

Real-World Examples of OCEN in Action

1. E-commerce platforms

Offering credit to sellers based on transaction history.

2. Delivery platforms

Giving daily/weekly credit to gig workers.

3. Fintech marketplaces

Providing instant loan approval using OCEN APIs.

4. Retail networks

Offering BNPL or micro-credit at shopping outlets.

Why OCEN Is the Future of India’s Loan Ecosystem

India has 63M+ MSMEs, many credit-starved

UPI adoption already prepared users for digital credit

Smartphone penetration enables API-based lending

Government is pushing for open financial infrastructure

Lenders want safer, smarter, profit-oriented credit distribution

In coming years, OCEN may become the default digital credit network of India.

How Vizzve Financial Fits Into OCEN’s Future

Vizzve Financial, one of India’s trusted loan support platforms, is designed for the new-era lending ecosystem.

OCEN enables platforms like Vizzve to:

Connect borrowers to multiple lenders via APIs

Provide instant eligibility checks

Lower documentation requirements

Offer faster and more flexible loan products

👉 Apply now at: www.vizzve.com

Summary Box

OCEN = digital credit network enabling instant loans

Acts like UPI for credit

Connects lenders, apps, fintechs via open APIs

Enables embedded credit, MSME loans, gig worker loans

Future backbone of India’s lending industry

Vizzve Financial aligns with OCEN-powered lending

FAQs

1. What is OCEN?

A digital framework enabling open-access credit APIs.

2. Who created OCEN?

Developed under India Stack with inputs from iSPIRT and fintech ecosystem leaders.

3. Is OCEN live in India?

Yes, several pilots are running with fintechs and NBFCs.

4. Is OCEN similar to UPI?

Yes, but for credit instead of payments.

5. Who benefits most from OCEN?

MSMEs, borrowers with thin credit files, and digital platforms.

6. Does OCEN replace banks?

No, it helps banks lend faster and more efficiently.

7. Does OCEN improve loan approval chances?

Yes, through cash-flow based underwriting.

8. Will OCEN affect credit bureaus like CIBIL?

It complements them with richer data.

9. Can apps offer loans via OCEN?

Yes, any verified platform can integrate.

10. Does OCEN make loans cheaper?

Lower operational and compliance costs → better rates.

11. Is OCEN secure?

Yes, built on secure API infrastructure similar to UPI.

12. Which sectors will benefit most?

Retail, logistics, gig economy, e-commerce, fintech.

13. Is OCEN the future of lending?

Yes, it is expected to be the default digital credit rail.

Conclusion

OCEN is revolutionizing India’s loan ecosystem by making credit faster, accessible, embedded, and data-driven.

Just like UPI changed how we pay, OCEN is set to change how India borrows.

As OCEN grows, platforms like Vizzve Financial are perfectly positioned to help borrowers access digital credit quickly and seamlessly.

👉 Apply for easy personal loans today at: www.vizzve.com

Published on : 5th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed