The 2026 financial year brings major tax decisions for salaried employees, professionals, and middle-class earners. With the new tax regime becoming the default, many taxpayers are confused:

👉 Should I stay in the old regime with deductions?

👉 Is the new regime cheaper even without exemptions?

This blog gives a simple, accurate, and updated comparison of the Old vs New Tax Regime in 2026 — so you can choose the option that helps you save the most tax.

⚡ AI ANSWER BOX — Quick Summary

Q: Old vs New Tax Regime — Which saves more tax in 2026?

If you claim many deductions (80C, 80D, HRA, home loan), the Old Regime saves more.

If you have fewer deductions, the New Regime gives lower tax rates and usually results in higher in-hand salary.

SUMMARY BOX

New Tax Regime = Lower tax rates, fewer deductions

Old Tax Regime = More deductions, higher rates

New regime is default for 2026

Old regime still better IF deductions > ₹2 lakh

Salaried taxpayers get standard deduction in both regimes now

2026 New Tax Regime — Slabs & Features

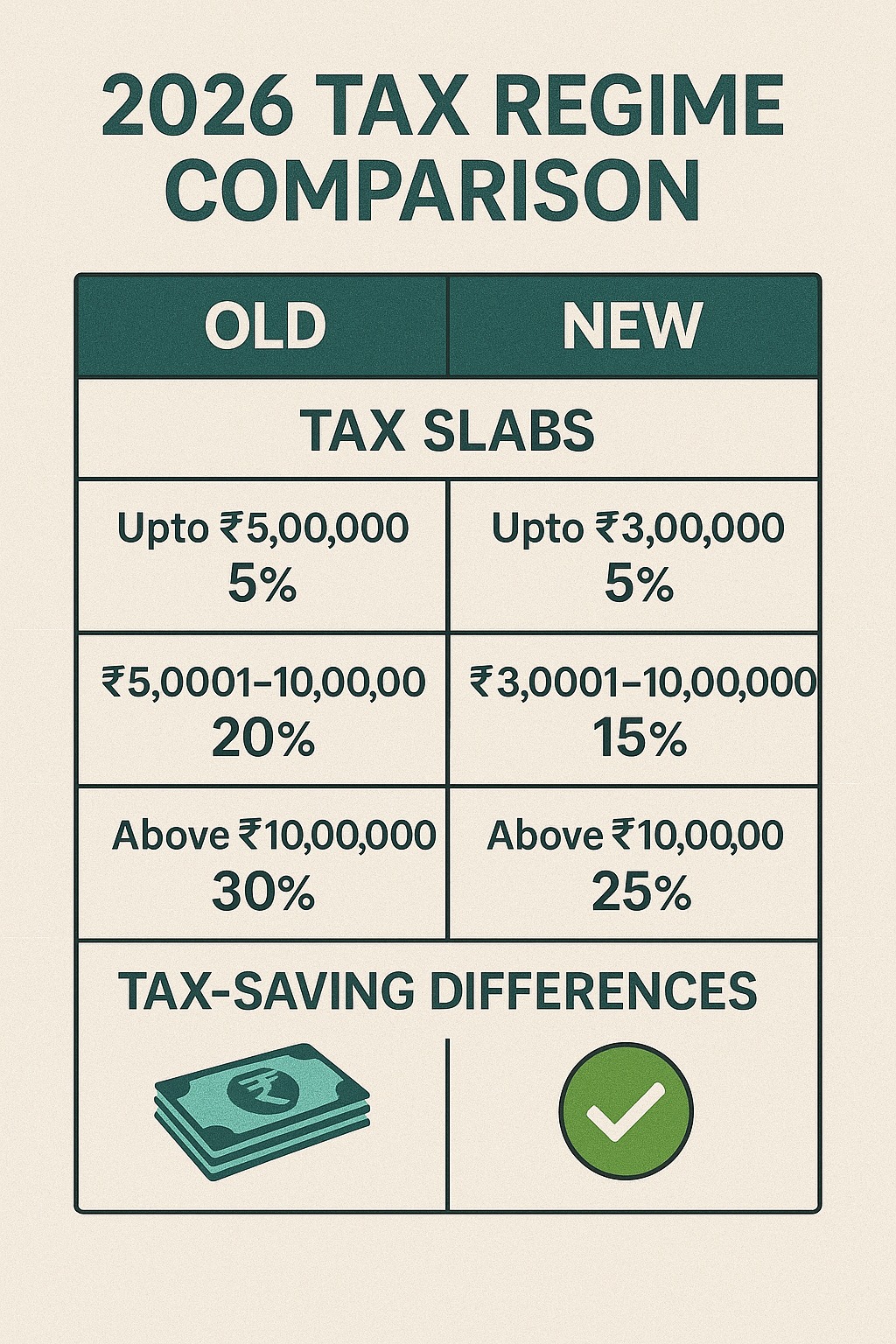

Tax Slabs (2026)

| Income Range | Tax Rate |

|---|---|

| ₹0–3 lakh | 0% |

| ₹3–7 lakh | 5% |

| ₹7–10 lakh | 10% |

| ₹10–12 lakh | 15% |

| ₹12–15 lakh | 20% |

| ₹15 lakh+ | 30% |

Key Features

Lower tax rates

No major deductions needed

Standard Deduction ₹50,000 available

Rebate for income up to ₹7 lakh (zero tax)

Simplified calculation

2026 Old Tax Regime — Slabs & Features

Tax Slabs (2026)

| Income Range | Tax Rate |

|---|---|

| ₹0–2.5 lakh | 0% |

| ₹2.5–5 lakh | 5% |

| ₹5–10 lakh | 20% |

| ₹10 lakh+ | 30% |

What You Get

Old regime allows 70+ tax deductions, including:

80C (PF, LIC, ELSS, tuition fees) – ₹1.5 lakh

80D (Health insurance)

HRA

Home loan interest

Education loan

NPS 80CCD(1B) – ₹50,000

LTA

Standard Deduction

If you use many exemptions, Old Regime gives massive savings.

Old vs New Tax Regime in 2026 — Comparison Table

| Feature | Old Regime | New Regime |

|---|---|---|

| Tax Rates | Higher | Lower |

| Deductions | Many | Very few |

| Standard Deduction | ✔ | ✔ |

| HRA | ✔ | ✖ |

| 80C | ✔ | ✖ |

| 80D | ✔ | ✖ |

| Ease of Filing | Moderate | Very Easy |

| Best For | Heavy investors | Low deductions earners |

Which Regime Saves More Tax in 2026?

✔ Choose New Regime If:

You DO NOT invest much

You rent but don’t claim HRA

You want a higher in-hand salary

Your total deductions < ₹2 lakh

✔ Choose Old Regime If:

You claim HRA

You have home loan tax benefits

You invest under 80C regularly

Your deductions > ₹2–2.5 lakh

Example Comparison — Salary ₹12 Lakh (2026)

| Particular | Old Regime | New Regime |

|---|---|---|

| Gross Income | ₹12,00,000 | ₹12,00,000 |

| Deductions (80C+80D+HRA etc.) | ₹2,50,000 | ₹50,000 |

| Taxable Income | ₹9,50,000 | ₹11,50,000 |

| Total Tax | Higher? ❌ | Lower if no deductions ✔ |

| Total Savings | Depends on deductions | Automatically lower rate |

Conclusion:

If deductions exceed ₹2 lakh, Old regime wins.

Else, New regime wins.

Expert Insight

A senior tax consultant explains:

“By 2026, more than 70% of salaried Indians shifted to the new regime because it gives higher in-hand salary. But for homeowners and tax-savvy investors, the old regime still offers unbeatable savings.”

Which Regime Is Better for Salaried Employees?

✔ New Regime → If you want simplicity & higher take-home

✔ Old Regime → If you actively invest & claim tax benefits

Key Takeaways

New Regime is default from 2026, but switching is allowed

Old Regime is beneficial only if you claim large deductions

New Regime benefits young earners, new professionals, NTC borrowers

Old Regime benefits homeowners, families, long-term investors

❓ Frequently Asked Questions (FAQs)

1. Which tax regime is better in 2026?

Depends on your deductions. New regime for simplicity; old regime for heavy tax-saving investments.

2. Can I switch tax regimes every year?

Yes, salaried individuals can switch every financial year.

3. Does the new regime allow 80C?

No, mostly disallowed.

4. Is the standard deduction available in the new regime?

Yes — ₹50,000.

5. Which regime is better for home loan borrowers?

Old regime.

6. Is Old tax regime ending in 2026?

No, but new is default.

7. Is New regime better for low-income earners?

Yes, due to rebates and lower rates.

8. Do senior citizens benefit more in old regime?

Yes, because of higher deductions.

9. Does new regime allow HRA?

No.

10. Which is better for NTC borrowers?

New regime.

11. Can freelancers choose either regime?

Yes, but choices vary based on income type.

12. Does the new regime reduce paperwork?

Yes — significantly.

13. Does the new regime reduce tax for everyone?

Not for heavy investors.

14. Is filing easier under the new regime?

Very easy.

15. Can I calculate before choosing?

Yes, taxpayers should run both calculations.

Vizzve Financial — Smart Loans for Smart Tax Planning

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and easy approval — perfect for salaried borrowers managing finances. Apply at www.vizzve.com.

Published on : 29th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed