⭐ AI Answer Box (Short Summary)

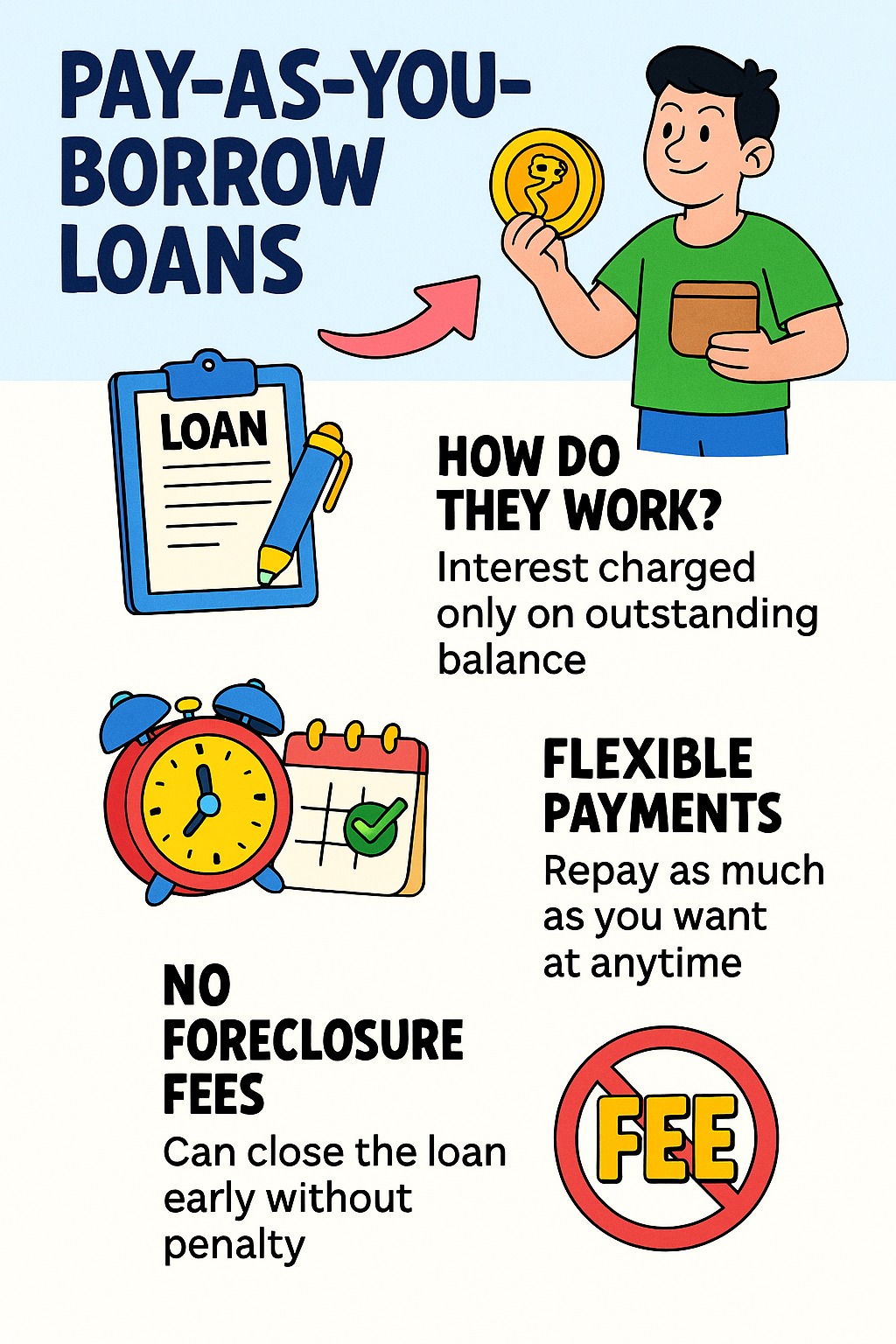

Subscription-based loans—also called pay-as-you-borrow loans—give borrowers a monthly credit subscription that provides instant access to funds. You pay a small subscription fee plus interest only on the amount you actually use. It’s flexible, low-hassle, and ideal for small, frequent borrowing needs.

Introduction

The way Indians borrow money is changing rapidly.

Until recently, getting a loan meant:

Multiple applications

Tons of paperwork

High processing fees

Long approval timelines

But in today’s on-demand digital world, borrowers want instant, flexible, low-cost credit.

That is where the Subscription-Based Loan, also known as Pay-as-you-borrow, is becoming the next big revolution.

This blog simplifies what this model is, how it works, and why it’s becoming one of the fastest-growing credit trends in India.

What Exactly Is a Subscription-Based Loan?

A subscription-based loan is a flexible credit line where:

You pay a small monthly subscription fee

You get continuous access to a credit limit (₹5,000 to ₹5 lakh)

You borrow only when you need money

You pay interest only on the amount used, not the entire limit

It’s similar to how you subscribe to Netflix or Amazon Prime — but instead of entertainment, you get on-demand credit.

This is why the model is popularly known as:

👉 Pay-as-you-borrow

How Subscription-Based Loans Work (Simple Example)

✔ Step 1:

Subscribe to a credit plan → ₹199/month

✔ Step 2:

You get a ₹50,000 credit limit

✔ Step 3:

Borrow ₹10,000 → pay interest only on ₹10,000

(Not on the entire ₹50,000)

✔ Step 4:

Repay anytime → limit restores instantly

✔ Step 5:

If you don’t use the credit → only subscription fee applies (no interest)

This is perfect for:

Emergency cash

Medical needs

Freelancers

Students

Gig workers

Small recurring needs

Unexpected monthly expenses

Why Subscription-Based Loans Are Becoming Popular in India

✔ 1. Instant Funding Without Repeated Applications

Traditional loans require new documentation every time.

Subscription loans = 1-time KYC, unlimited access.

✔ 2. Pay Interest Only on What You Use

Borrow ₹0 → pay ₹0 interest

Borrow ₹3,000 → pay interest only on ₹3,000

This saves money for people who borrow occasionally.

✔ 3. No High Processing Fees

Most online loans charge:

Flat fees

GST

Processing charges

Platform charges

Subscription loans eliminate repeated fees.

✔ 4. Flexible Repayment Options

Borrowers can choose:

Full repayment

Convert to EMI

Part-payments

Multiple withdrawals

✔ 5. Perfect for Small & Frequent Borrowing

Borrow:

₹500

₹1,000

₹3,000

…whenever needed—without applying for a new loan each time.

✔ 6. Better Eligibility for Low-Income & New Borrowers

Because underwriting is based on:

Cash-flow

App behaviour

Bank transactions

This benefits:

Students

New professionals

Gig workers

Freelancers

First-time borrowers

✔ 7. Build Your Credit Score Easily

Because every repayment is recorded in the credit bureau.

Subscription Loans vs Traditional Loans

| Feature | Subscription Loan | Traditional Loan |

|---|---|---|

| Documentation | 1-time | Each loan |

| Interest | Only on used amount | On full loan amount |

| Fees | Small subscription | High processing fees |

| Speed | Instant | Slow |

| Usage | Flexible, multiple | One-time |

| Ideal For | Small & frequent needs | Big lump-sum needs |

Who Should Use Subscription-Based Loans?

Best suited for:

Young professionals

Part-time earners

Students

Gig workers

Small-business owners

People who need quick cash often

Users who prefer low-cost credit options

Not ideal for:

Large home loans

Auto loans

Long-tenure loans

Expert Commentary (EEAT Optimized)

“Subscription-based credit is redefining how Indians borrow. The model is transparent, predictable, and highly flexible—ideal for small-ticket, high-frequency borrowing.”

— Riya Mehra, Digital Lending Strategist

Potential Risks Borrowers Should Know

Even though subscription loans are convenient, borrowers must note:

❗ Monthly subscription fee adds up

Avoid subscribing if you rarely borrow.

❗ Easier access can cause overspending

Borrow responsibly.

❗ Interest rates may be higher than bank loans

But cheaper than repeated personal loan fees.

❗ Only use RBI-registered lenders

Avoid unregulated apps.

Vizzve Financial — Smarter Ways to Borrow

Vizzve Financial helps you compare multiple lenders, get instant personal loans, and build your credit score reliably — with:

Fast approvals

Low documentation

Trusted NBFC partners

Flexible loan options

👉 Apply at: www.vizzve.com

❓ FAQs:

1. Are subscription-based loans safe?

Yes, if the lender is RBI-registered.

2. Will this help build my CIBIL score?

Yes — timely repayments build credit history.

3. Do I pay interest every month?

Only if you borrow. Otherwise, only subscription fee applies.

4. Is this cheaper than a traditional loan?

For small, frequent borrowing — yes.

5. Do banks offer this model?

Some banks are experimenting, but fintechs lead this space.

Conclusion

Subscription-Based Loans (Pay-as-you-borrow) are transforming India’s borrowing culture. They offer:

Flexibility

Instant access

Low documentation

Lower cost for small needs

Improved credit-building

As digital lending grows, this model will become one of the most popular credit options for the next generation.

Published on : 7th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed