In 2025, credit card EMIs and personal loans are the most popular ways to manage expenses — from phones to weddings.

But when money is tight, which is actually cheaper and smarter?

This blog breaks down both options across interest rates, fees, flexibility, and credit impact — so you can decide what works best for you.

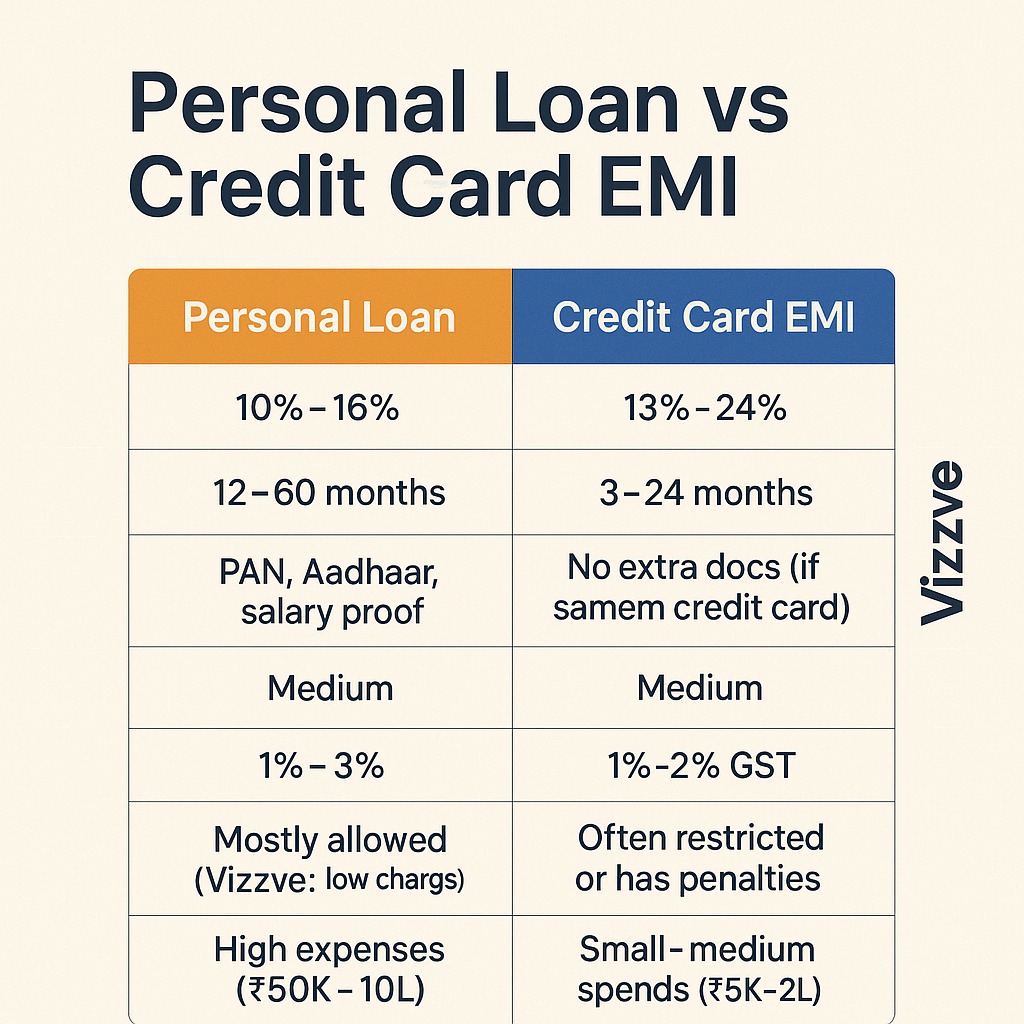

Personal Loan vs Credit Card EMI: Key Differences

| Criteria | Personal Loan | Credit Card EMI |

|---|---|---|

| 💰 Interest Rate | 10% – 16% (Vizzve partners) | 13% – 24% |

| ⏳ Tenure | 12 – 60 months | 3 – 24 months |

| 📝 Documents | PAN, Aadhaar, salary proof | No extra docs (if on same credit card) |

| 📉 Credit Score Impact | Medium (one-time pull, EMI score build) | Medium-High (card utilization matters) |

| 💸 Processing Fee | 1% – 3% | 1% – 2% + GST |

| 🚫 Prepayment Option | Mostly allowed (Vizzve = low charges) | Often restricted or has penalties |

| 💼 Ideal For | High expenses (₹50K–₹10L) | Small-medium spends (₹5K–₹2L) |

Which One Is Cheaper?

✅ Personal Loan Wins If:

You need ₹50,000 or more

You want flexible repayment (12–60 months)

You’re eligible for low interest via Vizzve

You plan to prepay without penalty

✅ Credit Card EMI Wins If:

You’re converting a single small purchase

Your bank offers 0% interest EMI (promo-based)

You want a quick EMI without new paperwork

⚠️ Beware: Credit card EMIs can hurt your credit score if you max out your limit or miss payments.

Why Choose Vizzve for Personal Loans?

✅ Low-interest loans from trusted NBFCs

✅ Quick disbursal & online approval

✅ No hidden charges

✅ EMI calculators & refinancing options

✅ Ideal for salaried, gig workers, freelancers

FAQs –

Q1. Can I convert a credit card bill into a personal loan?

Yes, Vizzve helps you consolidate credit card debt into a lower-interest personal loan.

Q2. Which is safer for my credit score?

Personal loan, because it doesn’t raise your credit utilization like credit card EMI does.

Q3. Can I pre-close a credit card EMI?

Possible, but many banks charge penalties or don’t allow early closure.

Q4. Which one is faster?

Credit card EMI is instant, but Vizzve personal loans also approve within hours if documents are ready.

Published on : 22nd July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed