A personal loan can help you manage urgent financial needs, but the high interest rates make many borrowers look for ways to close the loan early.

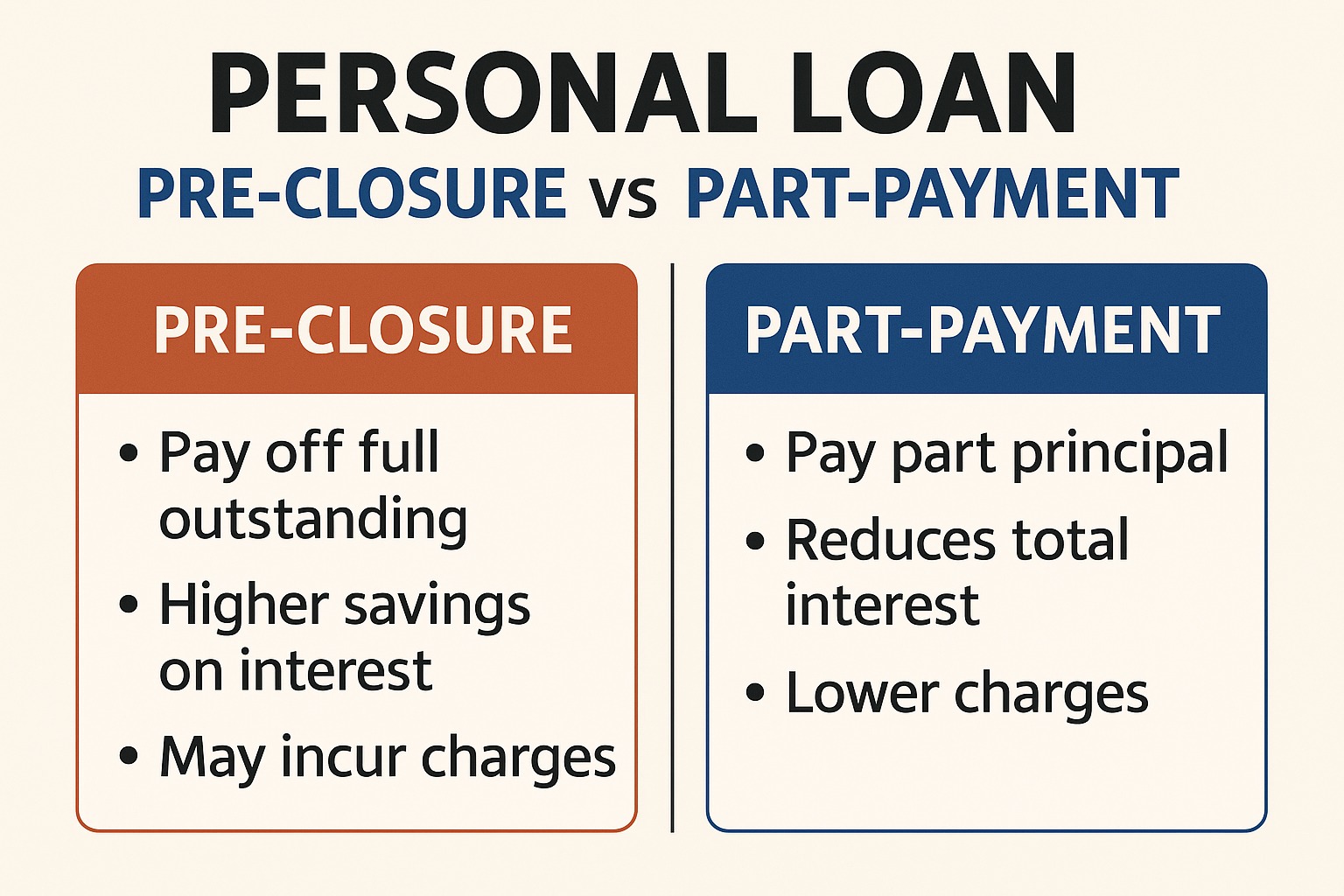

Two popular options are pre-closure (full repayment) and part-payment (partial repayment).

Both options help reduce interest, but the impact and timing differ.

Here is a clear guide to help you choose the right strategy in 2025–26.

What Is Personal Loan Pre-Closure?

Pre-closure means paying off the entire remaining loan amount at once, before the tenure ends.

Key Benefits:

Saves a large amount of future interest

Eliminates EMI burden

Improves credit score

Frees up monthly cash flow

Possible Drawbacks:

Foreclosure charges (2%–5%)

Loss of tax benefits (if any)

Requires large lump-sum amount

May impact cash savings

What Is Part-Payment?

Part-payment means paying a chunk of your loan amount while continuing the remaining EMIs.

Example:

If you owe ₹3 lakh and pay ₹50,000 as part-payment, interest is recalculated on the reduced balance.

Key Benefits:

Reduces principal

Lowers future interest

Lowers EMI or shortens tenure

Helps without full pre-closure

Possible Drawbacks:

Some banks allow only limited part-payments

Minimum amount required (often ₹10,000+)

Charges may apply (varies by lender)

Pre-Closure vs Part-Payment: Which Is Better?

| Feature | Pre-Closure | Part-Payment |

|---|---|---|

| Interest Savings | Highest | Medium–High |

| EMI Reduction | Yes (loan ends) | Yes (optional) |

| Cash Requirement | High | Moderate |

| Impact on Score | Strong | Good |

| Flexibility | Low | High |

Choose pre-closure if you have strong savings.

Choose part-payment if you want interest savings without draining your funds.

Best Timing for Pre-Closure & Part-Payment

✔ Best Time: First Half of the Loan Tenure

Personal loans follow a reducing balance method, but the lender takes most interest in the initial EMIs.

Doing pre-closure or part-payment in the first 12–18 months saves maximum interest.

✔ Second Best Time: When You Get Bonus / Incentives

Use one-time money like:

Bonus

Tax refund

Incentive

Maturity payout

Gifts or windfall

✔ Avoid Doing It Near Loan End

In the last 6–9 months, closing the loan early saves very little interest.

When You Should Choose Pre-Closure

✔ You have high-interest personal loans (12%–24%)

✔ You have enough emergency savings

✔ You want to reduce monthly EMIs entirely

✔ You want to improve credit score quickly

✔ You want to avoid long-term interest outgo

When You Should Choose Part-Payment

✔ You cannot fully close the loan

✔ You want to reduce EMI or tenure

✔ You receive moderate surplus funds

✔ You want to manage loan without disturbing savings

Important Charges to Check Before Deciding

Foreclosure charges: 2%–5%

Part-payment charges: 0%–3%

GST on charges: 18%

Minimum part-payment amount

Cooling period: Some banks allow closure only after 6–12 months

Always calculate your net savings before deciding.

FAQs

Q1. Which saves more — pre-closure or part-payment?

Pre-closure saves the most interest, but part-payment is more flexible.

Q2. Does pre-closure increase credit score?

Yes. Closed loans boost your credit profile.

Q3. Can I reduce EMI after part-payment?

Yes, you can choose to lower EMI or shorten tenure.

Q4. Is pre-closure allowed anytime?

Most banks allow it only after 6–12 months from loan disbursement.

Q5. Does pre-closure attract charges?

Yes, personal loans usually have foreclosure fees.

Published on : 15th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed