Personal Loan Search Made Easy in 2025 – Apply Instantly with Vizzve Financial

Introduction:

Looking for the best personal loan that suits your needs?

Your search ends here with Vizzve Financial — India’s trusted digital loan marketplace!

Whether you need funds for a wedding, emergency, travel, education, or any personal goal, finding the right loan is now simple, fast, and secure.

Why Personal Loan Search Matters Today:

With hundreds of banks and NBFCs offering different terms, choosing the right personal loan can be confusing.

That’s why smart borrowers compare — and save money on interest rates, processing fees, and EMI payments.

How Vizzve Financial Makes It Easy:

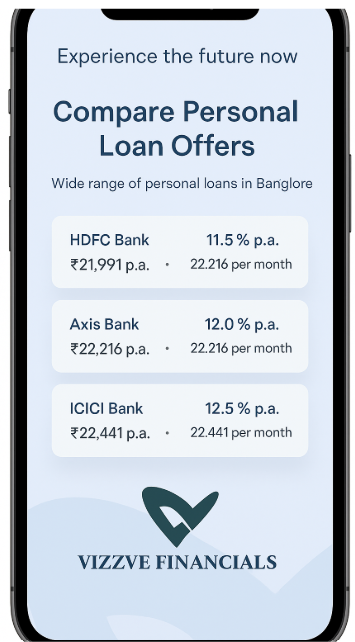

✅ Instant Loan Comparison

Get multiple loan offers in minutes.

✅ 100+ RBI Registered Partners

Tie-ups with India’s trusted banks and NBFCs.

✅ Minimal Documentation

Apply with just basic KYC and income proofs.

✅ Fast Approval and Disbursal

Loans up to ₹25 lakh credited within 24–48 hours.*

✅ Secure & Transparent

Your information is safe, and no hidden charges.

✅ 100% Digital Process

No need to visit a branch — apply from your phone!

Steps to Search and Apply for a Personal Loan with Vizzve:

1️⃣ Visit www.vizzve.com

2️⃣ Enter your basic details — income, employment type, city

3️⃣ Get instant personal loan offers tailored for you

4️⃣ Compare interest rates, EMI, tenure

5️⃣ Apply and upload minimal documents

6️⃣ Get approval and receive funds quickly!

Why Choose Vizzve Financial?

-

✅ 10+ years of combined team experience

-

✅ Trusted by 50,000+ happy customers

-

✅ Transparent loan offers with zero processing bias

-

✅ Support team to assist you anytime

📚 FAQs:

Q1: How fast can I get a personal loan via Vizzve Financial?

➔ You can receive approval within minutes and disbursal within 24–48 hours.*

Q2: Is Vizzve Financial a lender?

➔ No, Vizzve Financial is a trusted loan aggregator platform partnered with RBI-registered banks and NBFCs.

Q3: Will my credit score be affected while checking offers?

➔ No. Checking personal loan offers via Vizzve will not impact your CIBIL score.

Q4: What documents are needed for a personal loan application?

➔ Basic KYC (Aadhaar, PAN), 3–6 months' bank statement, and income proof.

Q5: Can I get a personal loan without a salary slip?

➔ Yes, alternative documents like bank statements and ITR can be used. Check with Vizzve for more options!

✅ Check Your Personal Loan Offers Now – Click Here!"

And internally link to other relevant pages like:

➔ "Documents Needed for Personal Loan"

➔ "How to Improve Your CIBIL Score"

➔ "Vizzve Financial Partners List"