When you apply for a personal loan, one of the most important choices you must make is the loan tenure — the period over which you will repay the loan.

Though it sounds simple, the tenure you choose affects your EMIs, interest costs, credit score, and financial stress.

Understanding how personal loan tenure works can help you borrow smarter and avoid unnecessary costs.

What Is Personal Loan Tenure?

A personal loan tenure is the total time you’re given to repay the loan, generally ranging from:

12 months (1 year)

Up to 60–72 months (5–6 years)

Your EMI is spread across this time period.

Formula:

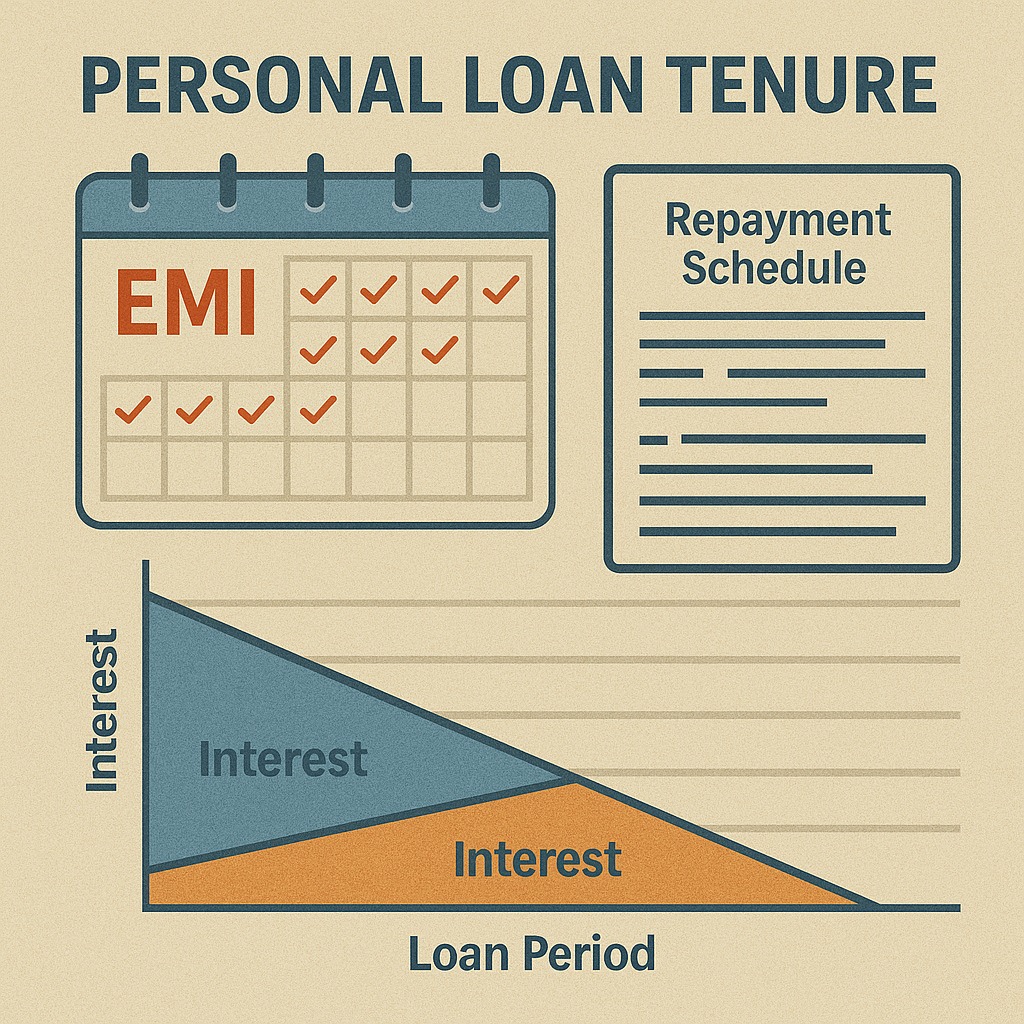

Longer tenure = smaller EMIs but higher interest

Shorter tenure = bigger EMIs but lower interest

Choosing the right balance is crucial.

Why Loan Tenure Matters

1. Your EMI Depends Directly on Tenure

Longer tenure → lower monthly EMI

Shorter tenure → higher monthly EMI

This affects your monthly budget and cash flow.

2. Total Interest Changes Dramatically

Interest builds over time. That means:

A 5-year loan costs much more in interest than a 2-year loan, even if EMI feels comfortable.

3. Tenure Impacts Loan Eligibility

Banks often approve loans faster when:

EMI fits comfortably in your income

Tenure improves repayment capacity

Sometimes extending tenure can help you qualify.

4. Tenure Affects Credit Score Stability

Longer tenures give you:

More breathing room

Lower risk of missing EMIs

Better repayment history over time

Shorter tenures need strong financial discipline.

How to Choose the Right Loan Tenure

1. Calculate Your EMI Comfort Zone

Use the 30–40% rule:

Your total EMIs should not exceed 40% of your monthly income.

If EMIs exceed this, extend the tenure.

2. Don’t choose the longest tenure by default

Borrowers often choose 5–6 years because EMIs look small, but:

You pay much more interest

You’re stuck with a long repayment cycle

Financial goals get delayed

If possible, pick a moderate tenure.

3. Pick shorter tenure when income is strong

If you can comfortably pay higher EMIs:

Choose 1–3 years

Reduce interest cost

Close the loan faster

Boost credit score stronger and quicker

4. Use prepayment options smartly

If your lender allows:

Part prepayment

Foreclosure

You can take a longer tenure for safety and still close the loan early, reducing interest.

5. Consider Future Income Changes

If your salary is expected to grow:

Choose a slightly shorter tenure

Increase EMI capacity later

Close early with bonuses or increments

Common Mistakes Borrowers Make

❌ Choosing the longest tenure just for low EMI

❌ Not calculating total interest cost

❌ Ignoring prepayment penalties

❌ Overestimating ability to pay higher EMIs

❌ Taking short tenure even when cash flow is tight

Avoid these to maintain healthy finances.

FAQs

1. What is a typical personal loan tenure?

Most personal loans offer 1 to 5 years, and some extend to 6 years.

2. Does longer tenure mean lower EMI?

Yes, but it also increases the total interest you pay.

3. Can I change loan tenure later?

Yes, through restructuring or refinancing, depending on the lender.

4. Which tenure is best for saving interest?

Shorter tenures save more interest, provided you can afford higher EMIs.

5. Does tenure affect my credit score?

Indirectly — disciplined EMI payments improve your score over time.

Published on : 19th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed