Personal Loan vs Credit Card Loan – Which is Better for You in 2025? | Vizzve Financial

Vizzve Admin

💳 Personal Loan vs Credit Card Loan – Which Is Better in 2025? | Vizzve Financial

Published on: April 29, 2025

Written by: Vizzve Financial

📢 Introduction

Need urgent funds in 2025?

You might be wondering — should I take a personal loan or swipe my credit card?

Both options offer quick access to money, but choosing the right one can save you thousands in interest and help you manage your finances better.

In this blog, Vizzve Financial breaks down the real differences between Personal Loans and Credit Card Loans in 2025 — so you can make the smartest choice based on your needs!

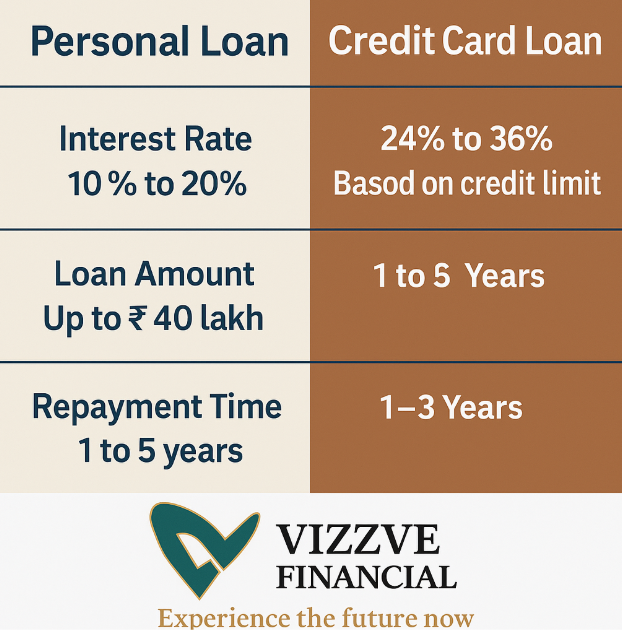

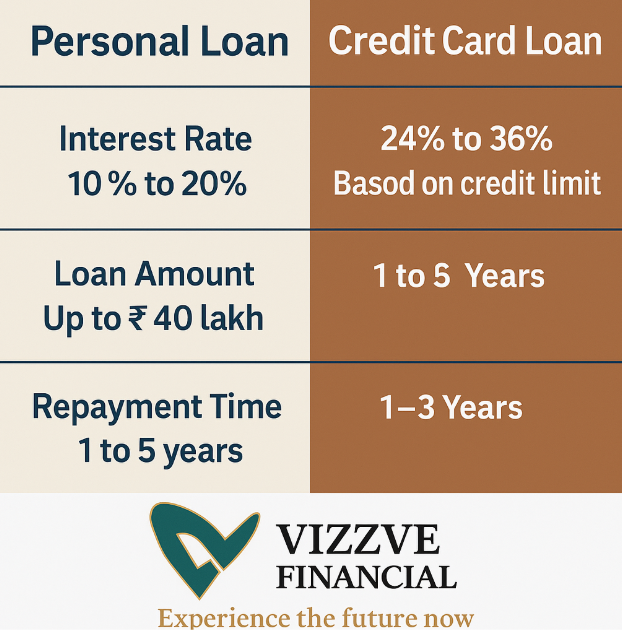

🔥 Personal Loan vs Credit Card Loan – Quick Comparison

💬 When Should You Choose a Personal Loan?

-

Large Expenses: Wedding, medical bills, travel, education, or home renovation.

-

Longer Repayment Needs: 1 to 5 years comfortable EMI structure.

-

Lower Interest Rates: Especially if applying through Vizzve Financial’s trusted network.

-

Higher Loan Amounts: ₹1 lakh to ₹50 lakh based on your eligibility.

✅ Apply Instantly for a Personal Loan via Vizzve Financial — compare 100+ offers and find the best deal!

💬 When Should You Use a Credit Card Loan?

-

Small, Immediate Purchases: Like shopping, small medical bills, gadgets.

-

Repay Quickly: Within 1-2 months to avoid heavy interest charges.

-

Pre-Approved Offers: If you have an existing good repayment history with your bank.

⚡ Warning: If you plan to repay over many months, personal loan is always cheaper than using a credit card loan!

🔥 Why Personal Loans are Smarter in 2025 (via Vizzve Financial)

-

🏦 Compare offers from multiple banks and NBFCs at once.

-

🔥 Get lowest rates starting at 10.5% p.a. with minimal paperwork.

-

📱 Apply from your phone — Instant Pre-Approval available.

-

🛡️ 100% Secure, RBI-registered lending partners.

No hidden charges. No endless bank visits. Just fast loans, made easy with Vizzve!

❓ Frequently Asked Questions (FAQs)

Q1. Is it better to take a personal loan or credit card loan in 2025?

👉 If you need a bigger amount or longer time to repay, personal loan is better. If you can repay quickly (within 1–2 months), credit card loan can work for small needs.

Q2. Which has lower interest rates – personal loan or credit card loan?

👉 Personal loans generally have much lower interest rates (around 10–16% p.a.) compared to credit card loans (often 24–36% p.a.).

Q3. Can I apply for a personal loan instantly online in 2025?

👉 Yes! With platforms like Vizzve Financial, you can compare multiple personal loan offers online and get instant approval.

Q4. What documents are needed for a personal loan via Vizzve Financial?

👉 Basic documents like Aadhaar card, PAN card, last 6 months' bank statements, and salary slips (or income proof for self-employed).

🚀 Final Words

Both personal loans and credit card loans offer flexibility — but personal loans win when it comes to lower interest, higher amount, and better EMI control.

If you’re planning a big expense in 2025, it’s smarter to choose a personal loan via Vizzve Financial for the best deals.

👉 Apply Now at Vizzve.com and experience instant approvals with trusted lending partners!

Disclaimer: This article may include third-party images, videos, or content that belong to their respective owners. Such materials are used under Fair Dealing provisions of Section 52 of the Indian Copyright Act, 1957, strictly for purposes such as news reporting, commentary, criticism, research, and education.

Vizzve and India Dhan do not claim ownership of any third-party content, and no copyright infringement is intended. All proprietary rights remain with the original owners.

Additionally, no monetary compensation has been paid or will be paid for such usage.

If you are a copyright holder and believe your work has been used without appropriate credit or authorization, please contact us at grievance@vizzve.com. We will review your concern and take prompt corrective action in good faith... Read more