When applying for a loan — especially a home loan or construction-linked loan — borrowers often come across two repayment options: Pre-EMI and Full EMI.

Both terms sound similar, but they work very differently and can significantly impact your repayment timeline, interest cost, and financial planning. Understanding these differences can help you choose the right structure for your needs.

What Is Pre-EMI?

Pre-EMI refers to the interest-only payment made on the loan amount disbursed until the entire sanctioned loan is released.

This typically applies to home loans for under-construction properties, where the bank disburses the loan in stages based on project progress. During this period, you only pay the interest portion of the loan on the disbursed amount — not the principal.

Once the construction is complete and the full loan is disbursed, your regular (Full EMI) payments begin.

Example:

If your total loan is ₹40 lakh and only ₹10 lakh has been disbursed for the first stage of construction, your Pre-EMI will be calculated only on ₹10 lakh. Once the full amount is released, you’ll start paying Full EMI on ₹40 lakh.

What Is Full EMI?

Full EMI means paying both interest and principal right from the start, even if the full loan amount hasn’t been disbursed yet.

Unlike the Pre-EMI option, here your loan repayment begins in full — helping you start reducing your principal balance immediately.

Full EMI payments are ideal for borrowers who can afford higher initial payments and want to save on long-term interest.

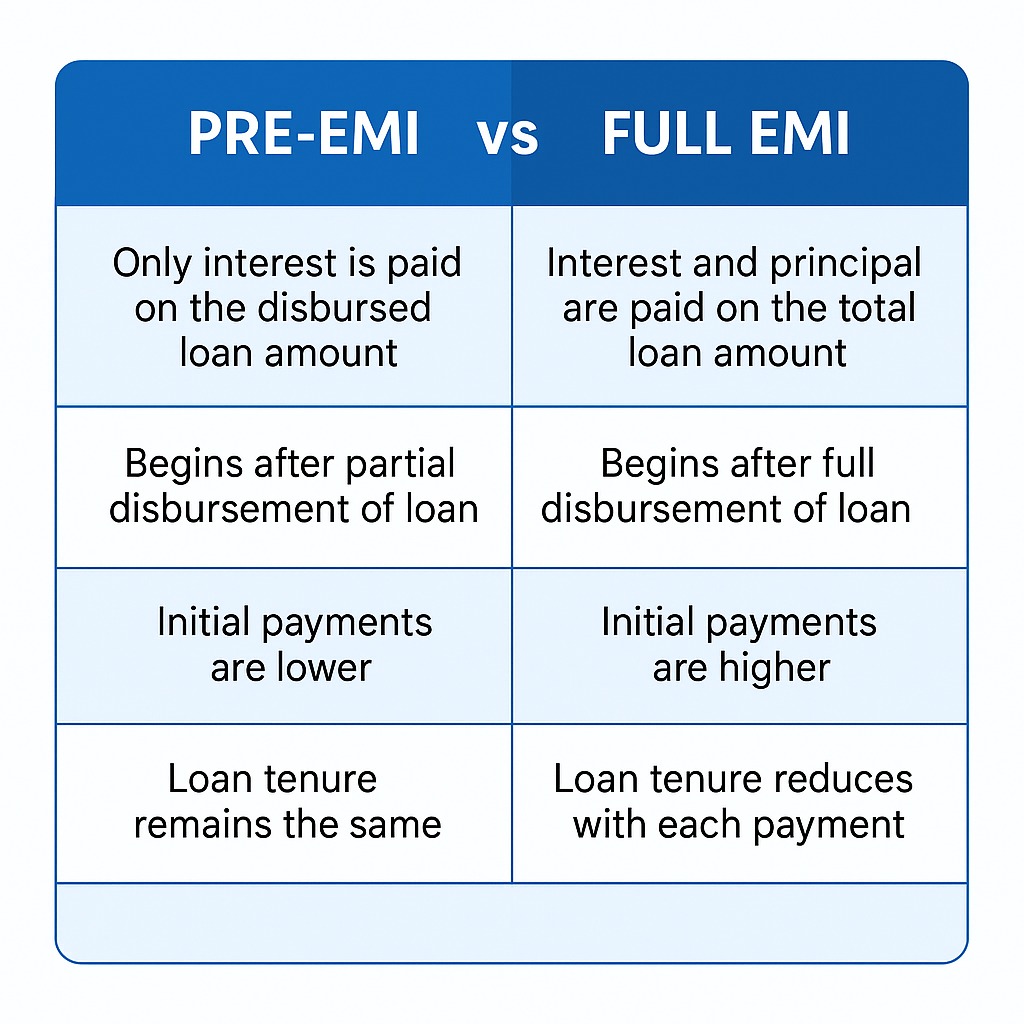

Key Differences Between Pre-EMI and Full EMI

| Feature | Pre-EMI | Full EMI |

|---|---|---|

| Payment Structure | Only interest on disbursed amount | Includes both principal and interest |

| When It Applies | Mostly during construction phase | Starts from the first disbursement |

| Impact on Principal | Principal does not reduce | Principal starts reducing immediately |

| Monthly Outgo | Lower during initial phase | Higher from the beginning |

| Total Interest Cost | Usually higher due to longer interest period | Lower as repayment starts earlier |

| Suitable For | Borrowers managing limited cash flow | Borrowers aiming to save interest and close loan faster |

| Tax Benefits | Tax benefits begin only after possession | Same, but effective sooner due to earlier repayment |

Benefits of Pre-EMI

Lower initial burden: Ideal for borrowers paying rent and EMI simultaneously.

Flexibility: Allows more financial breathing room during the construction phase.

Stage-wise disbursement: You pay interest only on the disbursed amount, not the total loan.

However, Pre-EMIs can increase your total loan cost since the principal remains unpaid during the early years.

Benefits of Full EMI

Faster loan repayment: You start repaying both principal and interest right away.

Lower total interest: Since the principal reduces earlier, overall interest paid over the tenure is less.

Better long-term savings: Ideal for those with steady income and ability to handle higher EMIs.

On the downside, Full EMIs can strain monthly budgets, especially when managing other financial commitments.

When Should You Choose Pre-EMI?

Go for Pre-EMI if:

Your property is still under construction and disbursements are staggered.

You’re paying rent and cannot afford full EMI initially.

You plan to sell the property soon after possession and don’t intend to keep the loan long term.

When Should You Choose Full EMI?

Opt for Full EMI if:

You have a stable income and want to save on total interest cost.

Your goal is long-term ownership and faster loan closure.

You want to build credit faster and reduce outstanding liability early.

Expert Insight

While Pre-EMI may appear convenient initially, Full EMI is often more beneficial in the long run. Starting repayment early shortens your tenure and saves you thousands in interest.

However, the right choice depends on your cash flow, financial goals, and property stage. For short-term flexibility, Pre-EMI works well; for long-term savings, Full EMI is the smarter choice.

Conclusion

Both Pre-EMI and Full EMI options serve different borrower needs. If you value lower initial outflow, Pre-EMI offers flexibility. But if you aim for faster repayment and interest savings, Full EMI delivers stronger long-term benefits.

Before finalizing your loan, consult your lender about both options — and calculate how each will affect your monthly budget and total cost over time.

FAQs

Q1. What happens to Pre-EMIs once construction is completed?

A: Once your property is ready and the full loan amount is disbursed, your Pre-EMI phase ends, and regular Full EMI payments begin.

Q2. Can I switch from Pre-EMI to Full EMI anytime?

A: Yes, many lenders allow borrowers to switch once they’re comfortable handling higher payments.

Q3. Does Pre-EMI offer any tax benefits?

A: Tax benefits on home loan interest start only after you receive possession of the property, regardless of Pre-EMI payments made earlier.

Q4. Which option saves more money in the long run?

A: Full EMI typically helps save more in interest costs, as you start repaying the principal earlier.

Q5. Is Pre-EMI suitable for under-construction home buyers?

A: Yes, it is designed for such situations where payments are linked to the project’s construction stages.

Published on : 12th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed