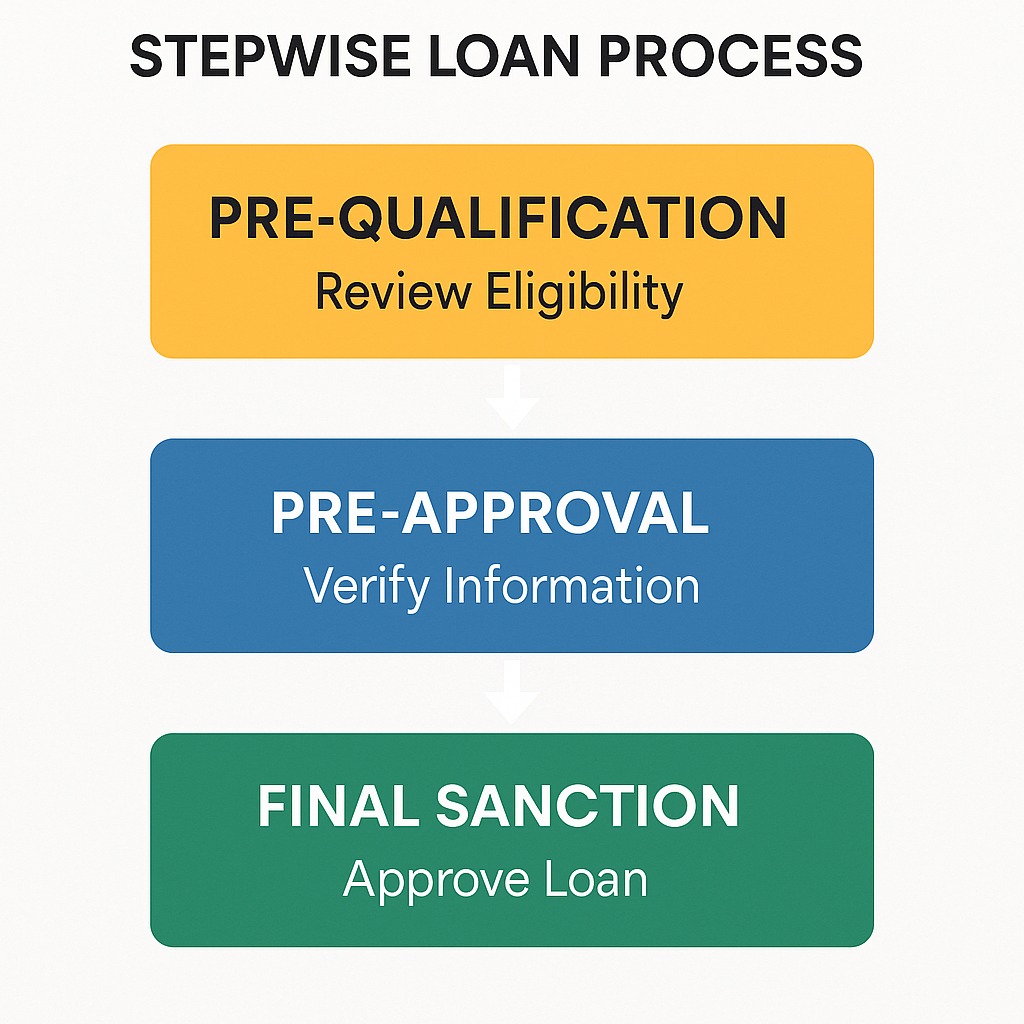

When applying for a loan — whether home loan, personal loan, vehicle loan, LAP, business loan, or education loan — you will come across terms like pre-qualification, pre-approval, and sanction. Though they sound similar, each stage represents a different level of evaluation, commitment, and certainty from the lender.

Understanding these differences helps you plan better, negotiate confidently, and avoid misunderstandings during the loan process.

What Is Loan Pre-Qualification?

Pre-qualification is the initial and informal assessment of a borrower’s eligibility based on basic self-declared information such as income, job type, age, credit score, and existing debts.

✔ Usually done via online tools, calculators, or verbal discussion

✔ No document verification required

✔ Gives an estimated eligible loan amount

📝 Purpose:

To give a rough idea of what amount you may qualify for before formally applying.

📌 Important: This is not a guarantee of loan approval.

What Is Loan Pre-Approval?

Pre-approval is a more formal verification step, where the lender evaluates borrower details using documents, credit report checks, and eligibility rules. A conditional approval letter may be issued.

✔ Documents are checked

✔ Credit bureau pull is done

✔ Risk profile is evaluated

✔ Time-bound conditional approval may be issued

📝 Purpose:

To show that you are financially credible and eligible, especially useful for home buyers, negotiations, and property shortlisting.

📌 Important: Still not final — property/legal/other conditions may be pending if applicable.

What Is Loan Sanction?

A loan sanction is the final official approval issued by the lender after completing all checks, including property/legal evaluation, KYC, income proof, risk checks, and compliance conditions.

✔ Final loan amount approved

✔ Approved interest rate & tenure

✔ Terms & conditions documented

✔ Disbursement can follow once agreement is signed

📝 Purpose:

To confirm that the lender has agreed to lend, subject to final execution.

📌 Important: After sanction, the borrower enters into loan agreement & disbursement stage.

Quick Comparison Table

| Stage | Type | Verification Level | Credit Check | Commitment Level | Output |

|---|---|---|---|---|---|

| Pre-Qualification | Informal | Low | Not always | Very Low | Estimated loan range |

| Pre-Approval | Semi-formal | Medium–High | Yes | Moderate | Conditional approval letter |

| Sanction | Final Approval | Highest | Yes | High | Sanction letter + disbursement process |

Why Understanding the Difference Matters

Avoids confusion between indicative eligibility vs commitment

Helps negotiate confidently with sellers & agents

Ensures planned budgeting and documentation readiness

Prevents last-minute rejections or delays

Helps compare lenders more effectively

❓ FAQs

Q1. Is pre-qualification necessary before applying?

No, but it helps estimate loan eligibility and avoid unrealistic expectations.

Q2. Does pre-approval guarantee final sanction?

No. It is a conditional approval, dependent on additional checks.

Q3. How long is pre-approval valid?

Typically 30 to 90 days, depending on lender.

Q4. Who benefits the most from pre-approval?

Home buyers, business borrowers, and anyone negotiating with sellers.

Q5. Can the sanctioned amount differ from pre-approved amount?

Yes, based on updated documents, property eligibility, or risk changes.

Published on : 17th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed