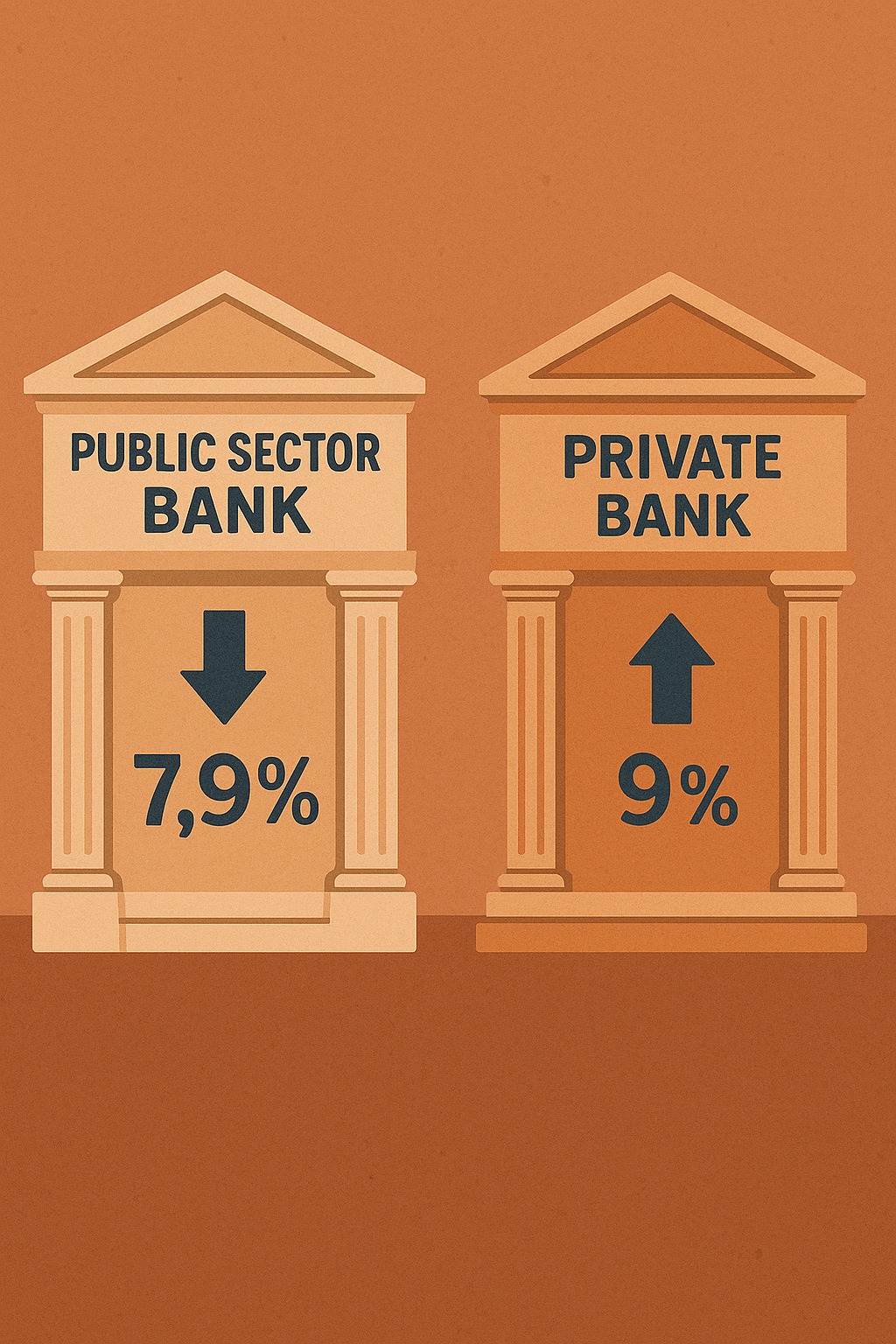

When you compare loan offers in India — for a home, car, or personal loan — you’ll often find public sector banks (PSBs) quoting slightly lower interest rates than private banks.

At first glance, this makes PSBs seem like the obvious choice.

But does a lower rate automatically mean a better loan?

Let’s break down how interest-rate gaps between public and private banks actually affect your borrowing decision.

1️⃣ Why Public Banks Often Offer Lower Rates

✅ 1. Lower Cost of Funds

Public sector banks have access to a large pool of low-cost deposits — government salaries, pensions, and fixed deposits — which lowers their funding cost.

This allows them to lend at more competitive rates.

✅ 2. Priority on Financial Inclusion

As state-backed institutions, PSBs are encouraged to support mass-market borrowers and priority sectors like housing, MSMEs, and agriculture.

They often cap margins to ensure broader access to affordable credit.

✅ 3. Government Backing Reduces Risk Premium

PSBs operate under implicit sovereign backing, lowering default risk and the extra premium that private lenders may charge.

2️⃣ Why Private Banks Charge Slightly Higher Rates

1. Higher Service and Tech Investment

Private banks spend more on digital infrastructure, customer service, and loan automation — costs that reflect in slightly higher rates.

2. Faster Processing, Flexible Products

You pay for speed and convenience. Private banks tend to process personal and home loans faster, offer doorstep service, and design flexible EMI or top-up structures.

3. Risk-Based Pricing

Private banks use dynamic pricing — adjusting rates based on your credit score, profile, and repayment capacity.

For borrowers with weaker credit, this often means higher spreads.

3️⃣ Real Impact on Borrowers

| Loan Type | Public Bank Avg. Rate (2025) | Private Bank Avg. Rate (2025) | Difference |

|---|---|---|---|

| Home Loan | 7.35% – 7.75% | 7.90% – 8.50% | ~0.50% – 1.00% |

| Personal Loan | 10.5% – 12.5% | 11.5% – 15.5% | ~1.00% – 3.00% |

| Car Loan | 8.5% – 9.5% | 9.0% – 10.75% | ~0.50% – 1.25% |

💬 Insight:

A 0.5% difference on a ₹40 lakh home loan over 20 years can mean a total saving of ₹2–3 lakh.

But — faster disbursal or smoother servicing from private banks may justify the slightly higher cost for some borrowers.

4️⃣ Beyond Rates: What Really Affects Your Loan Decision

1. Processing & Prepayment Fees

Public banks usually charge lower or no prepayment penalties on floating-rate loans, while private banks may impose small fees.

2. Transparency & Rate Transmission

When the RBI cuts repo rates, PSBs are typically faster to pass on the benefit to borrowers. Private banks, however, sometimes delay or apply it selectively.

3. Customer Experience

Private banks lead in app-based service, real-time updates, and online documentation — PSBs may require in-branch visits or manual forms.

4. Flexibility in Tenure & Top-Ups

Private lenders often offer quick top-ups or balance transfers, while PSBs may have more paperwork but better stability once approved.

5️⃣ How to Choose Between Public and Private Banks

| If You Value | Choose This Type of Bank |

|---|---|

| Lowest possible rate | ✅ Public Sector Bank |

| Fast approval and digital convenience | ✅ Private Bank |

| Long-term reliability and rate stability | ✅ Public Sector Bank |

| Flexible repayment and top-up options | ✅ Private Bank |

| Personalized customer service | ✅ Private Bank |

| Rural reach and government-linked benefits | ✅ Public Sector Bank |

💡 Tip: Always compare Effective Interest Rate (EIR) or Annual Percentage Rate (APR) — not just the advertised rate.

Final Thoughts

The public vs private bank debate isn’t about good vs bad — it’s about priorities.

If cost matters most, public banks are the better long-term bet.

If you want speed, flexibility, or premium service, private banks can be worth the extra price tag.

Smart borrowers don’t just chase low rates — they chase the right balance between price and performance.

❓ Frequently Asked Questions (FAQ)

1. Do public sector banks always offer cheaper loans than private ones?

Usually yes, but not always. Some private banks offer promotional rates that can match or beat PSBs for top credit-score borrowers.

2. Are private banks faster in approving loans?

Yes. Private banks typically process loans faster thanks to better digital systems and credit automation.

3. Does a lower rate guarantee the cheapest loan?

Not necessarily. Always check processing fees, insurance add-ons, and total cost over the tenure.

4. Can I transfer my loan from a private to a public bank?

Yes. A balance transfer is possible if interest rates differ significantly — just account for transfer fees and legal costs.

5. Are public banks safer for borrowers?

Both are safe under RBI regulation, but PSBs have sovereign backing, giving some borrowers extra confidence.

Published on : 11th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed