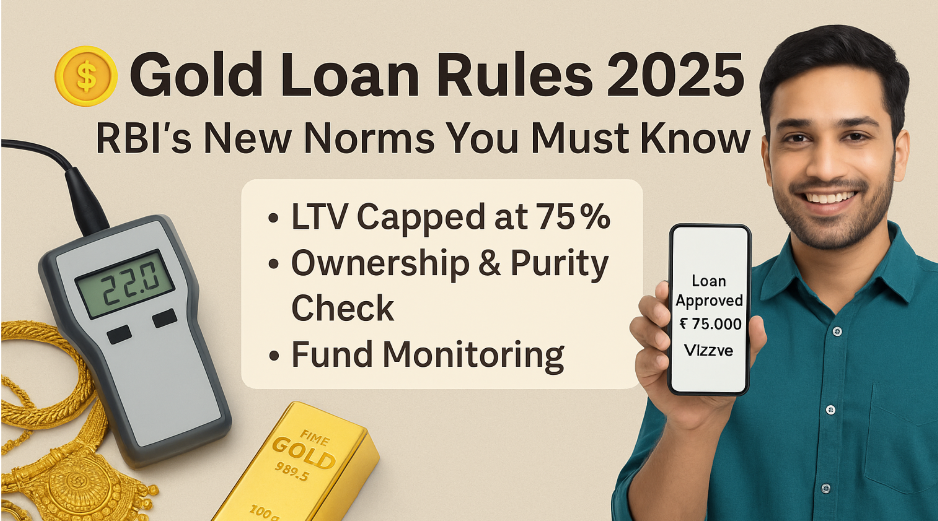

💰 RBI’s New Gold Loan Regulations 2025 – What Borrowers Must Know Before Pledging Gold

Published by: Vizzve Financial | Updated: May 2025

Apply for Gold Loan Instantly: www.vizzve.com

📌 Introduction

With gold prices soaring and demand for gold-backed loans on the rise, the Reserve Bank of India (RBI) has stepped in with stricter regulations to enhance security, transparency, and borrower protection. Whether you're a first-time borrower or someone considering refinancing your gold loan, understanding these new RBI rules is crucial.

At Vizzve Financial, we ensure all gold loans are processed in full compliance with RBI's updated norms, giving you a safe, secure, and transparent borrowing experience.

🧩 RBI’s Stricter Norms for Gold Loans – 2025 Update

✅ 1. 75% Loan-to-Value (LTV) Ratio

RBI now mandates that the maximum LTV for gold loans is capped at 75%. This means:

-

If your gold is worth ₹1,00,000, you can only get up to ₹75,000 as a loan.

-

This move reduces risk for both borrowers and lenders during gold price fluctuations.

🔐 Vizzve Advantage: We provide a real-time valuation and ensure you get maximum value under RBI norms.

✅ 2. Mandatory Gold Purity & Ownership Verification

Before disbursing a loan, lenders must:

-

Verify the purity of the gold (e.g., 22K, 24K).

-

Ensure ownership using documents or customer declaration.

This reduces fraud and strengthens legal standing in case of disputes.

💡 Vizzve Process: We conduct instant gold testing and require minimal documentation for ownership proof — hassle-free and secure.

✅ 3. End-Use Monitoring of Loan Funds

RBI has advised lenders to monitor how loan proceeds are used, especially to prevent:

-

Money laundering

-

Financing of unlawful activities

-

Unintended commercial speculation

📊 Vizzve Policy: We keep your loan intent documented, ensuring that your borrowing is for valid personal, business, or emergency needs — making compliance easy for you.

🏦 Why These Changes Matter to Borrowers

| 🛡️ Benefit | 🎯 Impact |

|---|---|

| Risk Control | Protects borrowers from over-leveraging against gold |

| Higher Trust | Builds transparency between lender and borrower |

| Legal Security | Safeguards gold in the event of loan default or fraud |

| Regulated Lending | Eliminates unauthorized or illegal gold loan schemes |