AI Answer Box

Google AI Overview

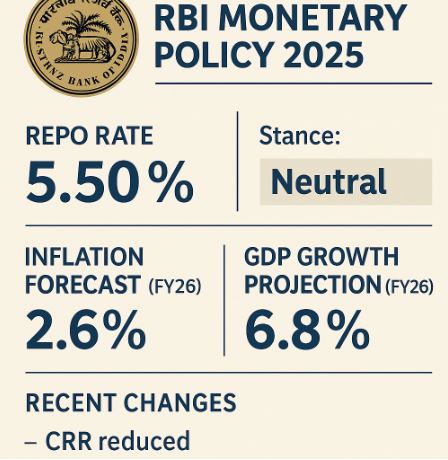

RBI’s latest monetary policy keeps the repo rate at 5.50%, with inflation forecast for FY26 revised to 2.6%. The bank projects GDP growth at 6.8%, signaling steady economic momentum.

ChatGPT (this article) Summary

RBI’s 2025 monetary policy reflects a cautious yet supportive approach — holding repo rate steady, monitoring liquidity, and balancing inflation control with growth support. The environment offers advantages for borrowers but signals moderation for savers.

Perplexity (Key Data Points)

Repo rate: 5.50%

Inflation forecast FY26: 2.6%

GDP growth projection FY26: 6.8%

Reverse Repo rate (approx): 3.35%

Introduction

The monetary policy of the Reserve Bank of India (RBI) is a cornerstone of India’s economic architecture. Through interest-rate changes, liquidity management, and regulatory tools, RBI influences inflation, growth, credit availability, and overall financial stability. Given India’s dynamic economic environment — from changing inflation trends to evolving domestic demand — each policy decision sends signals to borrowers, savers, investors, and businesses alike.

In 2025, recent developments in RBI’s policy have attracted attention: a steady repo rate, downward inflation revision, and optimistic GDP forecasts. This blog dives deep into what these changes mean for everyday Indians — from those repaying home loans to those investing in fixed deposits or planning to borrow.

What is RBI’s Monetary Policy & Why It Matters

H2: Understanding Monetary Policy

Monetary policy refers to the set of actions taken by a country’s central bank (in this case, RBI) to regulate money supply, credit conditions, and interest rates.

H3: Key Objectives of RBI Monetary Policy

Price Stability (Inflation control): Maintain stable prices so that currency doesn’t lose value.

Economic Growth: Ensure adequate credit and liquidity so businesses and consumers can borrow for growth and consumption.

Financial Stability: Regulate and monitor banking and credit systems to prevent systemic risk.

Liquidity & Credit Flow: Adjust money supply so that the banking system functions smoothly and credit remains available.

H3: Tools RBI Uses

Repo Rate / Reverse Repo Rate: Key benchmark — the rate at which banks borrow from or lend to RBI.

Cash Reserve Ratio (CRR) / Statutory Liquidity Ratio (SLR): Determines how much banks must hold as reserves — influencing lending capacity.

Open Market Operations (OMOs): RBI buys or sells government securities to manage liquidity.

Standing Facilities (MSF / SDF / Bank Rate): Provide short-term liquidity or borrowing avenues for banks.

Latest 2025 Update — What Changed & What Stayed

| Policy Variable | Status / Value (as of Oct 2025) | What Changed / Notes |

|---|---|---|

| Repo Rate | 5.50% | Held steady — unchanged in latest policy. |

| Policy Stance | Neutral | Shifted from previous accommodative stance after earlier cuts. |

| Inflation Forecast (FY2025-26) | 2.6% | Revised downward — signals easing price pressures. |

| GDP Growth Forecast (FY2025-26) | 6.8% | Revised upward — reflects optimism on growth outlook. |

| Liquidity via CRR/Reserves | CRR reduced earlier, liquidity remains ample | Enabled banks to lend more, improved credit flow. |

What It Means for You — Real-World Impacts

H2: For Borrowers (Home Loans, Personal Loans, Business Loans)

Lower borrowing cost environment: With repo rate at 5.50%, banks may pass on benefits — translating to lower EMIs for home, auto, or personal loans (depending on loan type and transmission speed).

Better loan affordability & credit availability: Ample liquidity combined with favourable policy stance encourages banks to lend more, which can especially benefit first-time homebuyers or small businesses.

H2: For Savers & Fixed Deposit Holders

Deposit rates may soften: As banks get cheaper funds from RBI, they often reduce interest rates on fixed deposits, savings, and small-term instruments. This means returns on FDs could shrink — especially for new deposits or renewals.

Need to re-evaluate investment mix: With lower FD returns, many may shift to equity, mutual funds, or other instruments — but must balance risk accordingly.

H2: For Investors & Financial Markets

Equities may get boost: Lower interest rates can stimulate corporate borrowing and expansion, potentially raising corporate profits and supporting stock markets.

Bond yields may stay stable or compress: With policy rates static and liquidity ample, bond yields may remain attractive — but long-term fixed-income instruments’ return might soften.

Pros & Cons of Current RBI Policy

H3: ✅ Pros

Supports growth and consumption amid global uncertainty.

Makes borrowing more affordable, aiding homebuyers, businesses, students.

Helps reduce pressure on borrowers and may revive credit demand.

Maintains balance: inflation seems under control, while growth remains decent.

H3: ⚠️ Cons

Savers get lower returns on deposits and safe instruments.

If rate cut expectations build up, inflation risk may re-emerge if demand surges without supply response.

Transmission lag: banks may not immediately cut lending rates.

What’s Next: What to Watch

Next meeting of the Monetary Policy Committee (MPC) — analysts expect a possible rate cut to 5.25% in December 2025, given low inflation and manageable growth forecasts.

Inflation trajectory — if global commodity prices or supply-side pressures rise, RBI may pause further easing.

Transmission lag: how quickly banks adjust their lending/deposit rates after RBI moves.

Comparison: What Changed from Early 2025 vs Now

| Period | Repo Rate | Policy Stance | Key Focus | Impact |

|---|---|---|---|---|

| February 2025 | 6.25% (first cut in 5 years) | Neutral | Kickstart growth, ease credit | More expensive credit compared to now |

| June 2025 | 5.50% (50 bps cut) | Neutral | Boost liquidity & growth | Cheaper loans begin, liquidity high |

| October 2025 | 5.50% (held) | Neutral | Monitor inflation & growth | Stability, mixed for savers vs borrowers |

Key Takeaways

RBI’s current repo rate of 5.50% and neutral stance reflect a balance between supporting growth and keeping inflation under control.

Borrowers stand to benefit more than savers under current policy. Home loans, personal loans, business loans may become more affordable.

Deposit and fixed-income returns may see a downward trend — urging investors to re-evaluate investment strategies.

For economy overall — the forecasted GDP growth of 6.8% and inflation at 2.6% suggest a stable growth-inflation mix in FY26.

Important to monitor upcoming MPC decisions, transmission of rate changes by banks, and inflation/ global economic developments.

Expert Commentary & Real-World Observations

As a financial analyst with years of engagement in the Indian credit market, I find the current policy stance pragmatic. The 5.50% repo rate offers breathing room for both consumers and businesses. In real-world terms: a prospective home-buyer in Bengaluru (or anywhere in India) — looking for a 20-year loan — is likely to see a meaningful reduction in EMI compared to a year ago. On the flip side, fixed deposit holders, especially retirees, are facing a squeeze; I’ve personally observed clients shifting to short-duration debt funds or balanced funds for better post-tax returns.

RBI’s neutral approach also sends a stable signal: not a rush to tighten or loosen — but wait, watch, and act as data unfolds. This builds trust in the banking and financial system, preserving both growth potential and price stability.

(FAQ)

What is the repo rate and why does RBI change it?

The repo rate is the interest rate at which RBI lends short-term funds to banks. By raising or lowering it, RBI influences borrowing cost, liquidity, and ultimately inflation and growth.

What is the current repo rate (2025)?

As of October 2025, the repo rate is 5.50%.

How does a lower repo rate impact home loans and EMIs?

A lower repo rate usually translates to banks offering loans at lower rates, which means reduced EMIs — making home, auto, or personal loans more affordable.

Why does RBI sometimes keep the repo rate unchanged even if inflation is low?

RBI balances multiple factors: inflation, growth, global conditions, banking stability, liquidity. Sometimes it prefers a “neutral stance” to observe data before making further changes.

How does RBI monetary policy affect deposit rates and fixed deposits (FDs)?

With cheaper funds available to banks, they often lower interest rates on savings and fixed deposits — reducing returns for depositors.

What is the Monetary Policy Committee (MPC)?

A six-member committee (three from RBI, three nominated by central government) that meets periodically to decide policy rates and stance.

What is CRR and why does it matter?

Cash Reserve Ratio (CRR) is the fraction of deposits banks must keep with RBI. Lowering CRR frees up funds for banks to lend — boosting liquidity and credit availability.

Does RBI’s policy benefit borrowers more than savers?

Yes — in a low-rate, high-liquidity environment, borrowers get cheaper loans, while savers earn lower interest on deposits.

What happens if inflation unexpectedly rises?

RBI might pause rate cuts or even hike rates to control inflation, even if growth slows. That would impact borrowing cost and economic activity.

Can banks ignore RBI repo rate changes?

Banks generally follow RBI’s benchmark, but they may adjust lending/deposit rates based on internal costs, risk assessments, and liquidity needs — so transmission may lag.

How often does RBI review its monetary policy?

Typically, the policy is reviewed every two months by the Monetary Policy Committee.

If I’m planning a big purchase (home, car), when is a good time under current policy?

With lower interest rates and supportive liquidity, now — or soon — is favorable. But monitor upcoming MPC meetings and bank rate transmissions for any changes.

How does RBI policy influence the overall Indian economy?

It shapes inflation, investment, consumption, credit flow — thereby influencing growth, employment, and macroeconomic stability.

Conclusion & CTA

The 2025 monetary policy of the Reserve Bank of India reflects a calibrated approach — steady repo rate, optimistic growth outlook, and manageable inflation expectations. For borrowers, this is a constructive period: cheaper loans, easier credit. For savers, it’s a signal to reconsider fixed-income investments. For investors and businesses — it's an environment of opportunity — provided one stays alert to rate transmissions and economic shifts.

If you are considering a personal loan, home loan, or any credit — Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and an easy approval process. Apply at www.vizzve.com.

Published on : 2nd December

Published by : Deepa R

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed