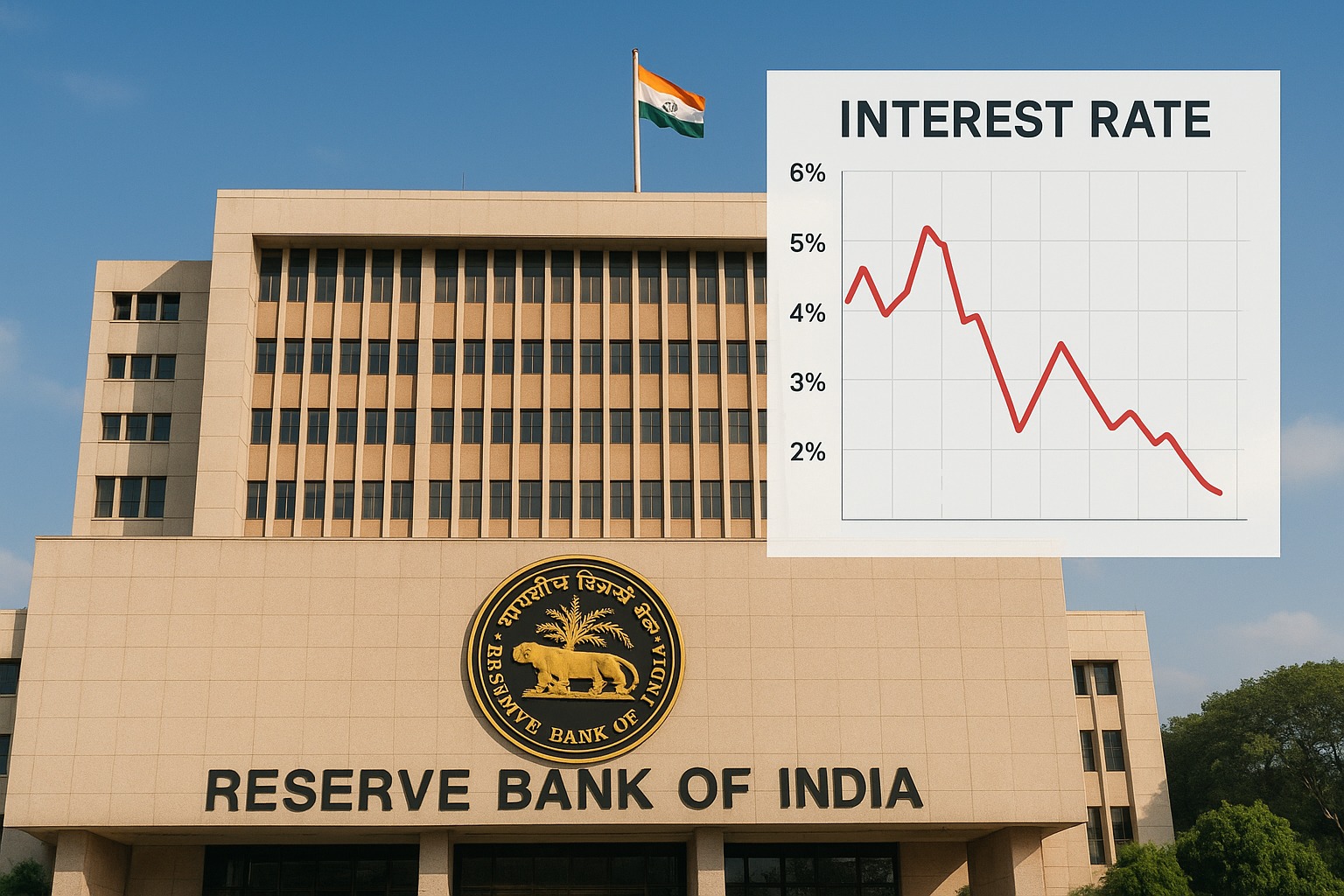

The Reserve Bank of India (RBI) is gearing up for its next monetary policy review, and all eyes are on whether the central bank will hold the repo rate steady at 5.50%. For borrowers, savers, and investors, this decision is more than just a number—it directly affects EMIs, deposit rates, and market sentiment.

What Is the Repo Rate?

The repo rate is the interest rate at which RBI lends short-term funds to commercial banks. It’s a critical tool for controlling inflation and ensuring liquidity in the economy.

Higher repo rate → Loans costlier, inflation controlled.

Lower repo rate → Cheaper loans, growth stimulus.

Currently, the rate stands at 5.50%, a level last seen before the recent inflation spikes.

Why RBI Might Hold the Rate at 5.50%

Inflation Moderating: Retail inflation is easing but remains within RBI’s comfort zone.

Global Cues: Other central banks are also pausing rate hikes.

Growth Considerations: Stable rates support industrial activity and consumer spending.

Fiscal Policy Alignment: Government focusing on capital expenditure; RBI avoids disrupting momentum.

Impact on You: Borrowers

Home Loans & EMIs: If the rate holds, your EMIs will remain stable—a relief for new and existing borrowers.

Personal & Auto Loans: No immediate spike in lending rates from banks.

Future Borrowing: Stable rates improve credit planning for big-ticket purchases.

Impact on You: Savers & Investors

Fixed Deposits (FDs): Banks may not raise deposit rates further, so lock in at current rates.

Mutual Funds: Debt funds likely to see steady returns; equity markets may react positively to policy stability.

Stock Market: A pause often signals confidence in growth, which can boost investor sentiment.

What to Watch Out For

Inflation Data: A sudden uptick could force RBI to resume hikes later.

Global Oil Prices: Higher crude costs can feed inflation.

US Fed Policy: Divergence could impact currency flows and rupee value.

Conclusion

If the RBI holds the repo rate at 5.50%, it signals a cautious yet supportive stance for growth. For consumers, it means stable EMIs, steady deposit returns, and a relatively predictable financial environment. Staying informed about future policy reviews can help you plan loans, investments, and savings better.

FAQs

Q1. What is the current repo rate in India?

It stands at 5.50%, pending the RBI’s next policy announcement.

Q2. How does the repo rate affect my EMIs?

Banks adjust lending rates based on the repo rate. If it holds steady, EMIs don’t increase.

Q3. Will deposit rates rise if the repo rate is unchanged?

Not immediately. Banks usually adjust deposit rates after policy changes.

Q4. Is this a good time to take a home loan?

Yes, a stable repo rate creates a favorable borrowing environment.

Q5. How does it impact the stock market?

Markets generally respond positively to policy stability as it signals confidence in growth.

Published on : 25th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share