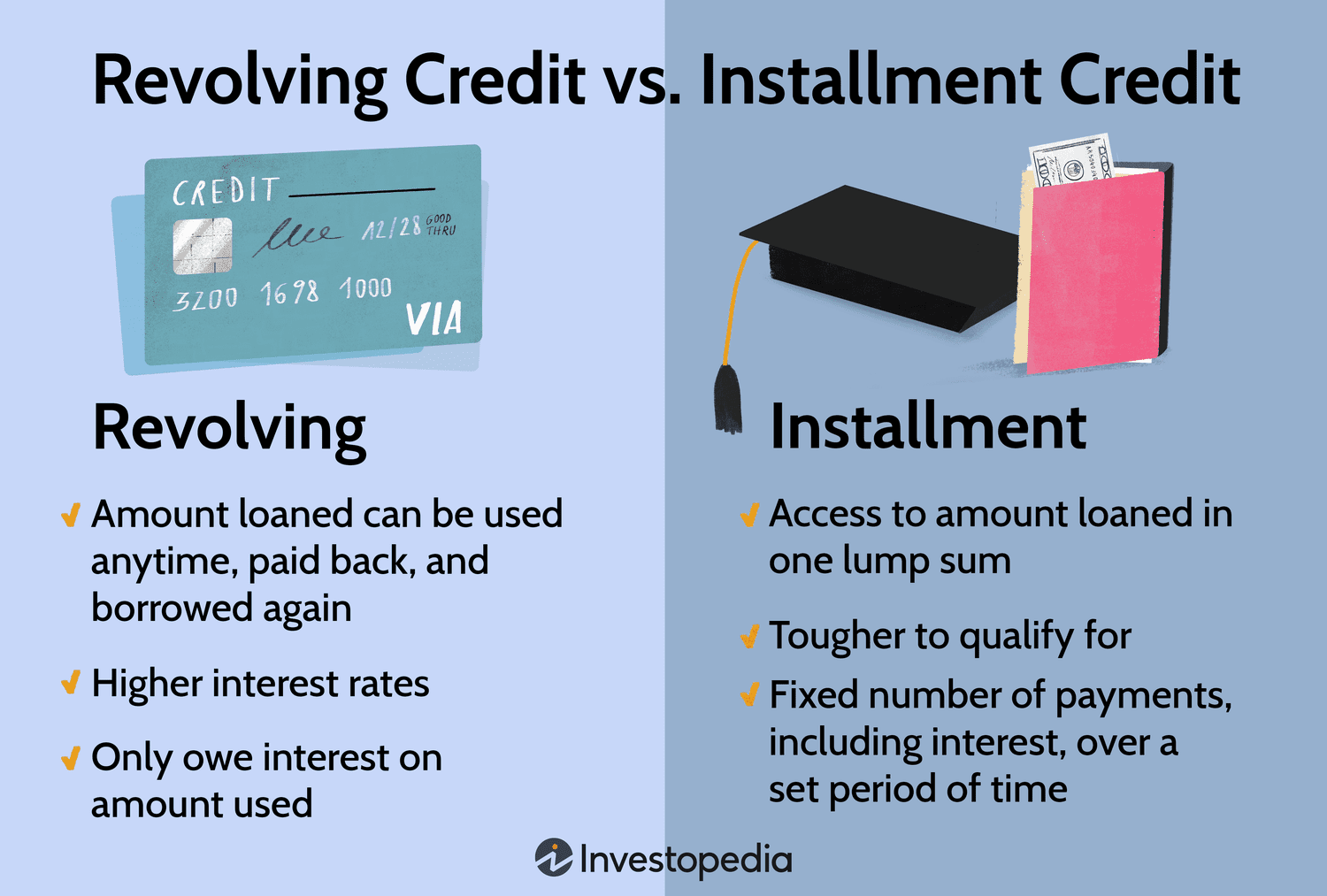

Revolving Debt vs. Installment Loans

When choosing between borrowing options, understanding the differences between revolving debt and installment loans is crucial for effective financial management.

What Is Revolving Debt?

Revolving debt provides a line of credit with a set limit that borrowers can use repeatedly up to the credit limit. The most common example is a credit card. Borrowers can carry a balance from month to month by paying at least a minimum amount, thereby revolving the debt.

Flexibility: Borrowers can borrow, repay, and borrow again within the credit limit.

Variable Interest Rates: Interest rates can fluctuate depending on market conditions.

No Set Repayment Date: Payments continue as long as there's an outstanding balance.

Interest Charged Only on Used Amount: Interest accrues only on the utilized credit balance, not the entire limit.

What Are Installment Loans?

Installment loans provide a lump sum upfront that borrowers repay in fixed monthly payments over a predefined term until fully paid off. Common examples include mortgages, auto loans,

personal loans, and student loans.

Fixed Payments: Equal monthly installments, making budgeting easier.

Fixed Interest Rates: Usually constant over the loan term.

Defined Loan Term: The loan closes once fully repaid.

Typical Approval Process: Includes credit checks and set repayment schedules.

Pros and Cons Revolving Debt

Pros:

Flexible borrowing and repayment

Access to credit anytime up to limit

Useful for emergencies and short-term needs

Cons:

Higher interest rates

Risk of accumulating debt due to revolving balance

Variable payments complicate budgeting

Installment Loans

Pros:

Predictable payments and interest

Lower interest rates relative to revolving credit

Can help establish credit history with consistent repayments

Cons:

Not flexible—once borrowed, funds are fixed

May require more extensive approval

Prepayment penalties possible in some cases

Which Should You Choose?

our choice depends on your financial goals and spending habits:

Choose revolving debt if you want flexible borrowing and can manage payments responsibly.

Choose installment loans if you need a lump sum with stable, predictable repayment terms and lower interest rates.

Frequently Asked Questions

What types of debt are classified as revolving?

Credit cards and lines of credit are the most common revolving debts, allowing repeated borrowing up to a credit limit.

Are installment loans better for budgeting?

Yes, because they have fixed monthly payments and a set repayment term for easier financial planning.

Can revolving credit affect my credit score?

Yes, especially your credit utilization ratio, which is a key factor in credit scoring.

Do installment loans have variable interest rates?

Typically, installment loans feature fixed interest rates, offering payment stability.

Is it easier to get approved for revolving credit or installment loans?

Revolving credit can be easier to get because credit limits are often based on your creditworthiness without a large lump sum disbursal, while installment loans involve more documentation and credit checks.

Can I pay off installment loans early?

Yes, but some lenders may charge prepayment penalties depending on the loan terms.

Published on: July 24, 2025

Published by: PAVAN

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed