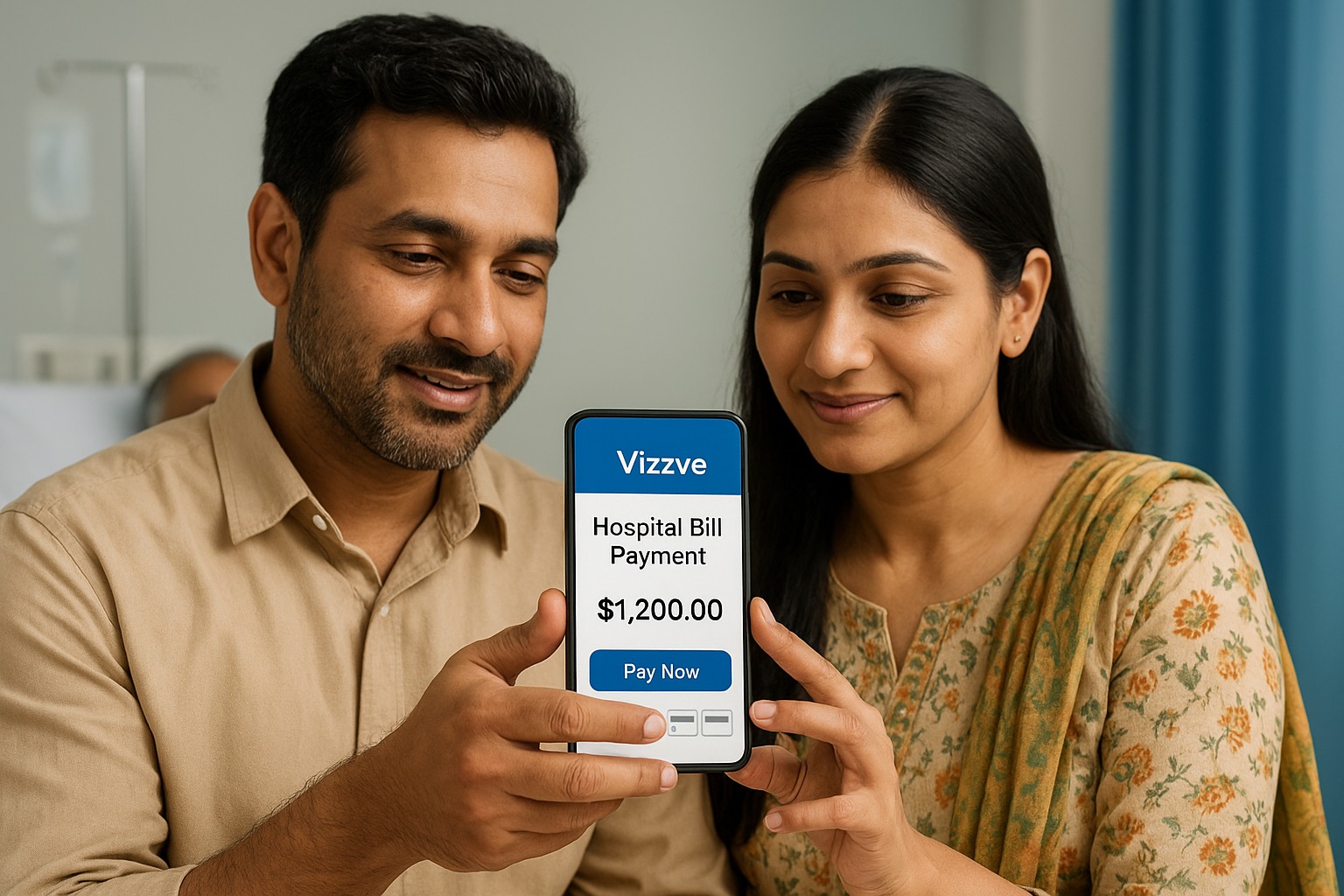

Healthcare costs in India are rising at a rapid pace, and unexpected medical emergencies can put immense financial pressure on families. While health insurance provides some relief, it often does not cover all expenses, leaving a gap. This is where medical loans or instant health financing solutions have emerged as a lifeline. Fintech players like Vizzve Finance are making access to quick medical loans easier, faster, and more affordable for patients and their families.

Why Medical Financing is Growing in India

1. Rising Healthcare Costs

Private hospital treatments, surgeries, and ICU charges are expensive.

Even with insurance, out-of-pocket expenses like medicines, diagnostic tests, and post-care costs remain high.

2. Low Insurance Penetration

Less than 40% of Indians are adequately insured.

Many policies have limitations such as waiting periods or disease exclusions.

3. Immediate Need for Funds

Health emergencies don’t wait for loan approvals.

Instant medical loans provide same-day disbursement, helping families avoid treatment delays.

4. Growth of Fintech Solutions

Platforms like Vizzve Finance leverage digital KYC, instant credit checks, and mobile-first applications.

This makes borrowing for emergencies quicker than traditional banks.

How Medical Loans Work

Loan Amounts: Typically range from ₹20,000 to ₹10 lakhs.

Eligibility: Salaried and self-employed individuals with a steady income.

Tenure: Flexible repayment plans from 6 months to 5 years.

Approval Speed: Instant to 24 hours via digital lenders like Vizzve.

Collateral: Most medical loans are unsecured (no collateral needed).

Advantages of Medical Loans

✅ Quick Access to Funds – Avoid treatment delays.

✅ No Collateral Required – Most are unsecured loans.

✅ Flexible Repayment – EMIs suited to your income.

✅ Covers Beyond Insurance – Medicines, tests, post-surgery care.

✅ Digital Convenience – Apply via apps like Vizzve Finance in minutes.

Things to Keep in Mind Before Taking a Medical Loan

Compare interest rates and processing fees.

Ensure affordable EMIs based on your income.

Check hidden charges like prepayment penalties.

Borrow only the required amount to avoid long-term debt.

Conclusion

With India’s rising healthcare costs and limited insurance penetration, medical loans are becoming a crucial financial tool. Platforms like Vizzve Finance are making it easier for families to secure funds instantly during emergencies. While borrowing can be a lifesaver, it’s important to plan repayment wisely and use these loans responsibly.

FAQs

1. Are medical loans different from personal loans?

Yes. While technically a type of personal loan, medical loans are tailored for healthcare needs with faster approvals and flexible repayment options.

2. Can I get a medical loan without health insurance?

Absolutely. Medical loans are independent of insurance and can cover expenses not included in your policy.

3. How fast can I get a medical loan?

With digital lenders like Vizzve Finance, funds can be disbursed within a few hours.

4. Is collateral needed for medical loans?

No, most medical loans are unsecured.

5. What if I miss my EMI?

Missing EMIs can affect your credit score. Always plan repayment before borrowing.

Published on : 25th August

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share