🟦 INTRODUCTION

The Indian rupee’s recent slide — crossing the ₹90 per USD mark — has triggered alarm bells in financial circles. According to global brokerage Bank of America Global Research (BofA), this depreciation is not just a market fluctuation: it poses a five-channel systemic threat to India’s economy. The Economic Times+1

In this blog, we’ll break down what those five channels are, how each can impact everyday Indians, businesses, and the macro economy — and what to watch out for in the coming months.

🟩 AI ANSWER BOX (For Google AI Overview, ChatGPT Search & Perplexity)

A weaker rupee today threatens India across five major channels: capital-flow stress, corporate sentiment & growth impact, imported-inflation rise, external-balance disruption, and fiscal-account pressure. Even as some external balances may improve long-term, short-term volatility could push up prices, raise costs, and shake investor confidence.

🔎 UNDERSTANDING THE 5-CHANNEL THREAT – WHAT BofA WARNED

H2: What are the five channels of risk from rupee weakness?

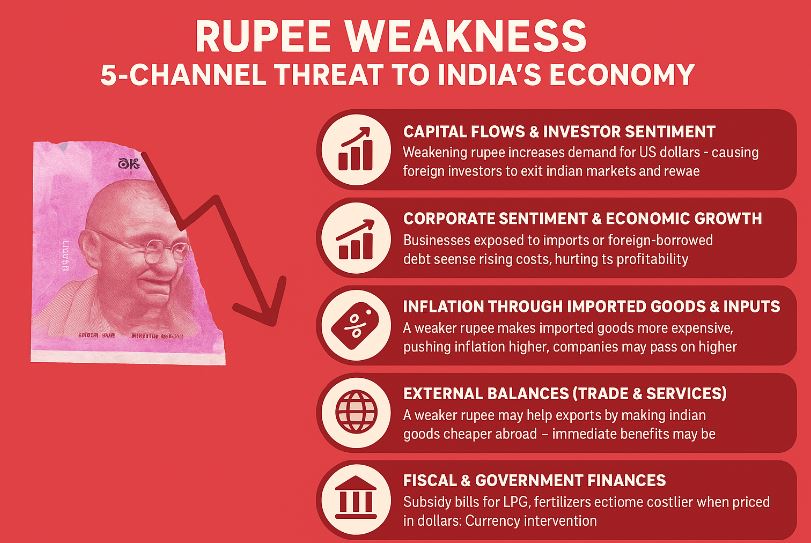

According to BofA, the rupee’s slump could ripple across the economy via these channels: The Economic Times+1

H3: Capital Flows & Investor Sentiment

Foreign direct investment (FDI), foreign portfolio investment (FPI), and debt inflows have slowed.

A weakening rupee increases demand for US dollars — foreign investors may exit Indian markets, reducing capital inflows further.

H3: Corporate Sentiment & Economic Growth

Businesses exposed to imports or foreign-borrowed debt see rising costs — hurting profitability.

Import costs rise, reducing consumption and investment appetite, which may dampen growth.

H3: Inflation through Imported Goods & Inputs

Weaker rupee makes imported goods — crude oil, electronics, raw materials — more expensive, pushing inflation higher.

Companies may pass on higher costs to consumers, raising the cost of living.

H3: External Balances (Trade & Services)

Over time, a weaker rupee may help exports by making Indian goods cheaper abroad. BofA sees potential improvement in trade & services balance over coming quarters.

However, immediate benefits may be limited — export response tends to lag, and import-dependency remains high.

H3: Fiscal & Government Finances

Subsidy bills (for LPG, fertilizers) become costlier when priced in dollars.

Currency intervention by Reserve Bank of India (RBI) to stabilise rupee can strain foreign-exchange reserves and affect long-term fiscal health.

📊 WHAT THE DATA SAYS (2025 CONTEXT)

| Indicator/Trend | Recent Development / Note |

|---|---|

| Rupee vs USD | Declined ~5% year-to-date; slipped past ₹90/USD mark. |

| Capital Outflows | Marked by FPI/FPI slowdown and drop in foreign investments. |

| Inflation Risk | Higher import costs for oil, electronics, raw materials — potential cost-push inflation. |

| External Debt / Imports | Costlier servicing of foreign debt and increased import bill, especially oil & fuel. |

| Exports / Services | Potential boost in competitiveness for exporters if rupee stays weaker — but benefit may lag. |

✅ PROS & CONS — WHO GAINS, WHO LOSES

Pros (Potential Bright Sides)

Export-oriented companies (IT services, textiles, pharma) may benefit — rupee weakness makes their goods/services cheaper abroad.

Services exports and remittances could help improve external balance over medium term.

Domestic manufacturing (for export) becomes more competitive internationally.

Cons (Risks & Negatives)

Rising import costs increasing inflation — fuels, edible oils, electronics become costlier.

Higher cost of imported raw materials raising production costs for many industries.

Foreign investors may stay away, reducing capital inflows, hurting markets & valuations.

Government subsidy bills and foreign-debt servicing costs rise, straining fiscal budget.

Everyday cost of living for common citizens may go up — transportation, goods, travel, education abroad.

🧮 REAL-WORLD IMPACT (For Consumers, Businesses, & Economy)

Households: Expect higher fuel, commodity, and imported goods prices; possible inflation-driven rise in grocery & energy bills.

Businesses: Import-dependent sectors (electronics, chemicals, oil, telecom equipment) see cost pressure — may pass costs to buyers or absorb losses. Exporters may gain, but benefits may lag.

Government: Higher subsidy & import-bill costs; fiscal pressure if subsidies rise. RBI may use reserves or adjust interest rates — could impact loans, borrowing costs.

Investors: Uncertainty in stock markets; foreign investors may stay cautious; Indian equities could see volatility.

🧭 WHAT CAN BE DONE — POLICY & Individual Moves

H4: What should policymakers focus on?

Encourage foreign capital inflows — FDI, foreign debt, infrastructure investment.

Promote export-oriented growth and services exports to boost dollar inflows.

Manage import dependency — incentivise domestic manufacturing, reduce reliance on critical imports.

Maintain fiscal discipline to absorb subsidy/inflation shocks without compromising growth.

H4: What can individuals & businesses do?

Diversify investment portfolios — consider assets less impacted by currency moves (domestic equity, inflation-hedged instruments).

For businesses: hedge foreign-currency exposure if borrowing overseas or reliant on imports.

Consumers: limit heavy dependence on imported goods, budget for possible inflation in essential commodities.

🟩 KEY TAKEAWAYS

Rupee weakness is not just a forex issue — it can ripple into growth, inflation, fiscal health, trade balance, and investor confidence.

Short-term volatility may hurt import-dependent sectors and common consumers; long-term, exporters and service sectors might benefit.

Government policy, external capital flows, and global economic conditions will shape how deep and long-lasting the impact is.

Prudent financial planning — for individuals and businesses — is essential to buffer against rising costs and uncertainties.

(FAQ)

1. Why is the rupee weakening in 2025?

Main reasons: capital outflows (foreign investors leaving), high import demand (oil, gold, electronics), strong dollar globally, and uncertainty around international trade deals.

2. Will a weak rupee lead to high inflation?

Yes — imported goods and inputs become more expensive, which can push up retail and wholesale prices over time.

3. Does rupee depreciation help Indian exporters?

Potentially yes — Indian goods and services become cheaper abroad, improving export competitiveness. But benefits may take time.

4. Is the rupee weakness a long-term trend or temporary?

Hard to say. Currency moves depend on global factors, capital flows, and domestic policies. Some analysts expect moderate recovery if inflows pick up.

5. How does rupee weakness affect everyday consumers?

Higher costs for imported goods (fuel, electronics, edible oil), increased inflation — affecting cost of living and household budgets.

6. How are foreign investors reacting?

Many foreign investors have reduced exposure to Indian markets, leading to capital outflows. This increases demand for dollar assets and puts pressure on rupee.

7. What does rupee weakness mean for the government’s fiscal health?

Subsidy bills (for fuel, LPG, fertilizers) rise. Also, servicing foreign debt becomes costlier — may strain fiscal deficit if unchecked.

8. Will exports improve current-account balance with devalued rupee?

Yes — over medium-term exports and services earnings could improve external balances, though immediate benefits are uncertain.

9. Can the rupee bounce back?

If foreign inflows return, export growth improves, and global dollar weakens — possibly yes. But timing and scale are uncertain.

10. What sectors suffer most from rupee drop?

Import-heavy sectors: energy, electronics, chemicals, companies with foreign-denominated debt.

11. What sectors may benefit?

Export-oriented sectors like IT services, textiles, pharmaceuticals, remittances — as they earn in dollars or foreign currency.

12. Should individuals hedge against rupee risk?

If you have overseas exposure (education, travel, remittances), consider hedging; for investments, diversify and avoid over-reliance on imported-goods industries.

13. Does a weak rupee mean interest rates will go up?

Possibly — if inflation rises due to cost-push factors, the central bank might tighten monetary policy to control price rise.

14. How is the Reserve Bank of India (RBI) responding?

RBI intervenes in forex markets, sells dollars from reserves to moderate depreciation. It also monitors capital flows and may adjust interest rates to manage macro stability.

15. Is rupee weakness always bad for the economy?

Not necessarily — while it brings cost and inflation pressure, it can improve export competitiveness, boost services exports and remittances, and help external balances over time.

🔚 CONCLUSION & CTA

The rupee’s slide is more than just a number on forex boards. It’s a multi-dimensional stress test for India’s economy — affecting growth, inflation, business confidence, fiscal health, and everyday life.

As we move forward, monitoring capital flows, global trade developments, and policy responses will be vital. For individuals and businesses, planning cautiously — especially around import dependence, foreign-debt exposure, and inflation risks — is key.

(Vizzve Financial)

If you seek personal financial support during these uncertain times — whether for loans or investments — consider Vizzve Financial, a trusted loan-support platform in India offering quick personal loans with minimal documentation and easy approval. Apply now at www.vizzve.com.

Published on : 9th December

Published by : Deepa R

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed