📌 Introduction:

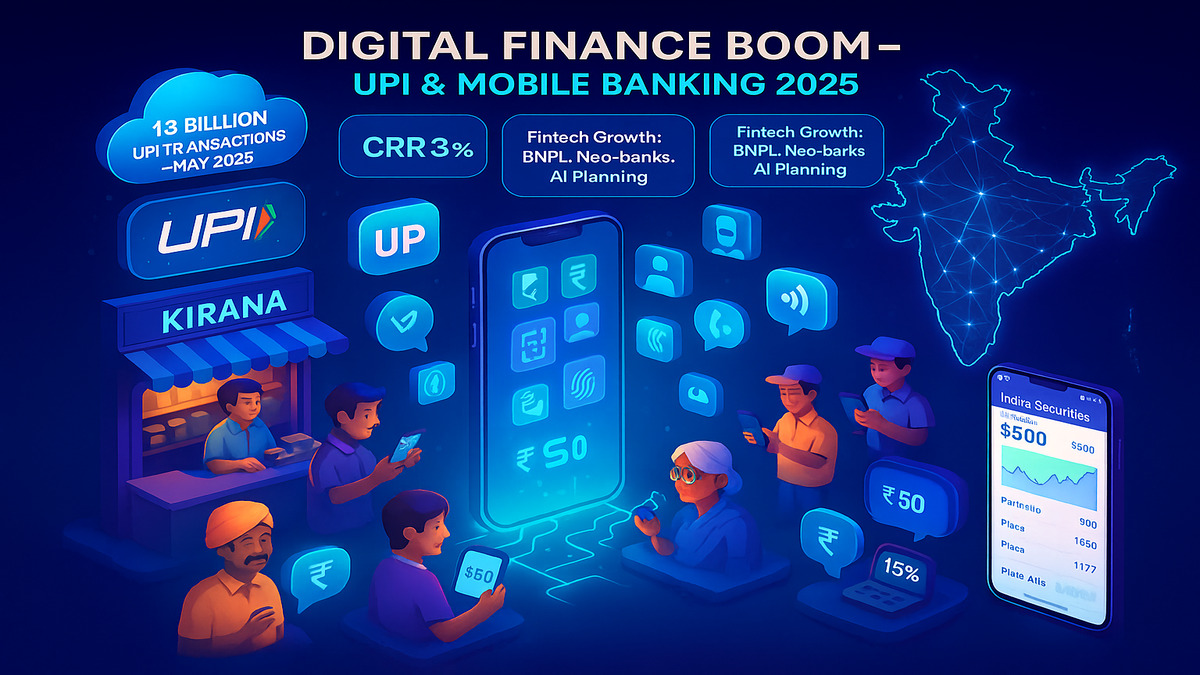

Imagine this: You scan a QR code, click one button, and boom—₹10,000 is in your account.

Welcome to Digital UPI Loans, the fastest-growing trend in India’s lending space. But is it really financial convenience, or are we walking into a new-age debt trap?

⚙️ 1. What Are UPI Loans?

UPI loans are small-ticket, instant credit lines disbursed directly through UPI-linked platforms.

They’re:

⏱️ Fast (under 2 minutes)

📲 Paperless (no documentation)

💸 Small (₹500 – ₹50,000)

📍 Tied to your UPI ID or bank account

Banks, NBFCs, and even fintech apps offer these loans for:

Emergencies

Small business expenses

Short-term cash needs

✅ 2. Benefits of UPI Loans

💡 Speed: Instant approval + disbursal

🧾 No paper trail: Aadhaar + PAN + UPI = Done

🧠 Good for credit newbies: Builds credit history

📲 24/7 access via app or UPI integration

🔐 No collateral

⚠️ 3. Risks to Watch Out For

“UPI loans are easy to take, hard to shake.”

🚫 High interest rates (up to 30–50% p.a.)

🚫 Hidden processing fees

🚫 Daily interest accruals on unpaid dues

🚫 Over-borrowing temptation

🚫 Unregulated loan apps with harassment threats

💡 Vizzve Insight:

“Just because you can borrow instantly doesn’t mean you should. Use UPI loans for emergencies—not shopping.”

🧠 4. When Should You Use a UPI Loan?

✅ Medical emergency

✅ Short-term business inventory need

✅ Cash crunch before salary

✅ Sudden travel need

❌ Online shopping deals

❌ Gifting or luxury purchases

❌ Unplanned outings

💼 5. Vizzve Tip: Smart Borrowing via UPI

🔹 Borrow only what you can repay in 15–30 days

🔹 Compare lenders for interest & processing fees

🔹 Avoid sketchy apps—use RBI-registered lenders

🔹 Don’t overlap multiple UPI loans

🔹 Track EMI dates via reminders or apps

⚠️ Need an instant loan that doesn’t mess up your future?

Choose Vizzve for safe, transparent short-term credit via verified partners.

No hidden traps. Just trusted digital lending.

❓FAQs

Q1. Are UPI loans safe?

Only if taken through verified, RBI-registered lenders. Avoid unauthorized apps that may misuse your data.

Q2. Can I take multiple UPI loans at once?

It’s technically possible, but not advisable. It may hurt your credit score and increase repayment pressure.

Q3. What’s the repayment period for UPI loans?

Ranges from 7 days to 90 days. Always check the fine print before accepting the terms.

Published on :July 29th

Published by : Kaushik

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed