When financial needs arise—be it medical emergencies, education, home repair, or festivals—you’re often faced with a key decision:

Should you choose an employee loan or a personal loan?

While both options provide quick cash, there are some important differences. Let’s break down the pros and cons to help you decide what works best in 2025—with the support of Vizzve Finance.

What is an Employee Loan?

An employee loan is a loan designed specifically for salaried individuals, either provided directly by the employer or in partnership with financial institutions like Vizzve Finance.

Common Features:

Lower interest rates or interest-free

Short to medium repayment period (3 to 24 months)

Often requires employer involvement (not with Vizzve)

No collateral required

What is a Personal Loan?

A personal loan is a general-purpose unsecured loan available to anyone with a good credit score and income proof. It can be taken from banks, NBFCs, or fintech lenders like Vizzve.

Common Features:

Higher loan limits (₹5 lakh or more)

Tenure up to 60 months

Can be availed by both salaried and self-employed

Interest rates vary based on credit score and lender

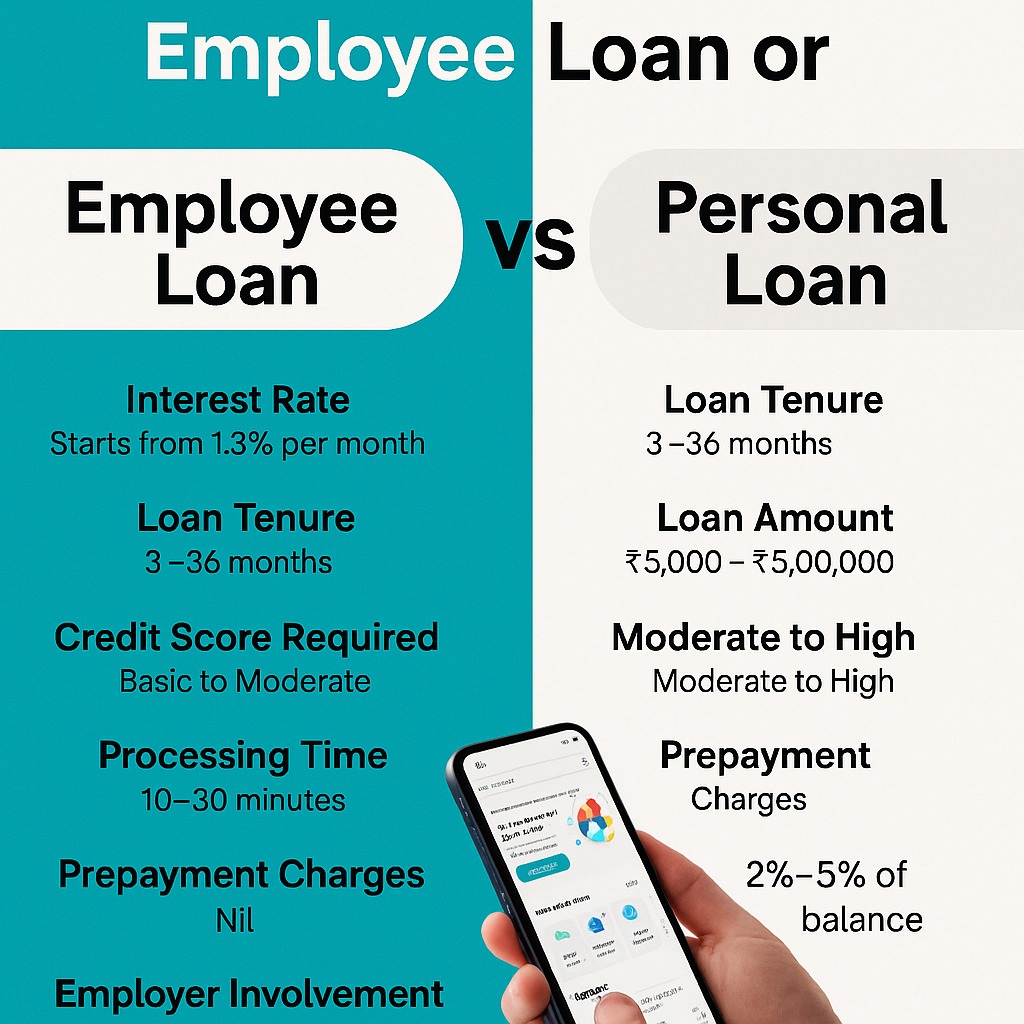

Employee Loan vs. Personal Loan: A Quick Comparison

| Feature | Employee Loan (Vizzve) | Personal Loan (Bank/NBFC) |

|---|---|---|

| Interest Rate | Starts from 1.3% per month | 10% – 24% annually |

| Loan Tenure | 3 – 36 months | 6 – 60 months |

| Loan Amount | ₹5,000 – ₹5,00,000 | ₹25,000 – ₹25,00,000 |

| Credit Score Required | Basic to Moderate | Moderate to High |

| Processing Time | 10–30 minutes (Vizzve) | 1–5 working days |

| Prepayment Charges | Nil (Vizzve) | 2–5% of balance |

| Employer Involvement | Not required with Vizzve | Not required |

| Tax Benefit | No | No |

✅ When to Choose an Employee Loan

You need fast approval and disbursal

You are salaried and meet basic income criteria

You want minimal paperwork

You’re looking for short-term funding with low interest

You prefer digital, app-based application via Vizzve

✅ When to Go for a Personal Loan

You are self-employed or outside formal employment

You require higher loan amounts (₹5–25 lakhs)

You want longer repayment tenure (up to 5 years)

You have a high credit score and can negotiate interest

You need funds for big-ticket expenses like home renovation or wedding

Smart Tip from Vizzve:

💡 Combine options wisely: Take an employee loan for small urgent needs and reserve personal loans for larger financial goals.

FAQs – Employee Loan vs. Personal Loan

1. Is an employee loan easier to get than a personal loan?

Yes. With Vizzve, employee loans are faster and require minimal documentation.

2. Can I take both loans at once?

Yes, if you meet the eligibility and repayment capacity for both.

3. Will both types impact my credit score?

Yes. Timely repayments of either loan will help improve your credit score.

4. Which loan is better for quick emergency funds?

An employee loan via Vizzve is best for urgent needs due to faster approval.

5. Can I pre-close these loans anytime?

Yes. Vizzve charges zero prepayment fees, unlike many personal loan providers

Published on : 25th July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed