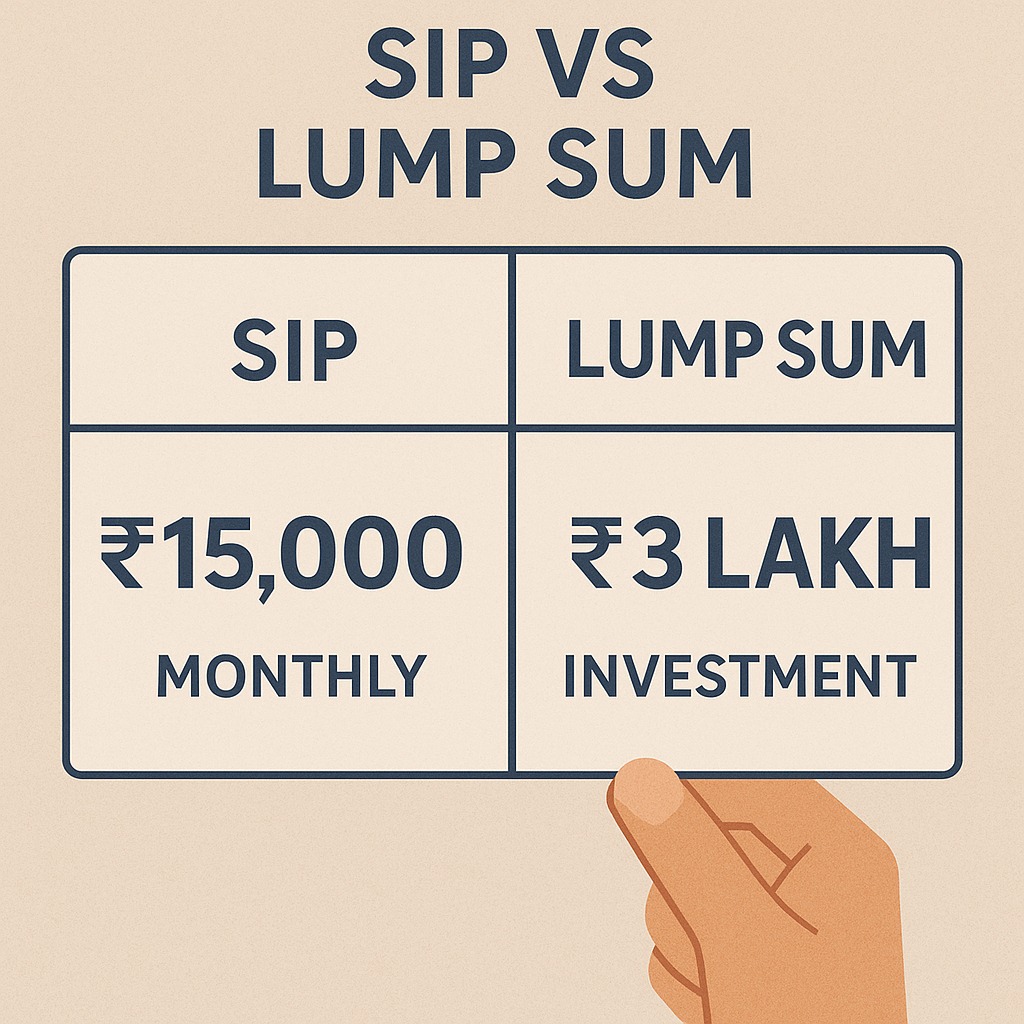

Building a ₹1 crore investment corpus is a major milestone for many Indian investors. The most common dilemma is whether to invest through a monthly SIP or put down a one-time lump sum. A recent analysis explores how fast each method can help an investor reach the ₹1 crore mark — assuming similar long-term market returns.

Here’s a breakdown of how these two strategies perform and which one helps you achieve your goal sooner.

Option 1: ₹15,000 Monthly SIP

A Systematic Investment Plan (SIP) helps you invest gradually over time. It benefits from:

Rupee-cost averaging

Market volatility smoothing

Discipline and consistency

If you invest ₹15,000 every month, your total yearly investment becomes ₹1.8 lakh.

Assuming an expected return of 12% per annum, a common benchmark for equity mutual funds:

You can reach ₹1 crore in approximately 22–24 years

SIPs take time, but they offer stability and allow investors to start even with small amounts.

Option 2: ₹3 Lakh Lump Sum

A lump-sum investment means you invest the entire amount at once and let it grow.

If you invest ₹3,00,000 upfront at an estimated 12% annual return:

It grows to ₹1 crore in approximately 30 years

This happens because ₹3 lakh is too small a principal amount to compound quickly into ₹1 crore unless returns are extremely high or the time horizon is very long.

So, Which Reaches ₹1 Crore Faster?

✔ Winner: ₹15,000 Monthly SIP

Why?

Because you keep increasing your contribution every month, and over the long term, your investment grows faster due to consistent additions + compounding.

Comparison Summary:

| Investment Type | Amount | Expected CAGR | Time to Reach ₹1 Cr |

|---|---|---|---|

| Monthly SIP | ₹15,000/month | 12% | ~22–24 years |

| Lump Sum | ₹3,00,000 one-time | 12% | ~30 years |

In simple terms:

SIP wins because the ongoing contributions accelerate compounding, unlike a static lump sum.

Which Option Is Better For You?

Choose a SIP if you:

Earn monthly income

Prefer disciplined investing

Want to start small and scale up

Prefer lower risk from market timing

Choose a Lump Sum if you:

Have idle cash available

Expect the market to be undervalued

Plan to diversify across multiple funds

Are comfortable with market fluctuations

Most investors prefer SIPs — they are stable, flexible, and proven for long-term wealth building.

FAQs

1. Can a ₹15,000 SIP make me a crorepati?

Yes. At ~12% returns, it can reach ₹1 crore in about 22–24 years.

2. Is it better to combine SIP and lump sum?

Yes, combining both often gives optimal results if your budget allows.

3. What if returns are lower than 12%?

Your investment will take longer. You can use step-up SIPs to speed it up.

4. Is ₹3 lakh enough for long-term wealth creation?

Yes, but only if paired with SIPs or periodic top-ups.

5. Which option is safer?

SIPs are generally safer because they average out market volatility.

Published on : 25th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

Source Credit: Content inspired by Personal Finance Desk report