When it comes to investing, one of the most common debates is SIP (Systematic Investment Plan) vs. Lump Sum. Both strategies have their strengths, but the better choice depends on your financial goals, market conditions, and investment discipline. In this blog, we’ll break down the differences, advantages, and disadvantages of each approach — so you can decide which strategy works best for long-term wealth creation.

What is a SIP?

A Systematic Investment Plan (SIP) allows you to invest a fixed amount regularly (monthly, quarterly, etc.) into a mutual fund.

Key Benefits:

Encourages financial discipline

Reduces the impact of market volatility (rupee cost averaging)

Affordable — can start with as little as ₹500/month

What is a Lump Sum Investment?

A lump sum investment means investing the entire amount in one go.

Key Benefits:

Immediate market exposure

Higher potential returns if the market performs well after entry

Best suited when you have surplus funds ready to invest

SIP vs. Lump Sum – Key Differences

| Factor | SIP | Lump Sum |

|---|---|---|

| Investment Timing | Regular intervals | One-time |

| Risk Level | Lower (spread over time) | Higher (market timing risk) |

| Market Volatility | Managed through averaging | Immediate exposure |

| Suitable For | Regular income earners | Investors with large funds |

| Emotional Stress | Low | High if market falls after investment |

Advantages of SIP for Long-Term Investment

Rupee Cost Averaging: You buy more units when prices are low and fewer when prices are high, balancing the cost over time.

No Need to Time the Market: SIPs work well even if you start during market highs or lows.

Disciplined Approach: Keeps your investment consistent.

Advantages of Lump Sum for Long-Term Investment

High Returns in Bull Markets: If the market rises right after investment, lump sum can outperform SIP.

Best for Large Windfalls: Ideal for bonuses, inheritances, or surplus funds.

Immediate Compounding: The entire amount starts compounding from day one.

Which Strategy Wins Long Term?

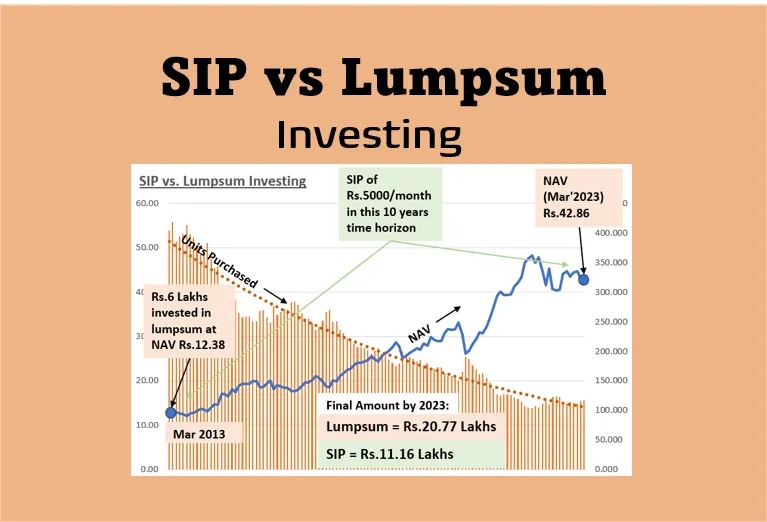

Historically, SIPs have provided better risk-adjusted returns for most retail investors due to the reduced volatility risk and disciplined approach. However, lump sum investments can deliver higher returns if the market is undervalued at the time of investment.

Expert Tip: If you have a large amount to invest but are unsure of market conditions, consider STP (Systematic Transfer Plan) — it gradually moves funds from a liquid fund to an equity fund, combining benefits of both strategies.

Conclusion

There’s no universal winner between SIP and lump sum — the best strategy depends on your risk tolerance, market knowledge, and investment horizon. For most salaried investors, SIPs are safer and more consistent. Lump sum works best for experienced investors who can identify strong market opportunities.

FAQs

1. Is SIP safer than lump sum?

Yes, because it spreads investments over time, reducing the risk of market timing.

2. Can I do both SIP and lump sum?

Absolutely. Many investors use SIPs for regular investing and lump sum for windfalls.

3. Which is better for a 10-year goal?

Both work, but SIP ensures disciplined investing without worrying about market fluctuations.

4. Should I invest lump sum during a market crash?

If you have a high-risk appetite and long horizon, market dips can be good entry points.

5. Does SIP give guaranteed returns?

No, SIP returns depend on market performance, but historically, long-term SIPs have delivered positive results.

Published on : 8th August

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed