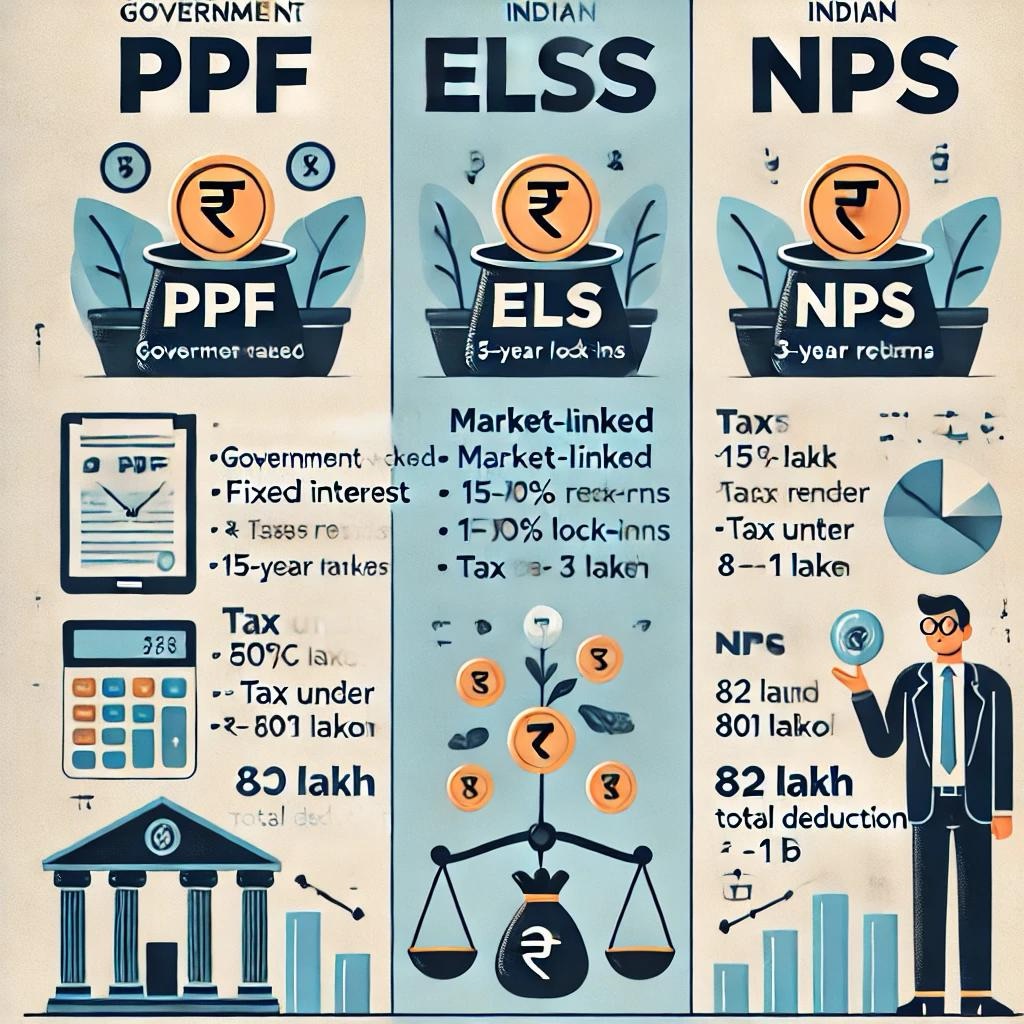

Paying taxes is every citizen’s duty, but smart investors know how to legally reduce their tax burden while growing wealth. Under Section 80C, 80CCD, and 10(10D) of the Income Tax Act, individuals in India can claim deductions through approved instruments. By choosing the right mix of ELSS, PPF, and NPS, you can save taxes and build a strong financial future.

1️⃣ Equity Linked Savings Scheme (ELSS)

Tax Benefit: Deduction up to ₹1.5 lakh under Section 80C.

Lock-in Period: 3 years (lowest among 80C options).

Returns: Market-linked; 10–15% over the long term.

Why Choose: Ideal for those who want tax savings plus wealth creation through equity exposure.

2️⃣ Public Provident Fund (PPF)

Tax Benefit: Deduction up to ₹1.5 lakh under Section 80C.

Lock-in Period: 15 years (partial withdrawals allowed after 7 years).

Returns: 7–8% (government-backed, reviewed quarterly).

Why Choose: Safe, guaranteed returns and tax-free interest. Perfect for conservative investors.

3️⃣ National Pension System (NPS)

Tax Benefit:

Deduction up to ₹1.5 lakh under Section 80C.

Additional ₹50,000 under Section 80CCD(1B).

Lock-in Period: Till retirement (age 60).

Returns: 9–12% depending on market performance.

Why Choose: Ideal for retirement planning with extra tax-saving advantage.

Other Legal Tax-Saving Options

Life Insurance Premiums (Section 80C)

Health Insurance (Mediclaim) under Section 80D

Home Loan Principal & Interest (Section 80C & 24B)

Education Loan Interest (Section 80E)

Quick Comparison Table

| Instrument | Tax Benefit | Lock-in | Returns | Best For |

|---|---|---|---|---|

| ELSS | ₹1.5 lakh (80C) | 3 years | 10–15% | Wealth growth + tax saving |

| PPF | ₹1.5 lakh (80C) | 15 years | 7–8% | Safe, long-term savings |

| NPS | ₹2 lakh (80C + 80CCD) | Till retirement | 9–12% | Retirement planning |

Key Takeaways

Use ELSS for wealth creation + tax savings.

Use PPF for guaranteed safe returns.

Use NPS for long-term retirement planning with extra tax benefits.

Combine multiple instruments for maximum tax savings + financial growth.

FAQs

Q1. What is the best tax-saving option in India?

ELSS offers the shortest lock-in and potential for high returns, while PPF and NPS provide stability and retirement benefits.

Q2. Can I invest in both PPF and NPS?

Yes, you can combine them to maximize tax savings under different sections.

Q3. How much tax can I save using ELSS, PPF, and NPS?

Up to ₹2 lakh (₹1.5 lakh under 80C + ₹50,000 under 80CCD).

Q4. Is ELSS risky compared to PPF and NPS?

Yes, ELSS is market-linked, but it also has higher return potential over the long term.

Q5. Can I withdraw my money anytime from NPS?

Partial withdrawals are allowed under specific conditions, but full withdrawal is available only after retirement.

Published on : 5th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share