Loans are powerful financial tools—they can help you buy a home, fund education, or cover emergencies. But mismanaging loans can hurt your credit score, making future borrowing expensive or difficult. The key is responsible borrowing and timely repayment. This guide will show you how to use loans wisely while maintaining a strong credit profile in India.

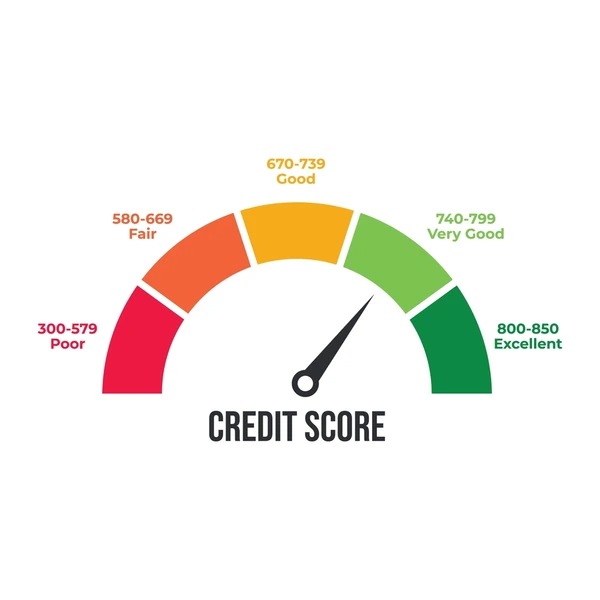

1. Understand Your Credit Score

Credit scores in India range from 300 to 900; higher is better.

Managed by CIBIL, Experian, Equifax, and CRIF High Mark.

Factors affecting your score: repayment history, credit utilization, loan type, and credit inquiries.

2. Borrow Only What You Need

Avoid taking loans unnecessarily.

Ensure your monthly EMIs fit your budget (ideally under 40–50% of income).

3. Make Timely Payments

Always pay EMIs on or before the due date.

Setting up auto-debit or reminders can prevent missed payments.

Late payments significantly lower your credit score.

4. Diversify, But Don’t Overdo

Having a mix of credit types (personal loan, credit card, home loan) can improve score.

Too many loans at once or frequent inquiries can reduce your score.

5. Keep Credit Utilization Low

Credit utilization = amount used ÷ total credit limit.

Keep it below 30–40% to show responsible usage.

6. Avoid Frequent Loan Applications

Each application generates a hard inquiry.

Multiple hard inquiries in a short time may signal financial distress.

7. Monitor Your Credit Regularly

Check your CIBIL or credit report at least once a year.

Correct any discrepancies immediately.

8. Use Loans Strategically

Use loans for investments, emergencies, or productive purposes, not impulsive spending.

Consider top-up loans or balance transfers for better interest rates without over-borrowing.

Conclusion:

Loans can build credit when used wisely, but careless borrowing can damage your score. By borrowing responsibly, paying on time, and monitoring your credit, you can leverage loans as a tool for financial growth rather than a liability.

❓ SEO FAQ Section

Q1. How do loans affect my credit score in India?

Timely repayment improves your score, while late or missed EMIs can lower it.

Q2. Can multiple loans lower my credit score?

Yes, taking many loans or having frequent credit inquiries can reduce your score.

Q3. How much of my credit limit should I use?

Keep credit utilization below 30–40% for a healthy credit score.

Q4. Should I check my credit score before applying for a loan?

Yes, it helps you understand eligibility and identify any discrepancies.

Q5. Can a top-up loan improve my credit score?

Yes, if repaid responsibly, as it shows credit management, but misuse can harm your score.

Published on : 23rd September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share