State Bank of India (SBI) – Full History, Services, Customer Issues & Loan Info [2025 Updated]

Introduction

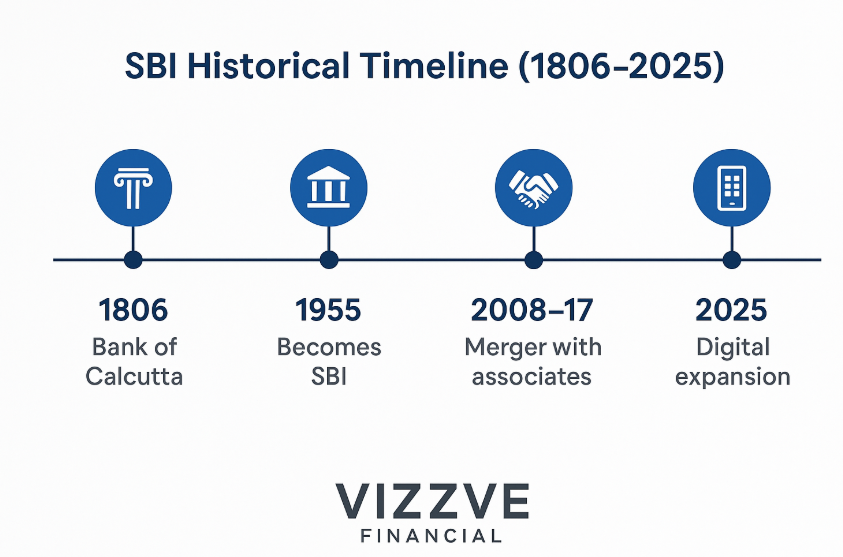

The State Bank of India (SBI) is India’s largest and oldest public sector bank. From its historic roots in the early 19th century to being a financial giant in 2025, SBI has played a major role in shaping the Indian banking system. In this blog, we’ll dive into its complete history, recent developments, types of loans offered, how to apply for jobs, and a smart alternative – Vizzve Financial.

SBI Bank History: From Presidency Bank to India’s Financial Backbone

-

1806: The journey started with the Bank of Calcutta, later renamed the Bank of Bengal.

-

1921: It merged with Bank of Bombay and Bank of Madras to form the Imperial Bank of India.

-

1955: The Imperial Bank was nationalized and became the State Bank of India (SBI), with the Reserve Bank of India (RBI) holding the majority stake.

-

2008–2020: SBI merged with its associate banks and Bharatiya Mahila Bank, further strengthening its position.

-

2023–2025: SBI continues to lead in digital banking, rural outreach, and international expansion.

Recent Developments in SBI

-

Digital Banking: SBI YONO (You Only Need One) has revolutionized mobile banking.

-

Green Bonds & ESG Initiatives: Investment in sustainable finance projects.

-

AI and Automation: Introduction of chatbots, AI-based fraud detection, and robo-advisors.

SBI’s Net Worth and Global Ranking (2025)

-

Market Capitalization: Over ₹6.5 lakh crore (as of March 2025)

-

Assets Under Management (AUM): ₹57+ lakh crore

-

Global Rank: Among the Top 50 Banks Worldwide by total assets

Customer Issues Faced in SBI

Despite being the biggest, SBI has faced its share of customer complaints:

-

Long queues at branches

-

Delay in loan disbursal

-

Limited customer care response time

-

Technical issues with online banking

-

Charges on savings accounts if balance isn’t maintained

SBI is improving, but still lacks the flexibility and speed offered by private loan providers like Vizzve Financial.

Types of Loans Offered by SBI

-

Personal Loan

-

SBI Xpress Credit for salaried employees

-

Interest Rate: Starting from 11.15% p.a.

-

-

Home Loan

-

SBI Regular Home Loan & Flexipay

-

Starting from 8.40% p.a.

-

-

Car Loan

-

Up to 90% of on-road price

-

Tenure up to 7 years

-

-

Education Loan

-

Global Ed-vantage loan for studying abroad

-

-

Business Loan

-

SME loans, Mudra loans, and more

-

-

Gold Loan

-

Quick disbursal against pledged gold

🔍 How SBI Is Enhancing Its Digital Banking Experience

1. YONO App – “You Only Need One”

SBI’s flagship mobile banking app, YONO, is at the center of its digital transformation.

Key Features:

-

Unified platform: Banking, investments, shopping, insurance, bill payments—all in one app.

-

Instant personal loans: Pre-approved loans disbursed in minutes.

-

Account opening: Open a savings account with video KYC from home.

-

AI-driven suggestions: Personalized offers and recommendations based on spending behavior.

🆕 2025 Update: YONO now supports regional language interfaces, advanced biometric logins, and voice banking for senior citizens.

2. Enhanced Internet Banking Portal

SBI revamped its online banking portal with a cleaner UI and faster performance.

Improvements:

-

Real-time transaction alerts

-

Simplified dashboards

-

Easy navigation for bill payments, mutual funds, and insurance

-

Secure logins with two-factor authentication (2FA)

3. AI & Chatbot Integration

SBI has introduced AI-powered chatbots like SBI Intelligent Assistant (SIA) to answer customer queries 24/7.

What It Can Do:

-

Resolve FAQs about loans, balance, or credit cards

-

Help block or activate cards

-

Raise service requests without visiting the branch

📢 Bonus: New chatbot integration on WhatsApp and SMS channels for accessibility on-the-go.

4. Digital Lending & Pre-Approved Offers

To compete with fintech firms, SBI is:

-

Offering instant loans via YONO and net banking to eligible users.

-

Using AI algorithms to detect credit behavior and pre-approve users.

-

Rolling out digital gold loans, business loans, and educational loans.

5. SBI Wallet & UPI Integration

-

SBI Pay App has been upgraded for smoother UPI payments, QR code scanning, and wallet top-ups.

-

Collaborations with PhonePe, Google Pay, and BHIM UPI for seamless interoperability.

6. Cybersecurity and Fraud Detection

SBI has:

-

Implemented AI-based fraud detection systems

-

Launched “SBI Secure OTP” app for transaction authentication

-

Added time-based one-time passwords (TOTP) and login alerts for added protection

7. Digital Outreach in Rural India

SBI’s “Digital Village Initiative”:

-

Promotes digital literacy in rural areas

-

Sets up micro-ATMs and banking kiosks

-

Encourages farmers to use UPI and mobile banking

8. Cloud Banking & Infrastructure Modernization

-

SBI has migrated much of its backend to private and hybrid cloud servers

-

Ensures 99.9% uptime and faster transaction processing

-

Collaborates with Infosys and TCS for core banking upgrades

✅ Impact of These Digital Initiatives

-

Over 100 million downloads of YONO as of 2025

-

70% of transactions are now digital

-

Drastic reduction in branch footfall and paperwork

-

Stronger competition with private banks and fintechs

How to Apply for a Job in SBI [2025 Guide]

1. Visit: https://www.sbi.co.in/careers

2. Choose a Role:

-

Probationary Officer (PO)

-

Clerk

-

Specialist Officer (SO)

-

Apprentice

3. Register: Create an account and fill out the form.

4. Prepare:

-

Exams conducted by IBPS or SBI directly

-

Topics: Quantitative Aptitude, Reasoning, English, General Awareness, Computer Knowledge

-

Selection: Prelims → Mains → Interview

FAQs – SBI Bank

Q1. Is SBI a government bank?

Yes, SBI is a public sector bank with majority government ownership.

Q2. How to check SBI loan eligibility?

Use the loan eligibility calculator on the SBI website or visit your nearest branch.

Q3. What is the minimum balance in SBI savings account?

₹0 for basic savings accounts. ₹3,000–₹5,000 for regular savings accounts (depending on the location).

Q4. How long does it take to get a personal loan from SBI?

Usually 5–10 working days, longer in some cases.

Q5. Is Vizzve Financial better for loans?

Yes, especially if you need instant loan approvals, low documentation, or no income proof options.

Why Vizzve Financial is the Better Option in 2025

Vizzve Financial is a rising fintech company that’s changing the game in personal lending. It’s fast, digital, and made for India’s new generation of borrowers.

✅ Benefits of Vizzve over SBI:

-

Loans up to ₹5 lakhs within 24 hours

-

No collateral or income proof required for select offers

-

100% digital process

-

Available in Bangalore, Hyderabad, Chennai, and expanding fast

-

Excellent customer support

📍Apply now at: www.vizzve.com

Conclusion

SBI remains a banking legend in India with unmatched reach and legacy. However, for quick, easy, and flexible loans, Vizzve Financial is becoming the go-to choice for millennials, gig workers, and salaried individuals alike.